Sulphur 417 Mar-Apr 2025

19 March 2025

Market Outlook

SULPHUR

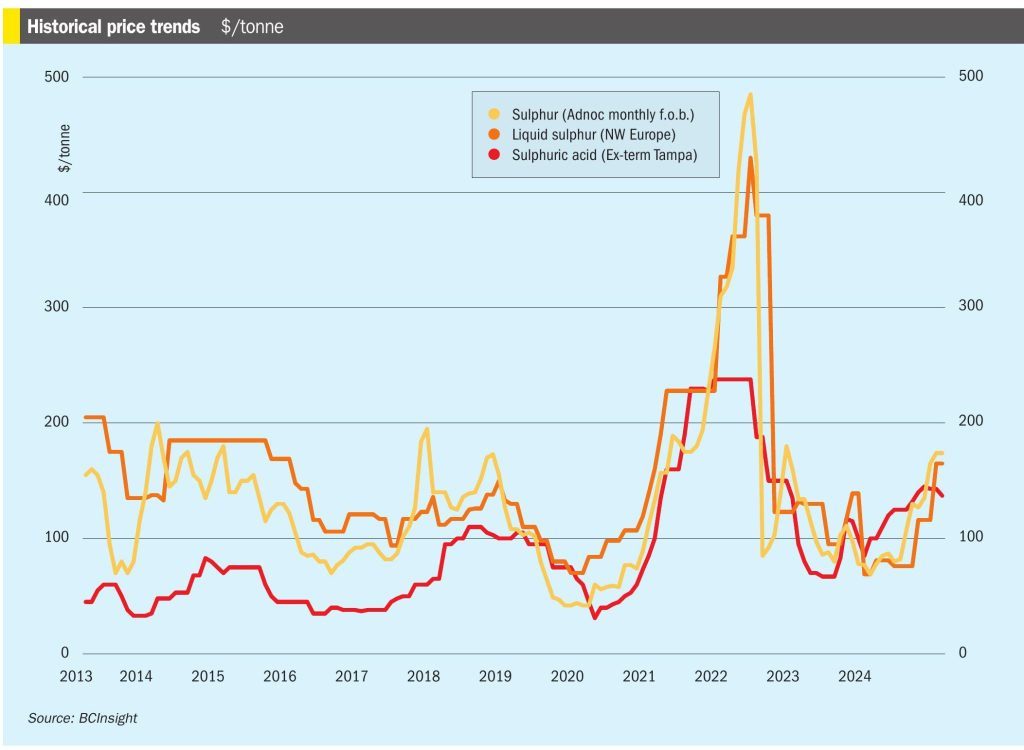

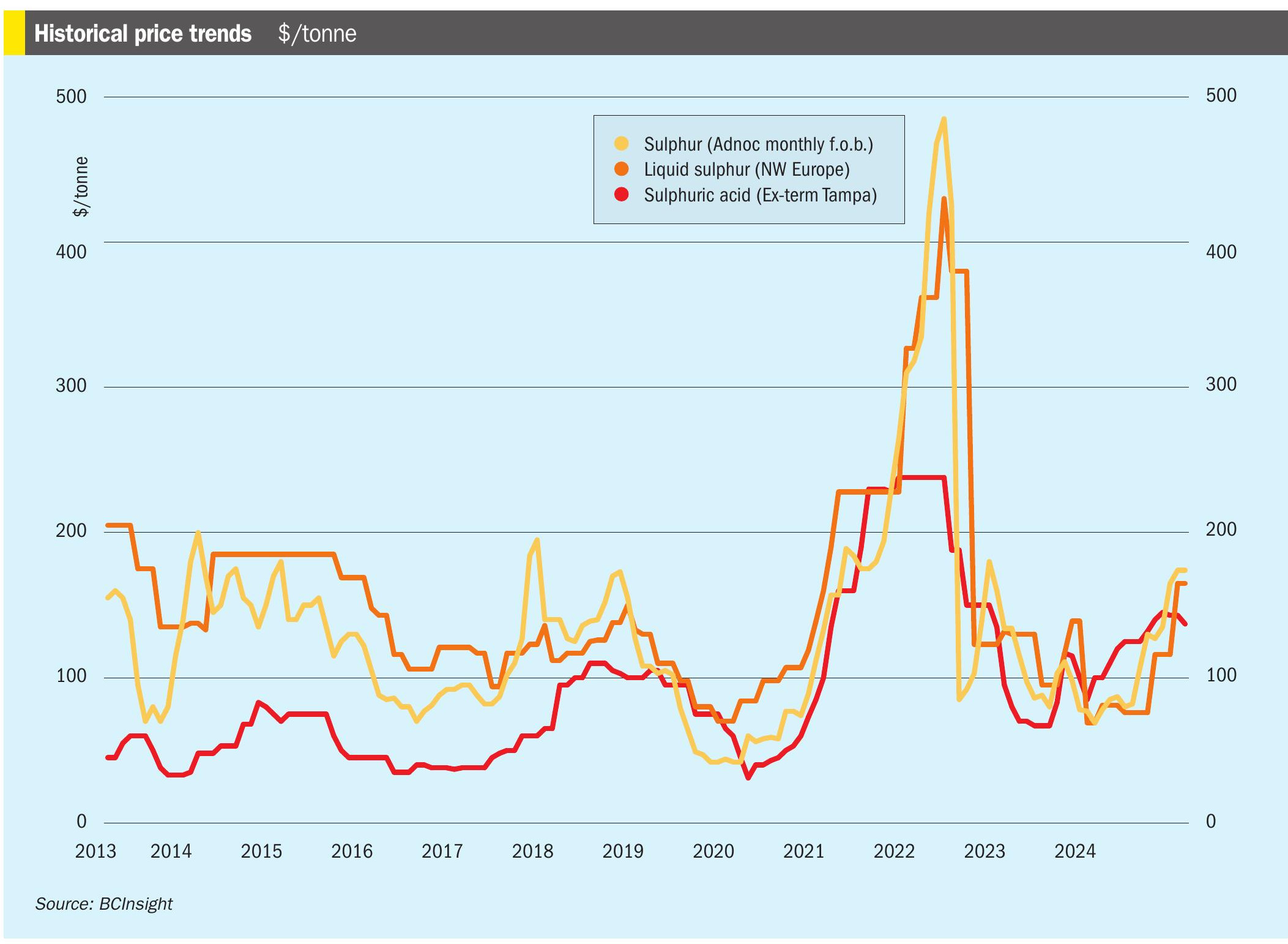

• Sulphur prices have been revised higher in the latest forecast after supply from the Middle East was lower than expected in February, and buyers with uncovered demand were forced to chase prices upwards. UAE sulphur exports normally fall at the start of the year due to scheduled maintenance, but sales in February this year were 200,000 tonnes short of what is typical. Prices may climb more than expected as buyers scramble to cover their shorts. If supply is slower to return than currently anticipated, momentum may push prices even higher in the short term.

• Prices are expected to ease around the start of Q2 as supply returns to normal and this will coincide with Kazakhstan pulling back its exports, as its inventory will be exhausted. One element of the sixteenth round of EU sanctions on Russia was a full transaction ban on three Russian ports, including Ust-Luga, which exports large volumes of Kazakh and Russian sulphur.

• Opinions on the impact of the fresh sanctions are mixed, and the outcome is not yet clear, although they are EU not US sanctions, and US companies such as Trammo may well be unaffected. Should there be an impact on export volumes from Ust-Luga, Morocco may feel the pinch as a major buyer of Baltic tonnes, and Brazil also takes tonnes from the region.

SULPHURIC ACID

