Nitrogen+Syngas 398 Nov-Dec 2025

19 November 2025

Market Outlook

Market Outlook

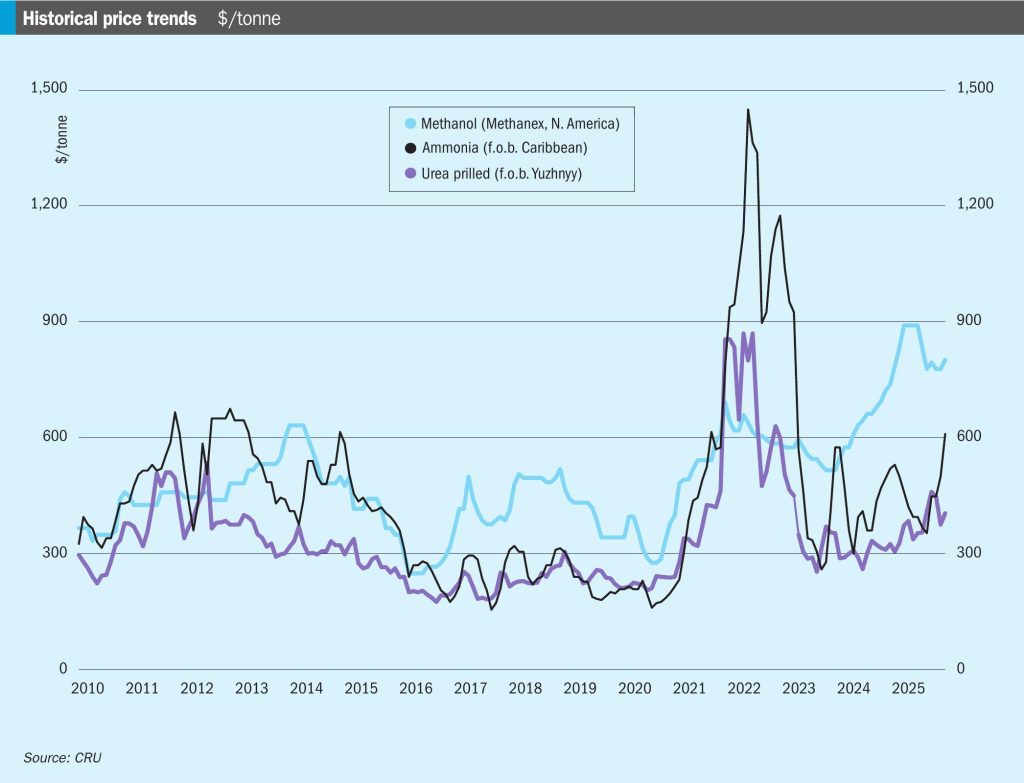

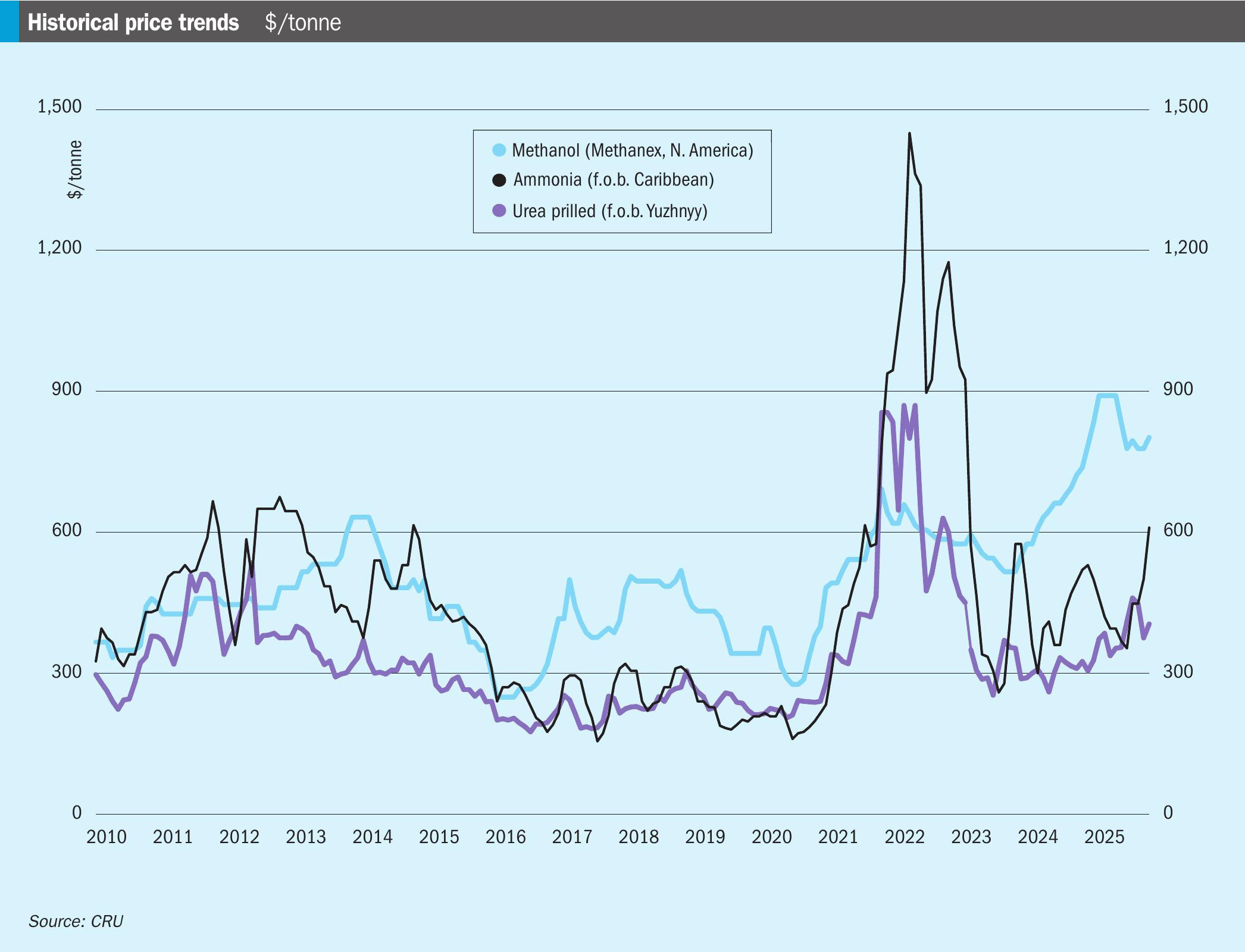

AMMONIA

- The market looks very tight through the end of the year, though some expect supply to improve in Q4. Prices are unlikely to ease in the coming weeks.

- Woodside’s Beaumont New Ammonia Project is now 97% complete, and the producer expects production from the first train in late 2025. There is no information from Gulf Coast Ammonia on when to expect commercial production.

- There was an absence of fresh confirmed business into northwest Europe. Still, producers with ammonia capacity in the region are expected to be maximising output given the favourable economics at current spot natural-gas prices at the Dutch TTF.

UREA

- The issuing of a fresh purchase tender by India’s IPL should sustain current upwards price momentum, though values could undergo a temporary reset should India delay its anticipated enquiry by a few weeks.

- The question of Chinese participation in any new Indian tender – or indeed Chinese exports in general – remains a point for contention, with availability under the country’s current export quota understood to be dwindling. An upcoming convening of the China Nitrogen Fertilizer Association (CNFA) is not expected to coincide with the issuing of any new export quota for at least the remainder of 2025.

- Prices in Iran edged up after 140,000 tonnes of granular material was committed by producers in the $367-370/t f.o.b. range. Iranian supply will likely tighten towards the end of the year as seasonal shutdowns come into play.

- In the US, barge values at NOLA leapt to $395-398/st f.o.b. in keeping with global sentiment, though meaningful American demand is expected to emerge towards the end of the year.

METHANOL

- l Methanol prices are currently varied by region, with the European posted contract price at €535/tonne, North America’s non-discounted price at $802/tonne, and Asia Pacific at $360/tonne.

- Increased production capacity in North America, such as the Geismar 3 plant in the US, has put downward pressure on some regional prices, particularly in Europe. Conversely, production disruptions, as seen in the Middle East and Europe, have caused price volatility. US sanctions affecting Iranian methanol exports have created supply constraints for markets like India, contributing to price spikes.

- Demand from key sectors like automotive and construction typically slows down during summer and monsoon seasons, affecting prices in regions like Asia and the Middle East. Demand for biomethanol and e-methanol in the shipping industry is expected to increase due to regulations like FuelEU Maritime.