Market Outlook

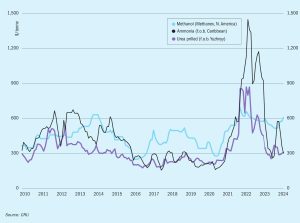

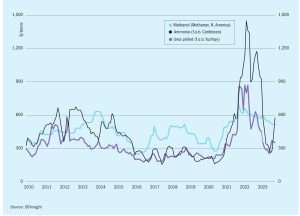

Prices in the Eastern Hemisphere, whilst still flat-to-firm, do not appear as supported as they have been over the past month, whilst indexes. There are still no signs of softening in the Far East although demand remains underwhelming and supply improving. While production in Indonesia is said to be back up and running, traders do not expect any spot cargo to emerge in July other than possibly some small part cargoes. August could see spot offers.