Sulphur 420 Sep-Oct 2025

19 September 2025

Price Trends

Price Trends

SULPHUR

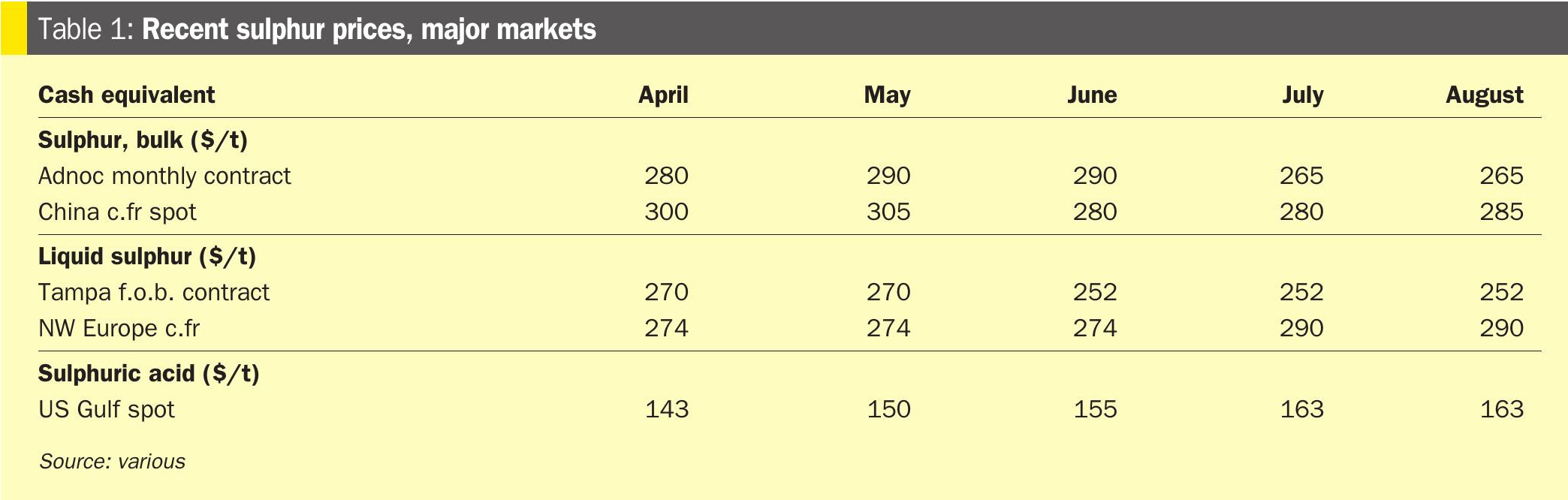

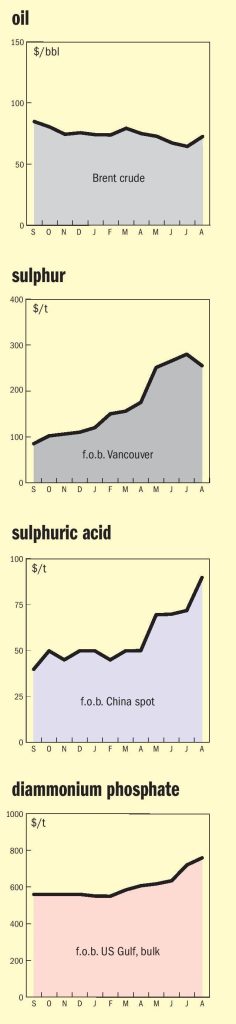

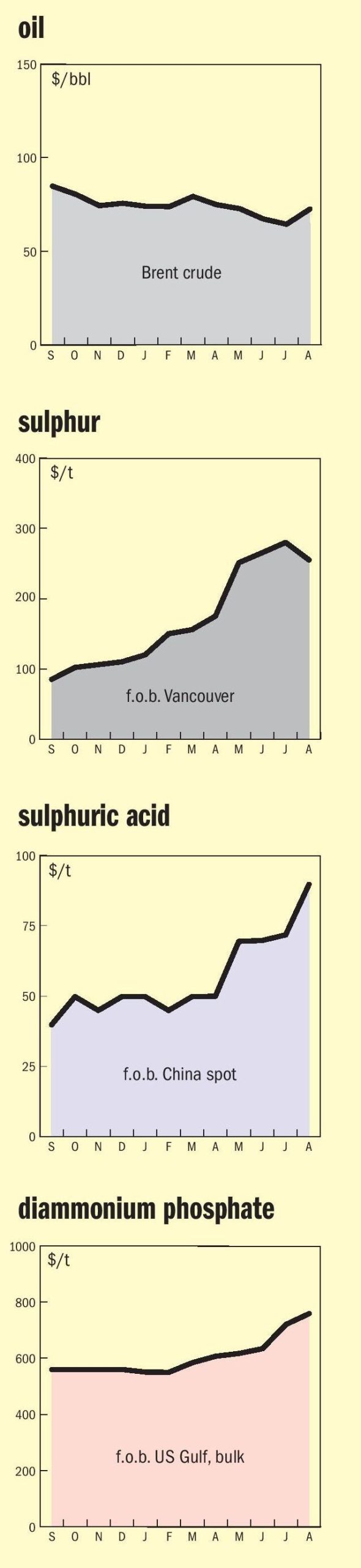

The global sulphur market registered price increases during August as a result of demand in Asia and North Africa, while supply has tightened due to limited supply from the FSU and Saudi Arabia, as well as logistical constraints in both Iranian ports and railway capacity to Black Sea ports.

Sulphur prices in Indonesia increased in the latest transactions into the country, which included a PT Lygend tender. Delivered prices into Indonesia were assessed up at $315-318/t c.fr at the start of September, with as many as three cargoes purchased during one week within the newly published range. The cargoes are understood to be of primarily Middle Eastern material, although some market participants indicated the possibility of one cargo being of Canadian material. Demand is expected to remain robust in the short term, according to market participants, but some of the bullishness has subsided, as China has not reported import purchases in the last two weeks. Indonesia’s sulphur imports increased by 74% year on year from January through June, reaching 2.59 million t/a for 1H 2025, according to Global Trade Tracker (GTT).

Delivered prices in China were unchanged, as transactions of international material have been absent. Phosphate producers’ operating rates, fewer fresh seaborne arrivals during August, and Indonesian purchases are driving the current market sentiment. Port spot prices were reported at $312-314/t c.fr, lower than current offers of international material of around $320/t c.fr. Still, Chinese buyers have become cautious due to the price difference between new international cargoes and port products. Domestic prices have been rising, however, and have reached a delivered price of around $314/t c.fr. At the start of September, Sinopec’s Puguang, China’s largest sulphur producer, with an output of around 5,500 t/d, increased its prices at both the port and its Dazhou factory. The seller’s price at Wanzhou port is currently reported at $359/t, increasing by $8/t from the previous week. The factory price at Dazhou for truck volumes is $344/t, up $11/t, while rail volumes were priced at $352/t ex works, up by $8/t compared to last week. Total sulphur port inventories in China were unchanged at 2.31 million tonnes by September 3rd. The volume at Yangtze River ports increased by 18,000 tonnes to 1.12 million tonnes, while the Dafeng port inventory was unchanged at 296,000 tonnes.

