Sulphur 420 Sep-Oct 2025

15 September 2025

Smelter disruptions reshape 2025 traded acid market

Smelter outages and maintenance, alongside a copper concentrate shortage, tightened sulphuric acid supply and supported high prices in early 2025, but new smelter capacity in China, India, and Indonesia is set to boost acid availability and reduce import needs in 2025 Q4 and 2026. As Chinese exports fill global gaps and Asian capacity ramps up, sulphuric acid prices are likely to move lower, predicts Viviana Alvarado, CRU analyst.

Supply disruptions have impacted the sulphuric acid trade dynamics and the price outlook in 2025. As smelter availability is anticipated to increase with the start-up of new capacity additions in Asia, import requirements are likely to decline in 2025 Q4 and 2026. Reduced import demand is expected to result in lower acid prices, which will place further pressure on smelter’s revenues amid persistently low treatment and refining charges (TC/RCs).

Smelter consumption set to grow despite copper concentrate deficit

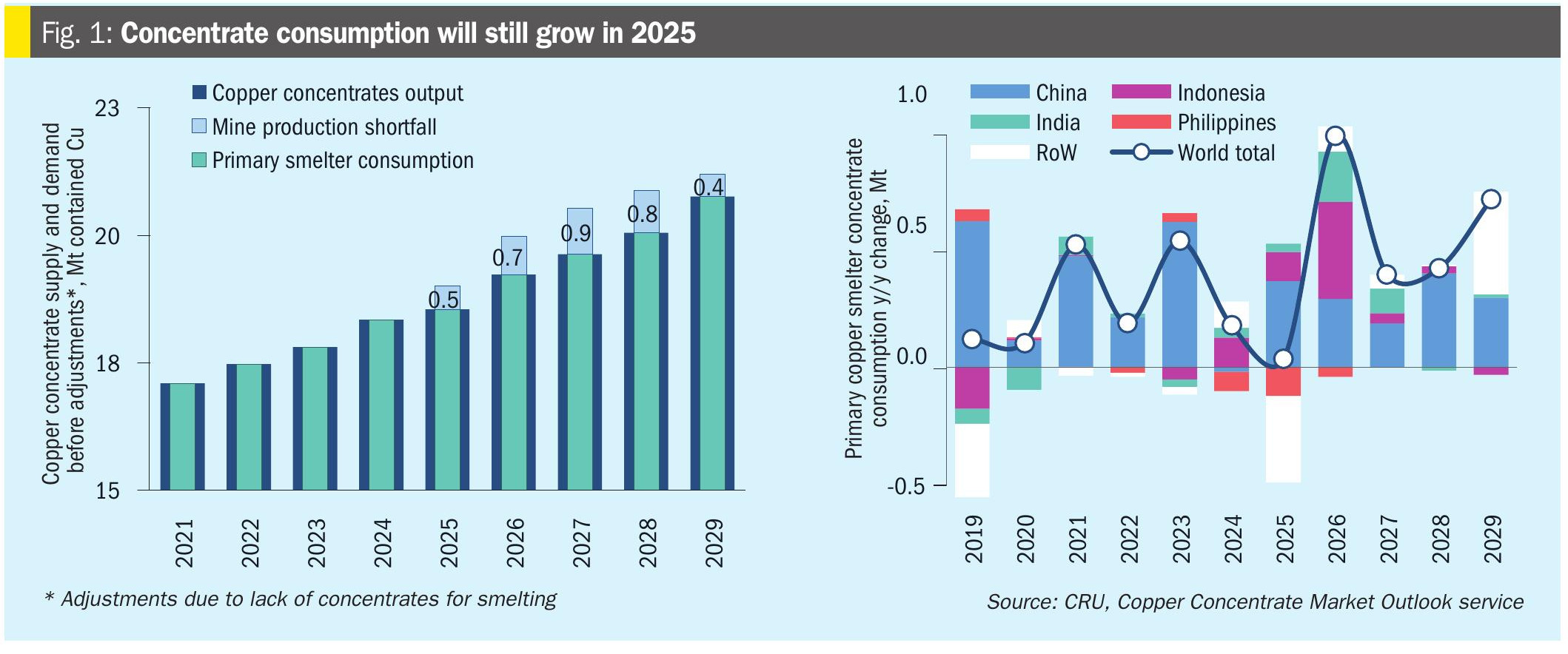

Several fundamental and temporary factors have caused disruptions at smelters, including extended maintenance periods, closures, and reduced operating rates. The copper concentrate shortage has been a significant issue, as the global increase in smelter capacity has outpaced mine supply, pushing TC/RCs into negative territory since early 2025. Despite consumption cuts in 2025, shortages have persisted, with further demand adjustments required to balance the market. In 2025, a mine production shortfall is estimated at 0.5 Mt Cu, with global concentrate consumption growth of only 0.2% y/y in 2025 (see Fig. 1).

