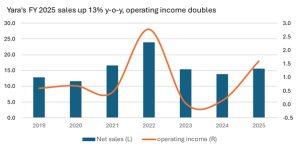

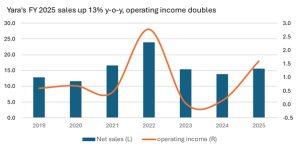

Yara’s 2025 earnings up 46% to $2.75bn

Yara’s full-year earnings (EBITDA) surged to $2.75bn in 2025, driven by stronger nitrogen margins, lower fixed costs and solid volumes.

Yara’s full-year earnings (EBITDA) surged to $2.75bn in 2025, driven by stronger nitrogen margins, lower fixed costs and solid volumes.

Mosaic has started activities to idle single super phosphate (SSP) production at its Fospar and Araxá facilities in Brazil due to the recent sharp increase in sulphur prices, the company said 16 December. The company said it has also suspended future purchases of sulphur, and it may review these decisions after 30 days. Sulphur spot prices in Brazil were assessed by CRU at $515/t c.fr at the time, representing the highest level since June 2022, and a staggering 180% increase from the figure of $182/t c.fr at the start of 2025. Prices for SSP, however, have been relatively stable, with only slight increases in recent weeks. CRU's assessment for 18-20% SSP was at $200-245/t c.fr Brazil in December, up from $190-240/t in November, though it remains below the $230-265/t of June.

Nutrien says that it underwent “a controlled shut down” of its Trinidad Nitrogen operations at the Point Lisas’ facility from October 23rd, 2025. The company said that the shutdown was in response to port access restrictions imposed by Trinidad and Tobago’s National Energy Corporation (NEC) and “a lack of reliable and economic natural gas supply that has reduced the free cash flow contribution of the Trinidad Nitrogen operations over an extended period of time”. Nutrien says that it will continue to engage with stakeholders and assess options with respect to its operations in Trinidad. Ammonia and urea sales volumes from Nutrien’s Trinidad operations were approximately 85,000 tonnes per month and 55,000 tonnes per month, respectively. Nutrien expects to be within its 2025 annual nitrogen sales volume guidance range of 10.7 to 11.2 million tonnes due to the continued strong performance of its North American Nitrogen operations.

Clariant says that it closed the divestment of its legal entity (Clariant Venezuela S.A.) in Venezuela for $1.8 million to CMV Química CA, Venezuela as part of its ongoing footprint optimisation. In 2024, Clariant’s operations in Venezuela generated sales of around $3.8 million and employed around 60 people.

Fertilizer sales to Brazilian farmers are currently in line with the average of the past three years, despite variations by crop and state. CRU’s Anthony Rizzo and Bruno Fardim Christo of Veeries provide an update on the status of fertilizers and crops in the Brazilian market.

Cover story! CASALE’s Giovanna Roviello and Francesco Baratto provide an update on the Villeta 'green' fertilizer project in Paraguay.

If decarbonising coffee starts with fertilizer, why don’t they feature more in conversations about sustainable coffee? In this article, Erna Maciulis of Proba outlines practical interventions that address fertilizer emissions from coffee growing. These can unlock significant progress towards Scope 3 emissions reductions – and be easily adopted without disrupting existing farm practices.

Mark Howell , Head of Agronomy & Product Development at Sulvaris, provides new insights on sulphur nutrition in soybean-maize systems.

Boron fertilization can improve coffee crop quality and yield. Fabiano Silvestrin of U.S. Borax reviews the evidence.

Brazil is well-positioned to lead the global transition to low-carbon ‘green’ fertilizers, suggests Petter Ostbo, CEO and founder, Atlas Agro.