CRU Fertilizers – top calls for 2026

CRU's fertilizer team provides their top calls for 2026

CRU's fertilizer team provides their top calls for 2026

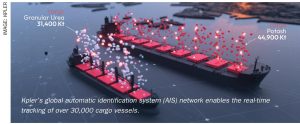

Kpler's intelligence on fertilizer shipping and supply chains can be used to optimise operations, mitigate risks, and capitalise on emerging opportunities.

Filipe Gouveia , BIMCO’s shipping analysis manager, looks ahead at the dry bulk market and freight rate prospects for 2026.

In this CRU Insight, Humphrey Knight assesses the key market factors driving high SOP pricing.

CF Industries has made its first shipment of certified low-carbon ammonia to Europe.

From ship to storage, Bruks Siwertell aims to ensure safe, reliable, high-capacity fertilizer transfers.

Ukraine’s resilient fertilizer market has undergone an import-led revival following a calamitous collapse in consumption in 2022.

Smelter outages and tight concentrate markets ease an oversupplied market.

In this CRU Insight, Alexander Chreky reports on China’s potash industry – and reviews the country's international potash investments.

The global sulphur market registered price increases during August as a result of demand in Asia and North Africa, while supply has tightened due to limited supply from the FSU and Saudi Arabia, as well as logistical constraints in both Iranian ports and railway capacity to Black Sea ports.