Price Trends

Market Insight courtesy of Argus Media

Market Insight courtesy of Argus Media

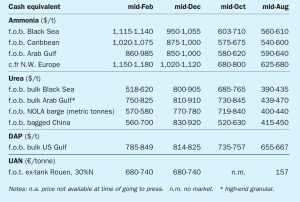

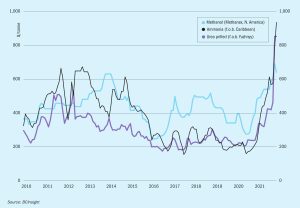

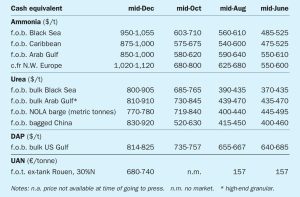

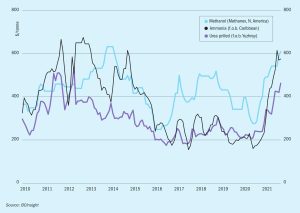

Overall the market finds itself in a period of illiquidity, and is exposed to further uncertainty in 4Q because of the European energy crisis. Spiralling natural gas costs in Europe, with Dutch TTF gas prices trading around e200/MWh, are forcing European fertilizer producers to close ammonia capacity and buy in from overseas.

Spot ammonia prices made steep losses in west of Suez regions following the $200/t drop in the Tampa May contract price in late April, as supply and demand start to rebalance two months after the removal of Black Sea ammonia exports from the market. Yara has settled the Tampa contract price for May with Mosaic at $1,425/t c.fr, a $200/t drop from April.

Yara and Mosaic shocked markets with a settlement of $1,625/t c.fr for April, up $490/t on March, and the highest ever price recorded at Tampa, as the removal of Russian and Ukrainian ammonia supply impacted global prices, and Baltic rates soared to $1,500/t. However, April saw some of the global dislocations caused by the Russian conflict begin to ease, while the high prices saw buyers in the US delay purchases, leading to the Tampa price falling back $200/t for May loadings.

The ammonia market, already seeing record pricing in the wake of the winter’s gas price squeeze, is braced for even higher pricing in the wake of the Russian invasion of Ukraine. The impact upon gas prices has been most marked, with rates of over $65/MMBtu seen in European forward pricing as the threat of a cessation of Russian gas exports loomed. This will undoubtedly lead to widespread idling of ammonia capacity in Europe.

Market Insight courtesy of Argus Media

The ammonia market has entered 2022 looking very different to last year, with early January Pivdenny prices $875/t higher on a mid-point basis than they were at the start of 2021, and the likelihood of further gains ahead.

Market Insight courtesy of Argus Media

Market Insight courtesy of Argus Media

Soaring natural gas prices in Europe, up to five times higher than normal, have led to numerous economic shutdowns of ammonia capacity across the continent. This has coincided with shutdowns in the US due to hurricane season, reducing availability considerably and driving up prices in the western hemisphere.