Sulphur 422 Jan-Feb 2026

28 January 2026

The sulphur market in deficit

SULPHUR MARKET

The sulphur market in deficit

Sulphur prices have risen rapidly in recent months as the market moves into a period of deficit which is likely to last until 2028.

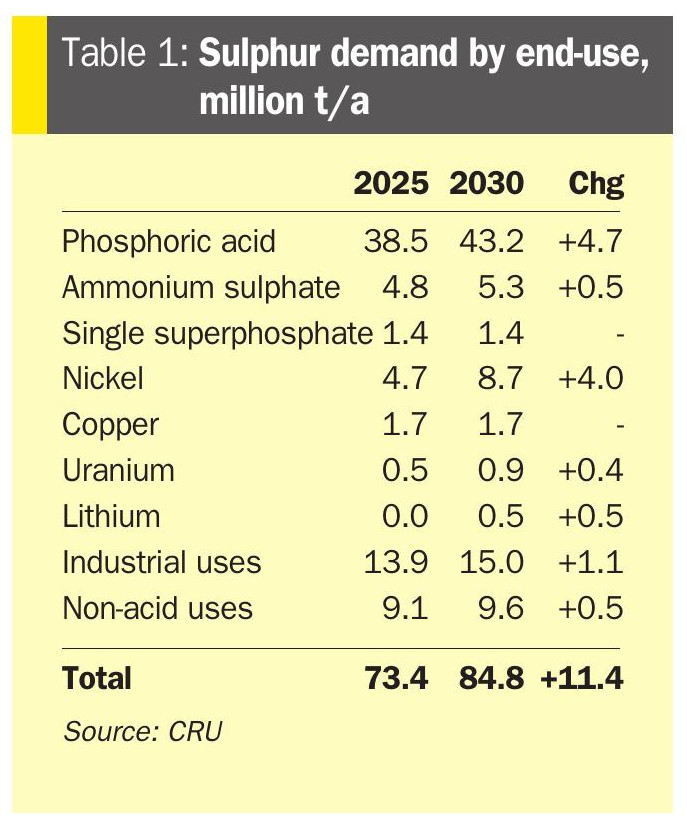

The sulphur market moved into a period of pronounced deficit in 2025. CRU estimates that total global demand for sulphur in 2025 was 72.8 million t/a, and supply 70.8 million t/a, leaving a structural deficit of about 1.9 million t/a. The reasons for this were an acute underperformance of supply, combined with concentrated import demand, particularly in Indonesia, Morocco and parts of Latin America, which has triggered a sharp price rise during 4Q 2025, with Middle Eastern and Vancouver prices rising past 2022 peaks. A partial price correction is expected in 2026, driven primarily by demand destruction and some recovery in production, but over the medium term it is expected that prices will remain at relatively high levels while the structural deficit continues. A complete rebalancing of the market is not forecast until the startup of major sour gas projects in the Middle East, around 2028.

In the interim, there has been a drawdown of sulphur stockpiles in Canada, Saudi Arabia and Kazakhstan, and additional sales from Turkmenistan, but further drawdown will be required to maintain traded market flows until new supply arrives.

The developing deficit

The sulphur market in fact had moved into a structural deficit by early 2024, but this was largely masked that year by proactive stock releases from Kazakhstan and Saudi Arabia. During the first half of 2025, however, a recovery in demand, particularly in the phosphate fertilizer sector emerged. A ramp up in demand from nickel HPAL projects also increased sulphur consumption. Indonesian sulphur imports reached 4.6 million t/a in the 11 months to November, up 1.2 million t/a year on year. By 3Q 2025, supply disruptions became acute, with operational issues and unplanned outages reducing output in several regions, notably the CIS and parts of the Middle East. At the same time, strong import buying from Indonesia and robust Chinese domestic activity kept demand high. This confluence of restricted exports, including a temporary Russian export ban allowing only transit shipments, and stock depletion triggered the Q4 price spike.

