Sulphur 410 Jan-Feb 2024

31 January 2024

Price Trends

Price Trends

SULPHUR

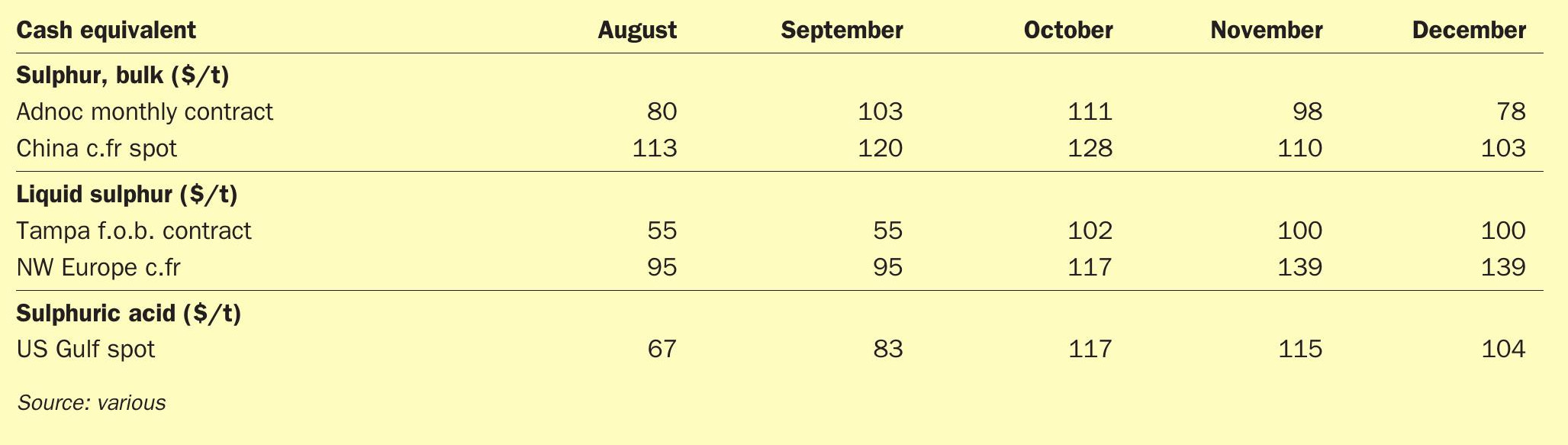

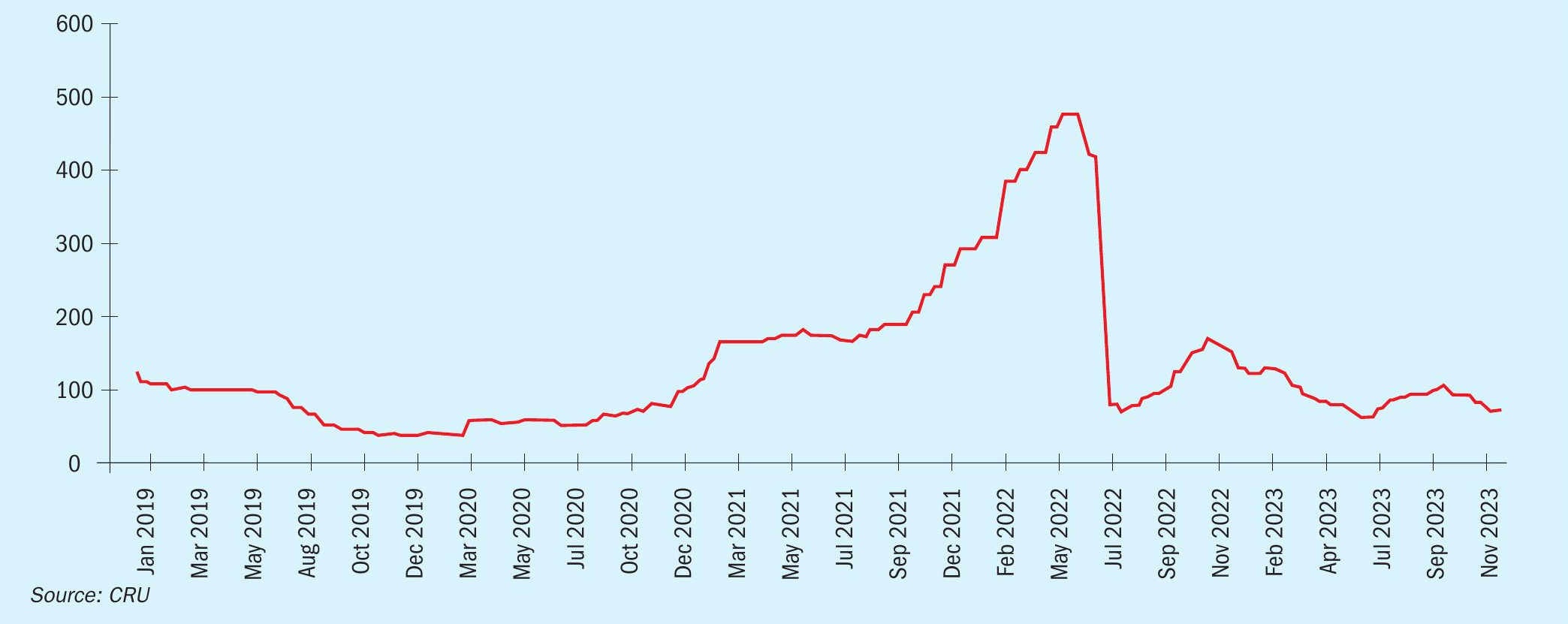

Sulphur prices declined in Q4 following the increases seen during Q3, because of ample availability and limited spot demand. One contributing factor was that phosphate fertilizer producers in China, the largest importer of sulphur, have cut downstream production due to increased export restrictions. In addition, high sulphur stocks at Chinese ports and continuing high domestic sulphur production mean that domestic buyers have other options aside from international purchases.

Phosphate fertilizer price increases during H2 2023 have further improved sulphur affordability for consumers, although there is still the potential for price declines within H1. Nevertheless, affordability of sulphur relative to phosphates remains good even at forecast price levels, with affordability for metals markets also good. Q1 contract prices to North Africa were assessed at $90100/t CFR.

Sulphur demand in Indonesia for nickel is set to increase further over the coming months following a big jump in imports since 2022, limiting the possible downside to global spot prices despite a weaker nickel market.

On the supply side, Russian exports have increased from the tightest periods that were experienced following the country’s invasion of Ukraine, but prices need to remain high enough to draw exports out, particularly given logistics constraints.

Kazakhstan’s Kashagan oilfield is facing government pressure to reduce its sulphur stocks, and sources indicate that it is moving crushed lump supply, adding to market length. However, Kazakh and Russian exports may be tighter for Q4 and Q1 due to the northern hemisphere winter reducing river navigation.

Availability from Vancouver has been strong due to relatively high production at sites in Canada, as well as increased remelting of solid sulphur stocks. Sources suggest that supply from Canada may be even stronger this year.

