Nitrogen+Syngas 396 Jul-Aug 2025

15 July 2025

Price Trends

Price Trends

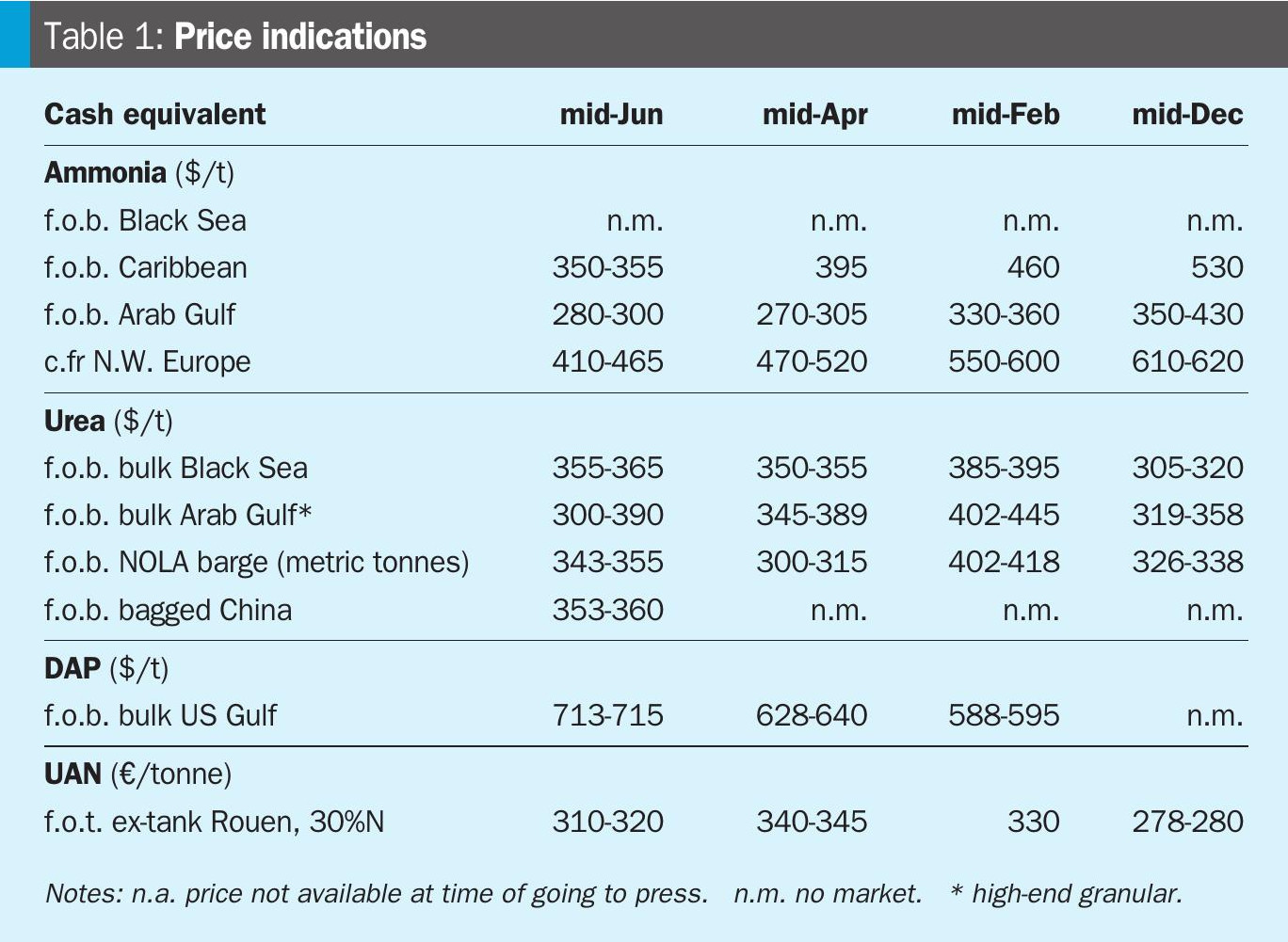

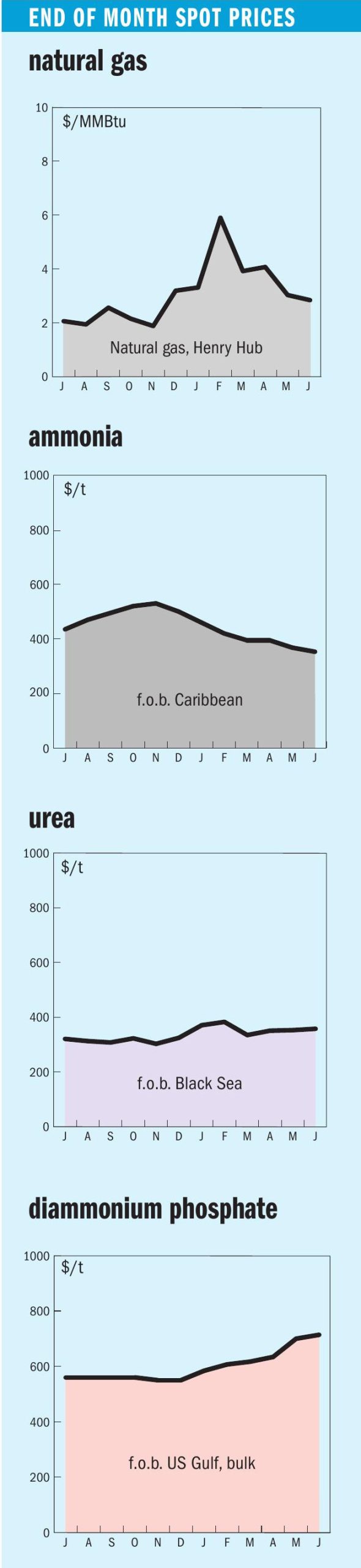

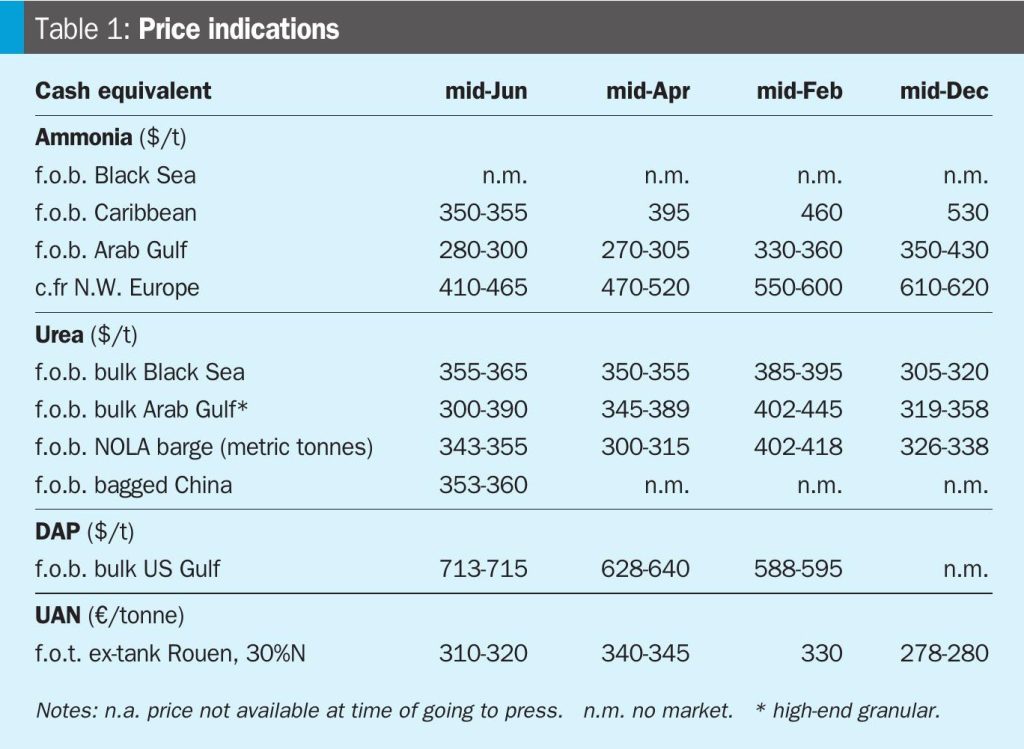

Ammonia benchmarks on both sides of the Suez were little changed in mid-June with a seemingly balanced supply-demand outlook, although those of a more bullish persuasion continue to support the notion that prices will soon – if they have not done so already – reach a floor. In Algeria, while activity was limited, producer Sorfert was believed to be seeking prices of $410415/t f.o.b. for July delivery, up $10-15/t and equivalent to >$450/t c.fr NW Europe. Imminent tariffs on imports of Russian fertilizers into the EU may trigger an uptick in downstream capacity utilisation across the continent.

Across the Atlantic, Yara is shipping a Trinidadian cargo under contract to Mosaic at Tampa, the first delivery to the phosphate major since the pair agreed to a $392/t c.fr settlement for June consignments. Mosaic will soon also receive the spot cargo it purchased from Trammo at $370/t c.fr back in 2H May, with the tonnes originally sourced by the trader in Saudi Arabia and Bahrain. Across the US Gulf in Texas, there is still no word as to when the next exports from the 1.3 million t/ ar Gulf Coast Ammonia (GCA) facility will occur. Meanwhile, in the South Atlantic, Profertil was heard to have sold a spot cargo for 1H July loading from Argentina, with further details awaited.