In the Middle East, the latest Indonesian purchases have been reflected in higher indications that place the price at around $290-300/t f.o.b. Despite the release of the September monthly prices this week by KPC at $284/t f.o.b. and ADNOC at $285/t f.o.b., following Qatar-Energy’s previous posting of $284/t f.o.b., the spot market was moving higher, with spot transactions at those levels considered no longer viable, according to multiple industry sources. Offers have increased in China where, as noted, they have been reported at around $320/t c.fr.

In Brazil, the latest CMOC tender is understood to have been awarded at a price level of $320/t c.fr., although the origin of the material could not be verified at the time of writing. Market talk suggested it was likely the FSU, in spite of earlier reports suggesting a very limited presence of FSU offers during the tendering process. Still, the transaction also supported prices in the US Gulf, which have now risen to levels at the $275-285/t f.o.b. level. The Brazilian market is likely to retain some bullishness in the short-term after having to compete with North African, Indonesian and Chinese demand, but activity is likely to remain subdued until October with prices expected to decrease around the same time, according to market participants.

In Europe, Mediterranean sulphur prices were assessed up at $275-280/t f.o.b. and $310-315/t c.fr. Availability in the market is understood to be limited, which has increased the bid level, with the latest transaction understood to have taken place within the newly published c.fr level. The price level saw a steady increase on three tenders in the span of a week, with the latest one, an NOC tender, understood to have been awarded within the newly published f.o.b. range. The market is bullish and limited availability is likely to see prices increase in the short-term, although prices are likely to soften towards the beginning of Q4, according to industry sources.

