Sulphur 422 Jan-Feb 2026

28 January 2026

Price Trends

SULPHUR

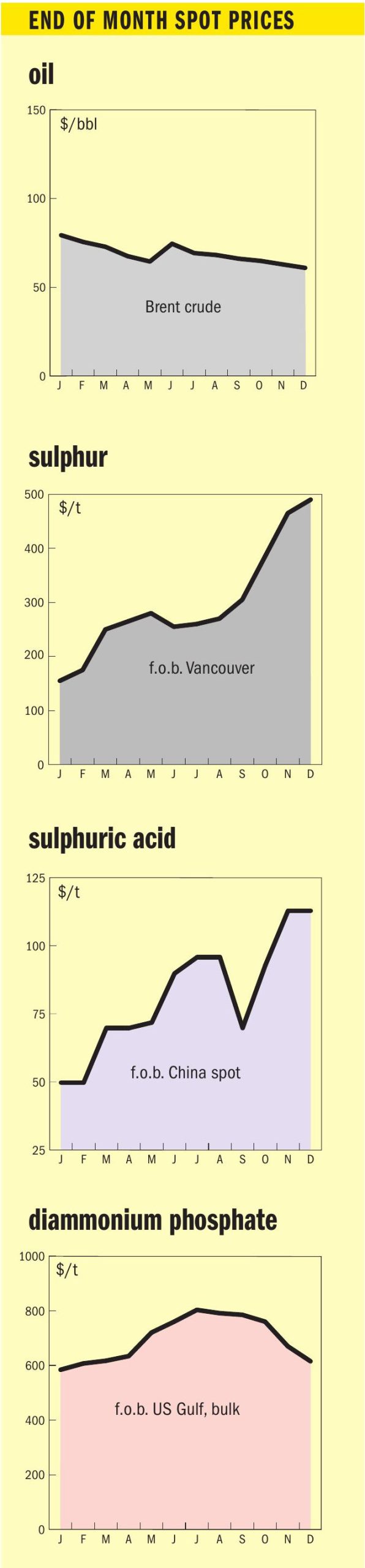

The global sulphur market’s bullish momentum from late 2025 has firmly carried over into the New Year, with prices pushing forward across most key regions despite a slow return to spot trading after the holiday break. With spot prices now past their 2022 highs and testing levels not seen since the 2008 peak, affordability has become the market’s central theme. The market remains divergent, with some buyers forced to accept the rally due to tight supply, while others, particularly in China, are showing clear signs of demand destruction.

The upward trend was largely driven by the official confirmation of higher forward prices from Middle Eastern producers. This firming price environment has also set a tense backdrop for Q1 contract negotiations, which are still under discussion in key markets. The Middle East market concluded 2025 on a powerful note, with spot prices reaching a 17-year high of $505-525/t f.o.b. after climbing 200% over the year. The latest monthly prices from the Middle East have maintained the market’s bullish sentiment, with leading producers announcing increases of $21-25/t, a more moderate hike compared to the steep $80-95/t jump recorded from November to December. The move, which was widely anticipated, brings Adnoc’s price to $520/t f.o.b., Qatar’s QSP to $517/t, and KPC’s to $516/t. These hikes reflect the significant run-up in spot prices that occurred throughout December. While no new spot sales were confirmed from the region, these f.o.b. levels were supported by notional netbacks from prevailing prices in India and Brazil.

It has been confirmed that the supply constraints from Russia will now extend further into 2026, following the government’s decision to extend its ban on technical sulphur exports until the end of March. The move, which was largely expected by the market, removes any prospect of Russian export volumes returning in the first quarter, maintaining a key pillar of support for global prices. The initial ban, which followed drone strikes on key gas plants in September, had already turned Russia into a net importer in late 2025. While the extension is bullish, the confirmation that transit volumes from Kazakhstan are unaffected prevents a wider supply disruption. In contrast, the supply picture is improving in Iran, where an easing of regional tensions has improved the logistical situation, allowing both domestic exports and previously constrained Turkmen transit volumes to return to the market.

The Chinese sulphur market is now being dictated by a new domestic price control policy. State-owned refineries have begun supplying core phosphate producers with sulphur at a significantly reduced price of around RMB2,000/t ex-works, which reflects a three-year historical average. While phosphate producers are maintaining stable operating rates to ensure domestic supply, their need for expensive seaborne cargoes has evaporated in the short term. This provides them with a temporary shield from high international prices, allowing them to delay spot purchases and wait for a market correction.

