Ammonia markets face continuing disruption

The curtailment of ammonia production in Europe and reduction in export supply from Russia has led to an unprecedented year for the merchant ammonia market.

The curtailment of ammonia production in Europe and reduction in export supply from Russia has led to an unprecedented year for the merchant ammonia market.

Maersk has ordered six more 17,000 teu (twenty-foot equivalent unit) container ships capable of running on methanol from Hyundai Heavy Industries (HHI). The order brings Maersk’s total order book of dual-fuel vessels capable of running on methanol to 19. Maersk said the new ships will replace existing tonnage in its fleet when they’re delivered in 2025. When all 19 vessels on order join the fleet and replace older tonnage, CO2 savings will be around 2.3 million t/a, according to Maersk. Maersk has committed itself to renewable methanol as a pathway to zero emissions shipping. Its first vessels are due for delivery from Q1 2024. The company has also signed several green methanol fuel supply agreements and joined a partnership to create the first e-methanol plant in Southeast Asia. Maersk is also working with Japanese trading house Mitsui and the American Bureau of Shipping (ABS), to jointly conduct a detailed feasibility study of methanol bunkering logistics in Singapore.

Most nitric acid is used for production of fertilizer nitrates and ammonium nitrate explosives, but it is also used in polyamides, polyurethanes and aniline dyes as well as a number of industrial processes including ore treatment. High ammonia prices have pushed nitric acid prices to record levels this year, but growth predictions remain robust.

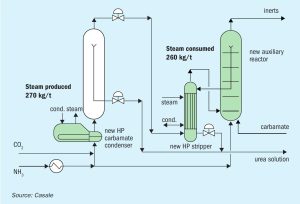

Casale reviews urea plant revamping process schemes and successful case studies for energy savings and TOYO discusses its latest revamping technologies including application of the new generation low-pressure, energy-saving ACES21-LP™ process.

The fertilizer price and supply chain shocks caused by the war in Ukraine have supercharged the debate about the shift to more sustainable and efficient crop nutrition – with farmers and governments urgently looking for different approaches to maximise crop productivity.

T he high-price environment for fertilizers and other commodities, including natural gas, is having very different consequences globally.

T he end of August saw a paper published in the Journal of the Royal Geographical Society by Dr Mark Maslin of University College London. Widely reported, it looked at the prospects for sulphur production in an era of declining fossil fuel use, concluding that there could be “a shortfall in the annual supply of sulphuric acid of between 100 and 320 million tonnes by 2040, depending on how quickly decarbonisation occurs”. It added that “unless action is taken to reduce the need for sulphuric acid, a massive increase in environmentally damaging mining will be required to fulfil this resource demand.”

While most sulphuric acid demand for phosphates is based on the production of phosphate fertilizer, non-fertilizer sources of demand such as animal feed and industrial processes additionally represent a relatively small but growing sector of the market.

In a major blow to the British fertilizer industry, CF Fertilisers UK announced the closure of its Ince production site in north-west England in June (see p8). Ince is the UK’s largest compound fertilizer producer, operating three NPK+S units. It also manufactures large volumes of ammonium nitrate (AN) for Britain’s farmers. At the heart of the Cheshire complex is Ince’s long-standing ammonia plant. Unfortunately, high natural gas costs have kept this shuttered since September last year.

New research findings strongly suggest that iodine behaves as a plant nutrient. SQM International has been quick to follow up on this discovery by launching a new speciality iodine fertilizer for fertigated crops.