Market Outlook

• Continuing oversupply means that ammonia prices should continue to come under pressure moving into 2H April, though it remains to be seen just how much further values in Asia can decline before producers begin to shutter output.

• Continuing oversupply means that ammonia prices should continue to come under pressure moving into 2H April, though it remains to be seen just how much further values in Asia can decline before producers begin to shutter output.

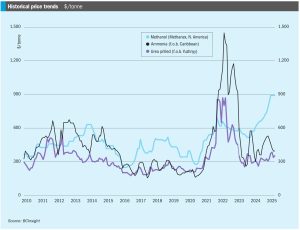

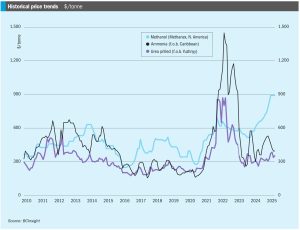

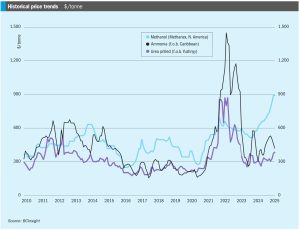

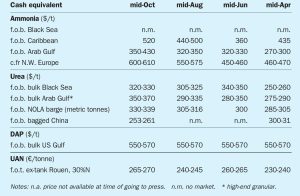

In mid-April, Ammonia prices both east and west of Suez remained firmly oriented to the downside, with supply still heavily outweighing demand and suppliers scrambling to place excess tonnage. Bearish market sentiment was exemplified by a Trammo sale to OCP at $415/t c.fr Morocco, $20/t short of Tampa’s c.fr settlement for April and around $44/t down on February.

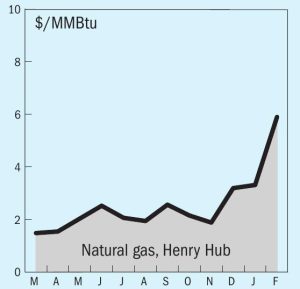

Support for ammonia prices in markets east of Suez eroded during February. The ongoing bubble of support seen in NW Europe remained just about intact, though news of further declines at Tampa for March and slumping natural-gas prices should begin to eat away at any remaining support in the West. After declining $70/t during the first two months of 2025, the Tampa settlement between Yara and Mosaic was revised down a further $40/t for March, imposing further downward pressure on f.o.b. values in Trinidad and the US Gulf.

• Prices look set to come under further pressure moving into March, particularly east of Suez. Prices in the West – specifically in northwest Europe – have enjoyed a partial degree of support through February, though this appears unlikely to hold for much longer.

Prices in most markets should register declines through January, though the extent to which benchmarks will ease is yet unclear. Chinese suppliers have seen significant price declines in recent weeks.

Ammonia markets saw a slow start to 2025, with further transparency needed on both sides of the Suez to determine the extent to which prices are expected to fall through January amid healthy supply and only limited pockets of demand.

Ammonia prices could remain stable for the duration of October, with any further increases likely to be capped by a lack of demand. The outlook for November is more positive for buyers, with prices set to ease off once turnarounds at key export hubs are concluded.

In October, ammonia benchmarks were more or less stable across the board. West of Suez, supply from Algeria was constrained by an ongoing turnaround at one of domestic player Sorfert’s production units. Still, demand from NW Europe remained quiet, although CF was set to receive a 15,000 tonne spot cargo from Hexagon some time in November, reportedly sourced somewhere in the region of $530/t f.o.b. Turkey. While regional supply appeared tight, steadily improving output from Trinidad and the US Gulf could alleviate recent pressures, with many players of the opinion that Yara and Mosaic could agree a $560/t c.fr rollover for November at Tampa as a result.

Ammonia benchmarks west of Suez remain supported by limited availability at key regional export hubs amid increased potential for cargoes to arrive from the East, where availability is far healthier, and prices appear under pressure. The disparity in prices was illustrated towards the end of August, when Nutrien sold 25,000 tonnes to multiple buyers in NW Europe for 1H September delivery at $550-555/t c.fr. When netted back to Trinidad, the price marks a sizeable premium on the $375/t f.o.b. last achieved by Nutrien back in late June, although given that last business in Algeria was fixed at $520/t f.o.b., it appears there is room for delivered sales into Europe to move up further. Regional availability is still limited, with extreme weather conditions in the US Gulf and North Africa potentially impacting supply further over the coming weeks.

In China, domestic prices are expected to come under significant downward pressure, with seaborne indications already following suit, with buyers said to have rejected offers around the $375/t c.fr mark.