• Prices in the sulphuric acid market, which have generally increased since the start of 2024, are expected to decline as 2025 Q1 progresses. Prices are now forecast to hold at similar levels to those seen in February. The declines in global prices will be shaped in pace and timing by fluctuations in the supply/demand landscape, but expected decreases could be more moderate or materialise later than expected depending on supply/demand dynamics.

• Availability in Europe, while still anticipated to return in 2025 Q1, has not yet materialised. The lack of spot market availability pushed prices briefly to $110120/t f.o.b., the highest since September 2022, before falling back in late February on lower demand from Morocco.

• Purchases of acid in Chile have been limited as buyers remain largely unable to take on spot volumes. The seasonal rough seas have also hampered new business. Local market participants expect similar conditions to continue into early March. The price is forecast to continue decreasing, stabilising at $148/t c.fr for May, June and July.

• China prices fell as traders cleared inventory ahead of New Year celebrations. The price narrowed to its current range of $50-55/t f.o.b. having adjusted to lower inventory levels.

• Local production and availability in India and Indonesia have increased and are expected to increase further. An increase in local availability could limit import requirements, with Adani’s smelter expected to start operations by 2025 H1. Paradeep Phosphates Ltd. (PPL) is also expected to commission a 500,000 t/a sulphuric acid plant by 2025 Q2.