Signs of demand curtailments began to appear in 4Q 2025, e.g., China delaying phosphate exports until August 2026; and Mosaic pausing SSP purchases in Brazil, signalling affordability issues. Middle Eastern f.o.b. prices have risen from $295/t in 2024 Q4 to $515/t by the end of 2025; Vancouver f.o.b. prices similarly rose from $275/t to $490/t, with delivered prices to key destinations rising to $480–550/t c.fr in markets such as Indonesia, China and Brazil (with Indonesia approaching $550/t). This means that sulphur’s share of the raw material cost of phosphate fertilizer production rose to historic highs (72–82% in some markets), exceeding the 2022 peak. This squeezed margins for producers of DAP/MAP and other fertilizers, especially in China and Brazil. China’s response has been to impose export restrictions, and CRU believes that this will trigger a price correction this year.

Supply

Overall, CRU expects supply to recover gradually from 2026, with a large acceleration from 2027 as large-scale gas projects in the Middle East commission. Near term supply impacts have come from, e.g. Ukrainian drone strikes at the Astrakhan gas plant in Russia, which caused major production losses during the second half of 2025. Output from Astrakhan fell by an estimated 300,000 tonnes over the period, leading to Russia’s export restrictions in Q4. In the Middle East, a fire at the Al Zour complex in Kuwait and temporary curtailments in other Gulf operations contributed to Q4 tightness. Lower sulphur content in crude processed in the US, together with some refinery closures or conversions to biofuel processing at Phillips66 in Los Angeles, LyondellBasell in Houston, and Valero in Benicia have also reduced oil-derived sulphur availability. Mexico’s Dos Bocas refinery ramp-up has increased oil-sourced sulphur production south of the border, and PEMEX will continue to lift domestic supply through 2025–2030.

European refinery throughput has trended down since 2015 due to conversions and closures. Mined sulphur output in Poland provides a partial offset, but remelt capacity projects (e.g., Aglobis/Rhenus) are being developed to meet domestic demand.

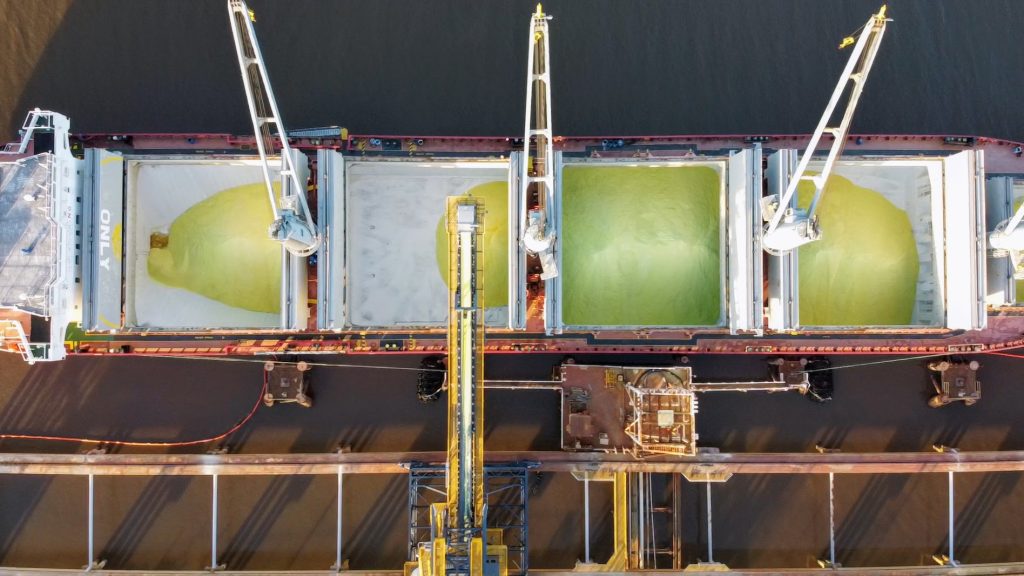

Stock drawdowns have been the balancing factor. Kazakhstan and Saudi Arabia previously drew down large stocks in 2023–2024 and continued into 2025; Canada has likewise ramped up remelting of its considerable stocks at Fort McMurray to supply the traded market – these flows have been critical to sustaining traded availability despite production shortfalls.

In the medium term, CRU projects global supply growth of ~3.0 million t/a for 2026, split roughly 45% from gas projects and 55% from refineries. Major new projects that will be commissioning include new refinery capacity in India and China (~1.1 Mt combined for 2026) and multiple gas project increases in the Middle East. Looking further forward, ADNOC’s Ghasha project will add about 3.5 million t/a of new sulphur capacity, beginning in late 2027, while expansions to Qatar’s North Field will boost output by 700,000 t/a. In Saudi Arabia there are the AlFadhili and Tanajib expansions. By 2030 CRU expects the Middle East to account for 67% of incremental global supply growth (+8.9 million t/a).