Production at refineries in other regions has been high to meet demand for refined products, particularly in the US. Although the market there has tightened from the exceptional surplus of the mid-year as the driving season has concluded, US availability still appears plentiful. US Gulf contract prices for liquid sulphur deliveries in the first quarter of 2024 were settled down $33/lt from 2023 Q4. This leaves the contract price at $69/lt FOB Tampa.

New project commissions and expansions accelerated last year, with Middle East producers adding considerable volume to the market. Much of the new capacity can access the market with low logistics costs, adding to the market surplus, though there are fewer capacity additions to come in 2024 and demand is expected to catch up with supply by next year. Meanwhile, Saudi Arabia has been selling crushed lump from stockpiles in addition to its new production. Domestic production in China is also set to continue increasing.

Overall, the recent growth in sulphur production, in addition to stock drawdown and high China inventories, is expected to limit upwards potential for prices in the short term, and keep sulphur prices low relative to phosphates. Still, affordability continues to support raw materials purchasing and leaves room for price increases, especially if downstream production picks up as expected.

Some contracts for supply of liquid sulphur in northwest Europe in the first quarter of 2024 have now been reported settled at rollovers from 2023 Q4. The price range for Q4 was published at $103.50-123.50/t Benelux for barge/railcar, with the truckload range at $123.50-153.50/t CPT NW Europe, after settlements were reported at increases of $16.50/t from Q3. Increases in global prices over the course of Q3 meant that Europe had to follow the trend. Still, relatively weak demand within Europe due to a struggling industrial sector is expected to limit the increase. During Q4, global prices weakened, but tight availability in Europe meant that buyers were unable to achieve a decrease on Q1 contract prices. Molten sulphur availability in Europe is set to remain tight throughout the year despite weakness in the downstream caprolactam sector, as European production continues to decrease.

