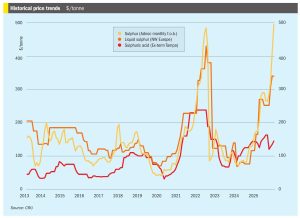

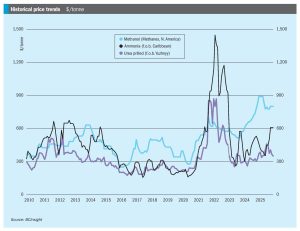

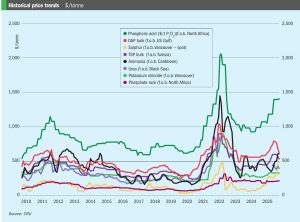

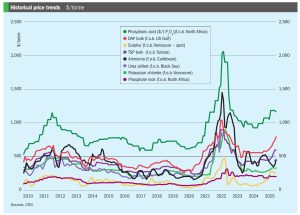

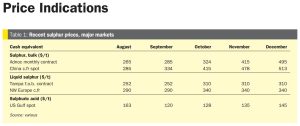

Price Trends

The global sulphur market’s bullish momentum from late 2025 has firmly carried over into the New Year, with prices pushing forward across most key regions despite a slow return to spot trading after the holiday break. With spot prices now past their 2022 highs and testing levels not seen since the 2008 peak, affordability has become the market’s central theme. The market remains divergent, with some buyers forced to accept the rally due to tight supply, while others, particularly in China, are showing clear signs of demand destruction.