The copper concentrate shortage will affect consumption patterns differently across countries. The most significant decline in consumption is expected from the Philippines, as Glencore announced in May 2025 that it will put its PASAR copper smelter plant under care and maintenance. Namibia will also play a role in rebalancing the market due to the halt of operations at the Tsumeb smelter starting in June 2025. Japanese smelters will address the deficit by reducing utilisation rates or processing more secondary material in 2026. By contrast, smelters in China, India and Indonesia are expected to ramp up new capacity additions. Particularly, the start-up of operations at Adani’s copper smelter in India, as well as at Amman Mineral’s and Freeport’s smelter in Indonesia, will push concentrate demand and acid supply higher.

In South America, smelter disruptions have also taken place but driven by technical issues. Glencore suspended operations at its Altonorte smelter for one month in April 2025 due to a furnace issue. Similarly, Coldelco’s Potrerillos smelter halted operations in June after a stack collapsed and has yet to restart operations.

Chinese smelter availability to fill the supply gap

The smelter supply outages have a direct impact on the sulphuric acid traded market. The unplanned outages at the Altonorte and Potrerillos smelters are expected to reduce the 2025 supply by around 0.3 Mt of acid. The Altonorte issue prompted buyers to commit to new imports, which pushed 2025 Q2 arrivals to a six-year high. The collapse of the stack at Potrerillos has not led to a further increase in buying activity, as Mejillones is currently experiencing port congestion, with buyers remaining well supplied.