Bullish sentiment returned to the Chinese market with force after the holidays. Delivered c.fr prices firmed to $520-530/t, supported by a pre-holiday Canadian cargo sale and the new Middle East postings. The key driver, however, was a significant drop in port inventories, which fell to their lowest level since May 2025 at 1.95 million tonnes. This tightening domestic supply, combined with a two-tier pricing system where many buyers must compete for high-priced spot cargoes, has underpinned the market’s strength. Although deals were concluded in the high $520-530s/t in late December, buying interest has remained slow, leaving the last formal assessment at $510-515/t c.fr. Chinese spot prices are forecast to peak in January at $533/t c.fr before declining steadily to bottom out at $298/t c.fr in October, followed by a slight recovery to $310/t c.fr by the end of the year.

Vancouver prices ended 2025 at a multi-year high of $485-495/t f.o.b., supported by firm netbacks from Brazil as Chinese demand remains limited. This price surpasses the 2022 peak but is still well below the 2008 record. Negotiations for quarterly liquid sulphur contracts in Tampa for Q1 2026 were not yet concluded at time of writing. Broader market chatter has recently coalesced around $475–520/t f.o.b. Tampa for Q1, though no settlement has been reached. Downstream affordability has been a key focus given firmer sulphur values versus softer fertilizer pricing. DAP has retreated from earlier highs, increasing buyer sensitivity to feedstock costs and tightening margin headroom for phosphate producers.

Market participants also pointed to recent Brazilian developments as an example of downstream margin pressure amid higher sulphur costs. Mosaic said in December it was idling SSP production at its Fospar and Araxá facilities and suspending future sulphur purchases following a sharp rise in sulphur prices. Brazil c.fr prices finished 2025 at an average of $535/t.

Indonesia’s sulphur imports have continued at a record-breaking pace, surging 42% year on year to reach 4.8 million t/a in the first eleven months of 2025, according to Global Trade Tracker (GTT) data. This is up from 3.4 million t/a in the same period of 2024.

SULPHURIC ACID

Prices for global sulphuric acid pushed higher at the start of 2026, as the market’s bullish underlying tone overshadowed a slow return to spot trading after the holidays. This upward momentum was driven not by a surge in new spot demand but by the inclusion of firmer forward-month indications in pricing windows and by tight supply fundamentals in key export hubs.

The clearest driver was Northwest Europe, where prices firmed to $110-120/t f.o.b. This was supported by an active forward market, with sources indicating a few deals for February loading have already been concluded at the $120/t f.o.b. level, confirming the market’s upward trajectory. This strength in Europe directly rippled across the Atlantic. The US Gulf assessment also firmed to $140-155/t c.fr, with delivered cost calculations from Europe supporting the increase.

In Chile, the market’s upward shift was clear. Annual contract talks are reportedly wrapping up in the $162-175/t c.fr range, a significant increase from last year, though these numbers are not yet formally assessed. In the spot market, while quiet, notional ideas have jumped to $180-195/t c.fr, tracking higher European f.o.b. prices, which have become a more competitive supply source.

In Brazil, prices rose to $160-165/t c.fr, finding support from a firm tender award in neighbouring Argentina, which set a strong regional benchmark in recent weeks. Brazil’s sulphuric acid imports contracted by 2% in 2025, with full-year arrivals totalling 540,479 tonnes, according to Global Trade Tracker (GTT) data. Spain solidified its position as the top supplier, with its shipments growing 22% year on year to 201,183 t. In contrast, volumes from the second-largest supplier, Belgium, fell by 31% to 86,811 t.

The Chinese sulphuric acid market was thrown into significant uncertainty in December following a series of conflicting government interventions. An initial halt on phosphate fertilizer exports prompted acid producers to sell out Q1 availability and raise offers to high levels of $140-160/t f.o.b. However, a subsequent government directive instructed producers to cap prices at early December levels and prioritise domestic supply. This created a wide gap between unworkable producer offers and market reality, effectively paralysing the export market as participants await clarity. This policy confusion represents the primary upside risk to the forecast, as the true volume of available Chinese exports for 2026 remains uncertain. Export assessments for both China and Japan/South Korea rose by $5/t, reflecting the inclusion of higher-priced February indications. The underlying supply in Asia remains tight; South Korean producers are reportedly sold out on contract, Japanese suppliers are holding back offers amid production uncertainty, and the Chinese market is paralysed by a standoff between high producer offers at $140-160/t f.o.b. and a lack of buying interest.

As a result, market participants report that most available spot cargoes are now in the hands of traders. Looking ahead, traders expect more offers to begin emerging for March-April loading. A 20,000 t sale to India from South Korea was reported at $148/t c.fr for early March delivery.

This buyer-seller impasse was most evident in India, where prices held stable at $145-155/t c.fr as the market stalled. Traders need $150-160/t c.fr to cover high sulphur costs, but importers are resisting any level above $150/t, freezing spot activity and forcing a reliance on inventories.