East of Suez, business in the Middle East was limited following recent Eid holiday festivities, though cargoes continue to exit the region at a steady pace. As has been suggested in previous weeks, demand could soon pick up in India ahead of this year’s Kharif season, although import appetite appears to be covered by contract deliveries for the time being. That said, Iranian material, which is heard to be on offer below $300/t c.fr, could soon find a home. Further east, South Korean contract prices remained largely stable amid the usual term cargo arrivals, while it was a similar story in Taiwan, China, where the latest prices range from $300-340/t c.fr. In urea markets, NFL is seeking to secure 1.5 million tonnes of urea for west coast India, with some speculation that a low offer could have been submitted at below $380/t c.fr.

The Middle East was generally quiet, but a granular sale was made to Australia at $390/t f.o.b. which is believed to have been sourced from Fertiglobe out of Ruwais. This would place the price in India well above $400/t c.fr. Russia has seen prilled sales of late at $360/t f.o.b. and above, albeit for limited volumes. This again would put prices in India well over $400/t c.fr. Supply is tighter in the summer months because of the usual annual turnarounds and Russian availability has also been hit this week by the loss of Euro-chem’s Novomoskovsk plant, which was hit by a drone on 7 June.

Nigeria has sold another cargo, with Indorama this time placing a cargo in the low $390s/t f.o.b. Dangote is looking to place another two cargoes for June with a tender taking place on 12 June. Asian availability is tight, but demand is virtually non-existent in the region although much needed rain that fell in Australia this week could help to absorb tonnages.