Market Outlook

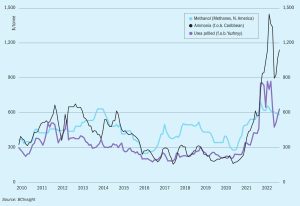

Supply in southeast Asia looks tight for the coming weeks, but further declines in Chinese domestic prices could alter the supply/demand balance in the region in August.

Supply in southeast Asia looks tight for the coming weeks, but further declines in Chinese domestic prices could alter the supply/demand balance in the region in August.

Market Insight courtesy of Argus Media

Further downward corrections are possible but the rate of demand is stabilising, suggesting the market floor is in sight, though some have suggested that May could bring another sharp reduction in the Tampa contract price towards the mid$300s c.fr. Demand remains sluggish in both eastern and western hemispheres.

Market Insight courtesy of Argus Media

Market Insight courtesy of Argus Media

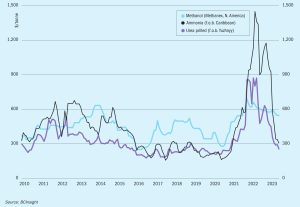

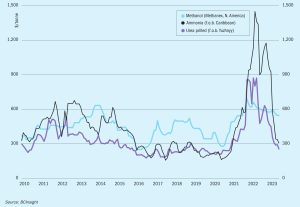

The EU benchmark TTF natural gas price had fallen to $16.89/MMBtu on average for February, down 19% on January’s average and 36% lower than the figure for February 2022. By the end of the month it had fallen to $14.83/MMBtu, its lowest level since the outbreak of war in Ukraine. EU gas storage was assessed as 61% full on 28 February, compared to a five-year seasonal average of 40%, due to strong LNG imports and mild weather over the winter. Over one third of European ammonia capacity has returned to production as gas prices fall.

Ammonia prices registered another week of losses at the start of January, with supply options continuing to outweigh demand in most regions. Prices have been falling steadily for the past twelve weeks, as the market rebalances after production curtailments across Europe for much of 2022. Steady falls in gas pricing over the past few weeks have put production costs firmly below today’s import price, with European production now scheduled to ramp up at many plants this month.

The market is anticipated to correct lower throughout the rest of the first quarter. Once a clearer picture over seasonal fertilizer demand in Europe emerges, this could stabilise downward momentum.

The ammonia market appears to be oversupplied as of the end of October 2022, with a ready availability of spot cargoes. Coupled with increased availability from European producers due to an easing of gas prices, this seemed to indicate bearish market sentiment for the immediate future.

Market Insight courtesy of Argus Media