The heat turns up on Mosaic and Nutrien

Corn grower groups are pressing the US Justice Department for an update on its fertilizer market probe.

Corn grower groups are pressing the US Justice Department for an update on its fertilizer market probe.

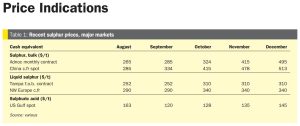

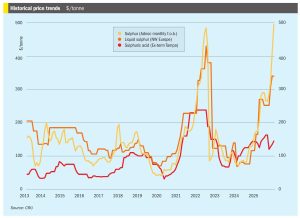

The global sulphur market’s bullish momentum from late 2025 has firmly carried over into the New Year, with prices pushing forward across most key regions despite a slow return to spot trading after the holiday break. With spot prices now past their 2022 highs and testing levels not seen since the 2008 peak, affordability has become the market’s central theme. The market remains divergent, with some buyers forced to accept the rally due to tight supply, while others, particularly in China, are showing clear signs of demand destruction.

Sulphur prices have risen rapidly in recent months as the market moves into a period of deficit which is likely to last until 2028.

• CRU’s latest global sulphur forecast is for a January price peak before a decline, with the key downside risk being a sharper correction if the supply deficit closes faster than expected. The global sulphur market’s upward momentum has been slowing, with attention shifting to geopolitical risks in Iran. Despite limited physical disruption being reported, the upside risk to prices could be substantial. Following the US bombing of an Iranian nuclear facility back in June, supply from Iran became bottlenecked, despite good production levels, as vessel owners became unwilling to call at ports like Bandar Abbas due to the increased risk.

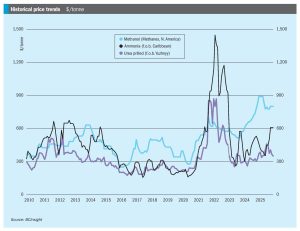

Ammonia values in the Middle East, Far East and Southeast Asia edged higher at the start of January, while other major benchmarks were largely unchanged amid a subdued market. Conditions at the start of the year mirror late2025, with prices supported by persistent supply tightness from the continued absence of Ma’aden’s MPC facility, which removes an estimated 300– 400,000 tonnes from the market. The unit is expected to return in midtolate January.

• Ammonia prices are expected to ease through January as new supply comes online. Woodside’s Beaumont facility produced its first ammonia at the end of December and is poised to start commercial production in early 2026, and there is also new supply from Gulf Coast Ammonia (GCA). In Saudi Arabia, the expectation is that both Ma’aden and Sabic will return to the market mid-to-late January.

The voluntary carbon market (VCM) is maturing rapidly, and a succession of governance, standards and policy initiatives has been launched since 2020 to tackle weaknesses in integrity and scalability which have constrained uptake and undermined confidence.

Europe is likely to become an increasing ammonia importer over the coming years as low global ammonia prices and high European gas prices squeeze producer margins, but CBAM remains a wild card.

Gas consumption is rebounding in Europe as prices stabilise at lower levels, while the LNG market continues to see large capacity additions.

CRU's fertilizer team provides their top calls for 2026