Chinese urea exports

Although it has been a major exporter of urea, increasing Chinese government restrictions have restricted the seasonal window for exports.

Although it has been a major exporter of urea, increasing Chinese government restrictions have restricted the seasonal window for exports.

Prices in the West are unlikely to garner much support moving into the latter stages of Q2. The May Tampa ammonia settlement was settled by Yara and Mosaic at $450/t c.fr, down $25/t on the $475/t c.fr agreed for April. With seasonal domestic demand in the US drawing to a close 2H April, many had anticipated that either a rollover or a slight decline would be agreed.

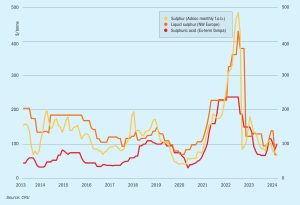

Sulphur prices reached a low point in mid-February, with buyers looking to the tender from Muntajat as well as the return of Chinese buyers following the Lunar New Year holiday for the direction that the market would turn. CMOC’s 5 February tender for 40,000 tonnes of sulphur for early-April arrival was indicated awarded in the upper $90s/t c.fr on supply from the FSU, though details were not confirmed.

CRU expects sulphur prices to be supressed in early 2024 by high port inventory and limited phosphate export business. However, affordability continues to support raw materials purchases and leaves room for price increases, especially if downstream production picks up as expected and sulphur stock drawdown slows.

Urea. As February ended, urea prices found support in the US and Brazil while Europe remained subdued and Egypt struggled to find buyers. New Orleans was the one bright spot in the urea market – with NOLA prices benefitting from the meeting of suppliers and buyers at the TFI’s domestic conference. With positive sentiment all round, prices moved up $30/st, peaking at $390/st f.o.b. for March.

Leo Alders , the CEO of LAT Nitrogen, is the new president of Fertilizers Europe. He was elected with immediate effect at an extraordinary general assembly on 5th December last year.

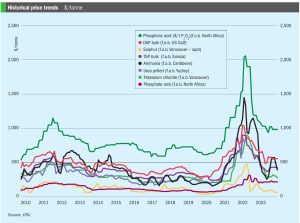

Prices will remain stable-to-soft across the board, though benchmarks could remain slightly more supported in the short-term than previously thought, with more significant declines likely in Q2-Q3.

Nitrogen magazine, as it originally began life in It has been a tough few years for the European nitrogen industry, and between covid, gas price spikes and Russian sanctions, not all companies have weathered the storm. Now that the initial shock of the sky-high ammonia prices that the closure of the Black Sea and the cutting off of almost 40% of Europe’s gas supplies has passed, and the world gas and ammonia markets have largely adjusted to the new reality, prices are coming back down. But it seems that in its wake it may leave quite a different European nitrogen industry from the one that existed in 2019.

Ammonia pricing in the US Mid-West stood at $625/st f.o.b. in February, with applications to field continuing to ramp up. Prices in the US Gulf remain pegged in the low-to-mid$400s/t f.o.b. Recent production outages in the region have largely subsided, though an unexpectedly early uptick in seasonal demand from local buyers is likely to provide a degree of price support moving forward. The Tampa ammonia settlement for March has been settled by Yara and Mosaic at a $445/t c.fr rollover, largely in line with market expectations. The North American market remains detached from the considerably more oversupplied global ammonia scene.

Sulphur prices declined in Q4 following the increases seen during Q3, because of ample availability and limited spot demand. One contributing factor was that phosphate fertilizer producers in China, the largest importer of sulphur, have cut downstream production due to increased export restrictions. In addition, high sulphur stocks at Chinese ports and continuing high domestic sulphur production mean that domestic buyers have other options aside from international purchases.