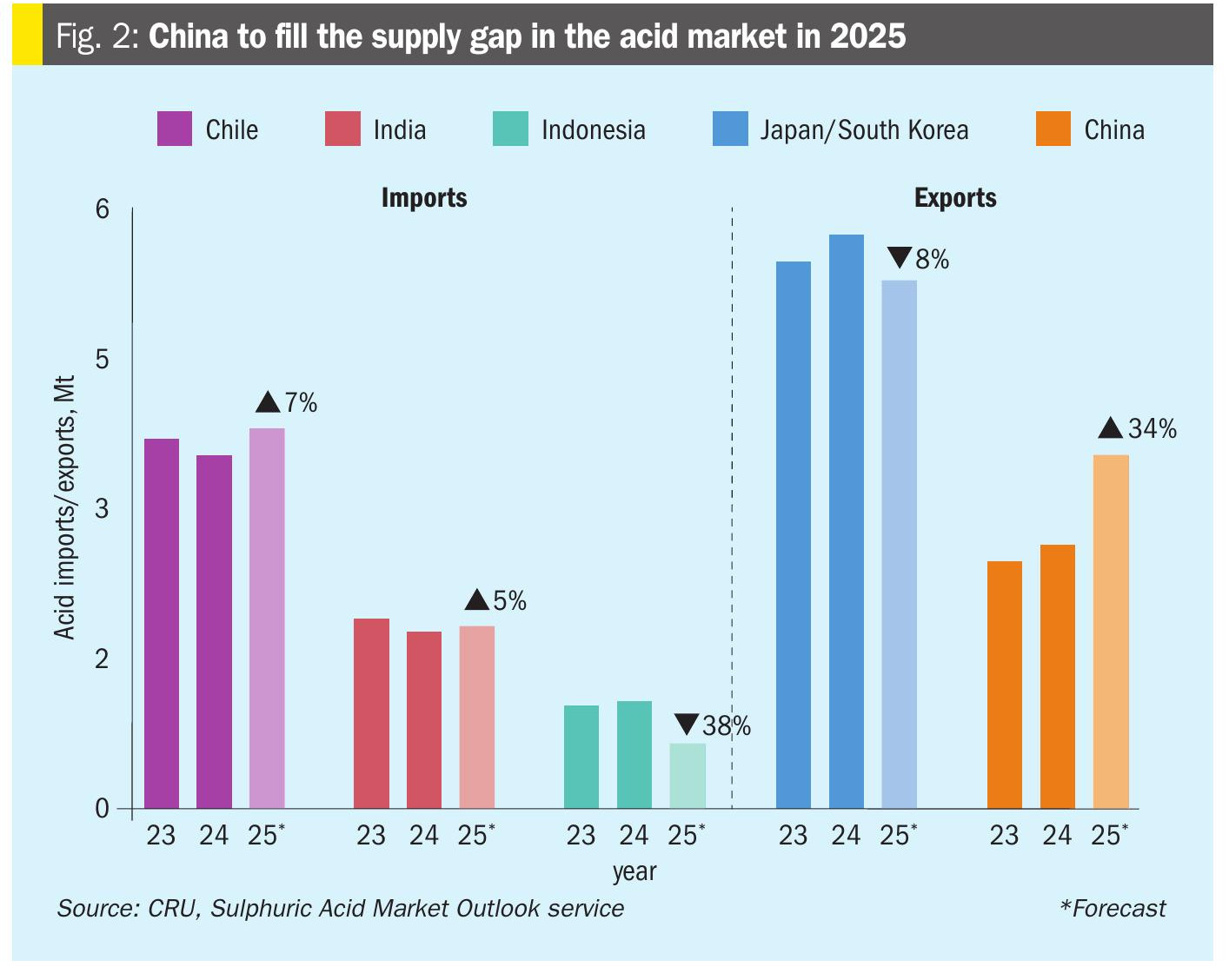

In Asia, the halt of operations at the PASAR smelter in the Philippines will reduce regional production and export availability by around 0.4 Mt in 2025. However, in the opposite direction, the start-up of Freeport’s Gresik operation and Amman Mineral’s smelter project will increase acid capacity by 1.4 Mt/y and 0.9 Mt/y, respectively. Likewise, the start-up of Adani’s Copper smelter project in India, with a capacity of 1.5 Mt/y, will further rise supply in the region. As India and Indonesia are the Philippines’ major trade partners, a surge in local availability from both countries will partially offset the lack of supply from PASAR.

From the export side of the market, higher concentrate consumption in China, driven by new smelter capacity, is expected to increase export acid availability from 2.6 Mt in 2024 to 3.6 Mt in 2025. China will play a major role in filling the supply gap in the international market as renewed demand has emerged – particularly in Chile and Saudi Arabia. Additionally, the tight availability from Japan, due to smelters’ lower operating rates, will facilitate Chinese export activity (see Fig. 2).

High acid prices are likely to move lower

Smelter supply disruptions have had a significant impact on acid price trends in 2025. The series of smelter issues in Chile, high domestic acid prices in China, tight availability in Japan and South Korea, and strong demand have all supported acid prices.

The notable decline in TC/RCs values has cut smelters’ revenue, and high sulphuric acid prices have partially countered this drop. However, the inherent volatility of sulphuric acid prices makes a move to lower acid prices likely, particularly as import requirements decline. Any decline in acid prices, whilst TC/RCs remain low, would put further strain on smelter economics.

About the author

Viviana Alvarado is a Sulphur and Sulphuric Acid Analyst at CRU.

Email: Viviana.alvarado@crugroup.com

Tel: +44 20 7903 2055