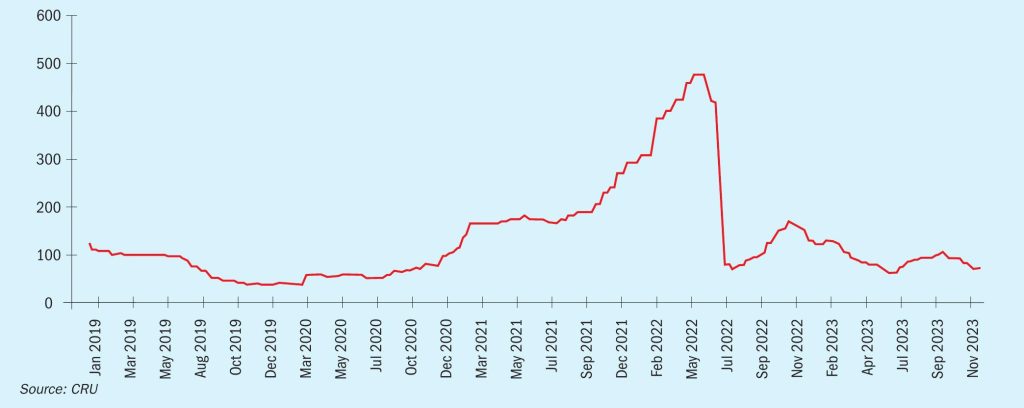

SULPHURIC ACID

Sulphuric acid prices are expected to decline further from their current levels, with slightly lower prices likely through 2024. The key risk remains to the downside and prices may be pushed lower if demand is weaker than expected. China, the key source of marginal seaborne acid supply, requires higher acid prices to draw out more volume, as domestic sales offer favourable pricing, although production is increasing further this year. Less Chinese exports are likely to be required in 2024, as some Asia/Pacific importers will have greater domestic availability. Smelters in Japan and South Korea have needed to commit 2024 supply and have sold on term agreements at prices from single-digit FOBs to low double digits.

Buyers in Chile are relatively well covered with contract supply, with the majority of volume agreed in the $120s/t CFR, increasing buyer resistance to high prices. Sources indicated that most of the volume on term contracts is below $130/t CFR for this year. Chilean buyers will likely be unable to source as much from Europe this year, necessitating that they pay to cover logistics costs from the Far East, limiting the downside to delivered prices.

Spot prices for acid sales into Chile were assessed stable at $130-140/t CFR in early January, though deals at the upper end of the range were increasingly unlikely, and forward offers were reported at much lower prices. The assessment is still up 59% from early August 2023, though the mid-point is down from a high of $280/t CFR in June 2022. Ocean swells in the New Year led to Chilean port closures until at least 8th January, according to sources, delaying offtake and reducing spot demand. There was some concern about potential knock-on effects reducing spot import demand over the coming weeks and months.

Market players are mostly bearish for the coming months, particularly for Asia/ Pacific markets, as supply is set to climb considerably in India, Indonesia and China. The tone for Europe/Atlantic markets is a bit more positive as Brazil and the US seem to be relatively steady, Morocco’s OCP is buying again, and there are some big European maintenances coming up, particularly in Q2.

India’s import demand is under pressure as sulphur offers a more affordable raw material option. In addition, buyers are adding sulphur burner capacity, limiting merchant acid requirements, with additional smelter acid production also expected in India within 2024.

Indonesian imports increased steeply in 2023, but import demand there is also likely to decline as domestic production increases from both integrated sulphur burners and new smelting capacity, while sulphur will generally be more favourably priced.

In Europe, demand remains constrained, leading to ample acid availability. Industrial demand is not guaranteed to improve within the forecast period, but it is at least unlikely to weaken further, while a strong producer maintenance slate should prevent supply overhang.

Renewed appetite from Morocco should absorb some European supply, but this will likely just replace some Chilean demand from last year. Morocco’s continued demand will be a key determinant of market balance, and it is likely it’s consumption will be slightly higher than last year, but still well below the highs of other recent years. Imports are also likely to be more spread through the year than in 2023, avoiding price shocks, with spot purchases likely to be more opportunistic.

Improving availability of smelter acid and sulphur in the US Gulf has been limiting merchant acid import requirements there. Though the sulphur market there may tighten slightly, it is unlikely this will push up acid demand and prices much, with sulphur prices still suggesting lower levels on acid.

Other import destinations such as Brazil have also had limited spot requirements, though downstream demand should be steady over the coming months.

Overall, acid affordability remains acceptable relative to downstream commodities, despite high freight rates keeping CFR levels high; but acid is less affordable than it has been for some time and appears very expensive compared with upstream sulphur. Buyers in need should be willing and able to pay up at current prices for spot acid cargoes, but requirements are limited, while availability is set to increase in a range of locations.

PRICE INDICATIONS