Although prices were assessed unchanged in Vancouver at $270-279/t f.o.b. at the start of September, local market sentiment is bullish, with expectations of the price entering the $280s/t f.o.b. in the next transaction, according to market participants. Although exports to Asia were limited, demand in Indonesia is likely to be robust or at least constant in the weeks ahead, according to market participants.

SULPHURIC ACID

Current sulphuric acid availability in Europe has exerted downward pressure on prices as offers decline across delivered markets, while the latest tender in China also registered a price decrease. Acid prices in Europe decreased further at the end of August, down at $85-85/t f.o.b. from a previous weekly figure of $105-115/t f.o.b., with ample availability. Volumes in Europe have been offered across delivered markets, but demand has remained subdued in recent weeks with prices at higher levels, according to market participants. Bearish market sentiment persists, and expectations point towards the market consolidating at the $80s/t f.o.b. level in the near-term, according to multiple industry sources.

The latest tender in China also registered a decrease, with the award understood to have taken place at the high $70s/t f.o.b. price level. Decreasing offers of European material have put downward pressure on China’s export market, with demand quickly becoming subdued and losing interest in Asian material at higher price levels, according to industry sources. The export price range for sulphuric acid in China was assessed down to $76-79/t f.o.b. from a previous figure of $93-98/t f.o.b. Although the domestic market remains a possibility for sellers in the region, more material is expected to enter the international market, leading to a slightly bearish sentiment. China’s sulphuric acid exports during January-July 2025 increased 103% year on year to 2.6 million tonnes, while imports decreased 21% on year, according to data via Global Trade Tracker (GTT).

Demand in North Africa remains limited. Sulphuric acid prices into North Africa were assessed down at $120-140/t c.fr from a previous level of $150-170/t c.fr. With prominent buyers in the region reportedly now covered for the remainder of the year, the price floor was not immediately clear, with activity likely to be limited until at least Q4, when buyers re-enter for 2026 Q1 purchases, according to industry sources.

Spot sulphuric acid prices for import into the US Gulf were assessed down at $120-130/t c.fr, from previous levels of $150-155/t c.fr. Firm offers into the US Gulf fell, and the latest transaction, although unverified, is understood to have taken place within the newly published range. Demand is low, and a healthy domestic market has limited the purchases of imported material recently, although buying interest has reportedly grown as offers continue to fall. The US imported 1.65 million tonnes of sulphuric acid during January-June 2025, decreasing by 6% compared to the volumes imported during the same period in 2024, according to data via Global Trade Tracker (GTT).

Buying interest in Chile has also remained subdued, even as offers declined. Sulphuric acid prices into Chile were assessed down at $165-170/t c.fr, after having spent five weeks assessed at a level of $175-182/t c.fr. Even so, a number of transactions on an FCA basis took place this week, according to market participants, at levels suggesting CFR prices that fall within the newly published range. Current availability in Europe has put downward pressure on prices, and buyers are waiting for the start of annual contract negotiations, and are limiting themselves to opportunistic purchases in the meantime, according to industry sources. Chile’s imports of sulphuric acid from January through July 2025 increased by 19% to 2.33 million tonnes, compared to the volumes imported during the same period in 2024, according to Global Trade Tracker (GTT) data.

The delivered price of sulphuric acid into Brazil was assessed lower at $140-150/t c.fr from last week’s $175-180/t c.fr. The decrease in prices reflects the sentiment in Europe, with volumes from the region being offered within the newly published range, according to market sources. The market is bearish and offers are expected to decrease further, but demand is likely to be muted in the coming weeks, with most of the market reported to be already covered. Still, offers have kept a downward trend with the latest firm offers within the newly published price range, and prices above are considered no longer viable, market sources said. Brazil’s imports of sulphuric acid for January-July 2025 were down 11% year on year at 263,000 tonnes, according to GTT.

Prices into Turkey were assessed down at $110-130/t c.fr from last week’s $140-150/t c.fr. Domestic availability is reported to be stable, and there is little demand for imported material, according to multiple market participants.

END OF MONTH SPOT PRICES

Price Indications