Demand

Fertilizer demand via phosphoric acid production, as well as ammonium sulphate and single superphosphate (SSP) remains the single largest consuming sector. CRU forecasts that phosphoric acid demand will rise from 37.7 million t/a in 2024 to over 43 million t/a by 2030 in terms of sulphur tonnes consumed.

China’s supply increased in 2025 due to new refinery capacity (e.g. the Yulong refinery) and production recovery at existing assets. Gas-based supply from the Puguang gas field also lifted slightly. Increased supply has reduced import dependence, and CRU projects Chinese production to continue rising to 2030, lowering import dependency from the late 2020s, although industrial demand from ammonium sulphate (see the article elsewhere in this issue) and other chemical outputs have remained resilient.

Morocco has seen capacity expansions from new sulphur burners at Jorf Lasfar leading to increases in demand capacity. Morocco’s import pattern in 2025 also reflected stock drawdown initiated in earlier years.

Brazil’s phosphate sector has seen a recovery plus new plants (EuroChem’s Serra do Salitre) which have supported steady demand, and the country remains reliant on seaborne imports.

India is also seeing increasing sulphur consumption from expanded phosphate burners (Iffco, PPL, CIL) and limited domestic supply increases which will create ongoing import requirements over the next few years.

The metals industry also continues to expand rapidly, with nickel and lithium production for batteries and also (in the case of nickel) stainless steel production. Indonesia has been the centre for nickel production growth via large Chinese-backed high-pressure acid leach (HPAL) projects. HPAL plant rampups (e.g., Huayue, PT Lygend, ENC, PT Meiming) have led to a major expansion in sulphurburning capacity, and many of these projects will continue to ramp through 2026 and beyond. Cobalt credits have mitigated HPAL sulphur cost passthrough in 2024–2025, reducing nearterm demand destruction from high sulphur prices, but policy (Indonesia requiring downstream refining) and project viability could alter future demand. Overall, metals consumption is expected to increase its share of demand notably from 2026 onward. CRU forecasts nickel-related sulphur demand doubling or more through the later 2020s. Phosphate remains dominant in absolute terms, but metals constitute a larger share of incremental demand.

Trade flows

Global trade remained large (39-40 million t/a in 2025), but origin and destination patterns are changing. Kazakhstan historically fed Morocco and China, but after an aggressive stock drawdown in 2023–2024, Kazakh exports fell in 2025 to more typical levels of 3.3-3.5 million t/a as inventories depleted. Canada increased its seaborne export volumes in 2025 as stock remelting ramped to supply a tight market, although remelt/logistics costs (ca. $180–200/t for oil sands remelt to Vancouver) affect competitiveness and set a floor on export volumes. Middle East exports remained central, and CRU expects the region to expand export capacity post2026.

China’s port inventories began declining in Q3–Q4 2025; northern river stocks fell more rapidly than southern port stocks. Chinese policy measures to stabilise domestic prices, including discouraging long positions by traders, have influenced inventory drawdown patterns. Global inventories are projected to fall to 30–33 million tonnes as stock drawdowns continue. This places the market below the recent fiveyear average and heightens vulnerability to further supply shocks.

Near-term outlook

CRU expects a moderation in demand in 2026 Q1 as affordability constraints bite and some consumers formally restrict purchases. This is the primary mechanism for a short-term price correction from late 2025 peaks. A supply recovery due to new project commissioning, and production repairs is expected to start contributing from 2026 H1-H2, but material relief will also come further down the line in 2027–2028, when major gas projects start up. Even so, the market will remain in deficit through 2026 and into 2027; therefore, while prices may fall from Q4 2025 highs, they will remain elevated vs historical norms until structural supply additions fully arrive. Producers in deficit regions can expect robust pricing into 2026 if supply disruptions persist; however price volatility is high and dependent on stock releases and short-term demand changes. Fertilizer producers face squeezed margins; some (e.g., Mosaic) are already curtailing purchases/ production – this may feed through to fertilizer product availability/pricing. Nickel producers (HPAL) currently see sulphur cost exposure offset by metal credits (cobalt), but persistent high sulphur may influence project economics and downstream integration decisions.