Market Insight

Market Insight courtesy of Argus Media

Market Insight courtesy of Argus Media

T he end of August saw a paper published in the Journal of the Royal Geographical Society by Dr Mark Maslin of University College London. Widely reported, it looked at the prospects for sulphur production in an era of declining fossil fuel use, concluding that there could be “a shortfall in the annual supply of sulphuric acid of between 100 and 320 million tonnes by 2040, depending on how quickly decarbonisation occurs”. It added that “unless action is taken to reduce the need for sulphuric acid, a massive increase in environmentally damaging mining will be required to fulfil this resource demand.”

A large portion of the oil reserves of Canada and Venezuela exist as oil sands. By the mid-2000s, production from these sources had topped 5.5 million bbl/d. But with Venezuela’s economic implosion and increasing environmental scrutiny of oil sands production, what is the future for this high sulphur fuel source?

Marco van Son and Frank Bela of Comprimo share lessons learned from SRU war stories, including: inadvertent NH3 destruction in an oxidising atmosphere, rich amine emulsion, SWS fixed valve trays, H2 spiking of SRU feed, rich amine flash drum early warning, V-ball fuel gas safety shutoff valves, TGTU methyl mercaptan, and commissioning and Murphy’s Law.

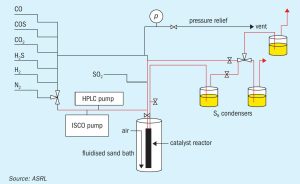

Temperature dependent rate constants for the hydrolysis of CS2 and COS across Claus Al2 O3 and TiO2 catalysts are valuable tools for the design and optimisation of new, as well as existing, sulphur recovery units. In this context, Alberta Sulphur Research Ltd (ASRL) has measured CS2 and COS hydrolysis rates over a range of temperatures for both Al2 O3 and TiO2 catalysts under start-of-run and, more recently, end-of-run first converter conditions. In this article Christopher Lavery, Dao Li, Ruohong Sui, and Robert A. Marriott of ASRL report on their methodology and the utility of the kinetics calculated from their data and draw comparisons between the start-of-run and end-of-run results.

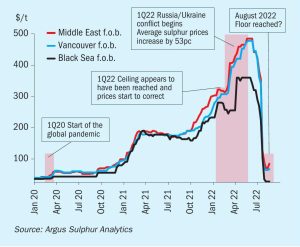

Reduced appetite for sulphur from processed phosphates producers in China will continue to place downwards pressure on pricing in the near term. l Phosphates-based demand is likely to remain low in the second half of 2022 as issues surrounding affordability persist, slowing import requirements.

The US refining sector continues to face operating pressures with 1.3 million bbl/d of closures in the past three years, while sour gas sulphur production has recovered somewhat. Meanwhile, demand from copper and lithium leaching projects will increase use of sulphuric acid over the next few years.

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

After two years of virtual events, the CRU Sulphur + Sulphuric Acid 2022 Conference & Exhibition will return to an in-person event at the World Forum, The Hague, 24-26 October 2022. CRU will be welcoming the global sulphur and sulphuric acid community to this premier annual event for networking and essential updates on the markets and technical developments that are influencing the industry.

In a major blow to the British fertilizer industry, CF Fertilisers UK announced the closure of its Ince production site in north-west England in June (see p8). Ince is the UK’s largest compound fertilizer producer, operating three NPK+S units. It also manufactures large volumes of ammonium nitrate (AN) for Britain’s farmers. At the heart of the Cheshire complex is Ince’s long-standing ammonia plant. Unfortunately, high natural gas costs have kept this shuttered since September last year.