Sulphur 418 May-Jun 2025

3 May 2025

Market Outlook

Market Outlook

SULPHUR

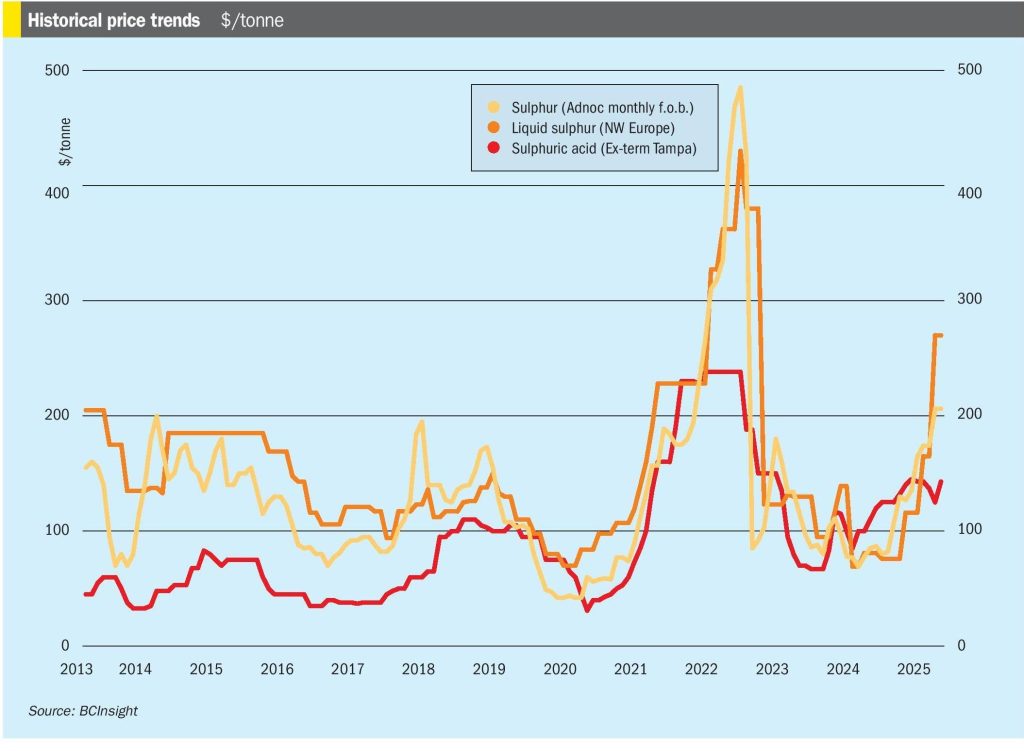

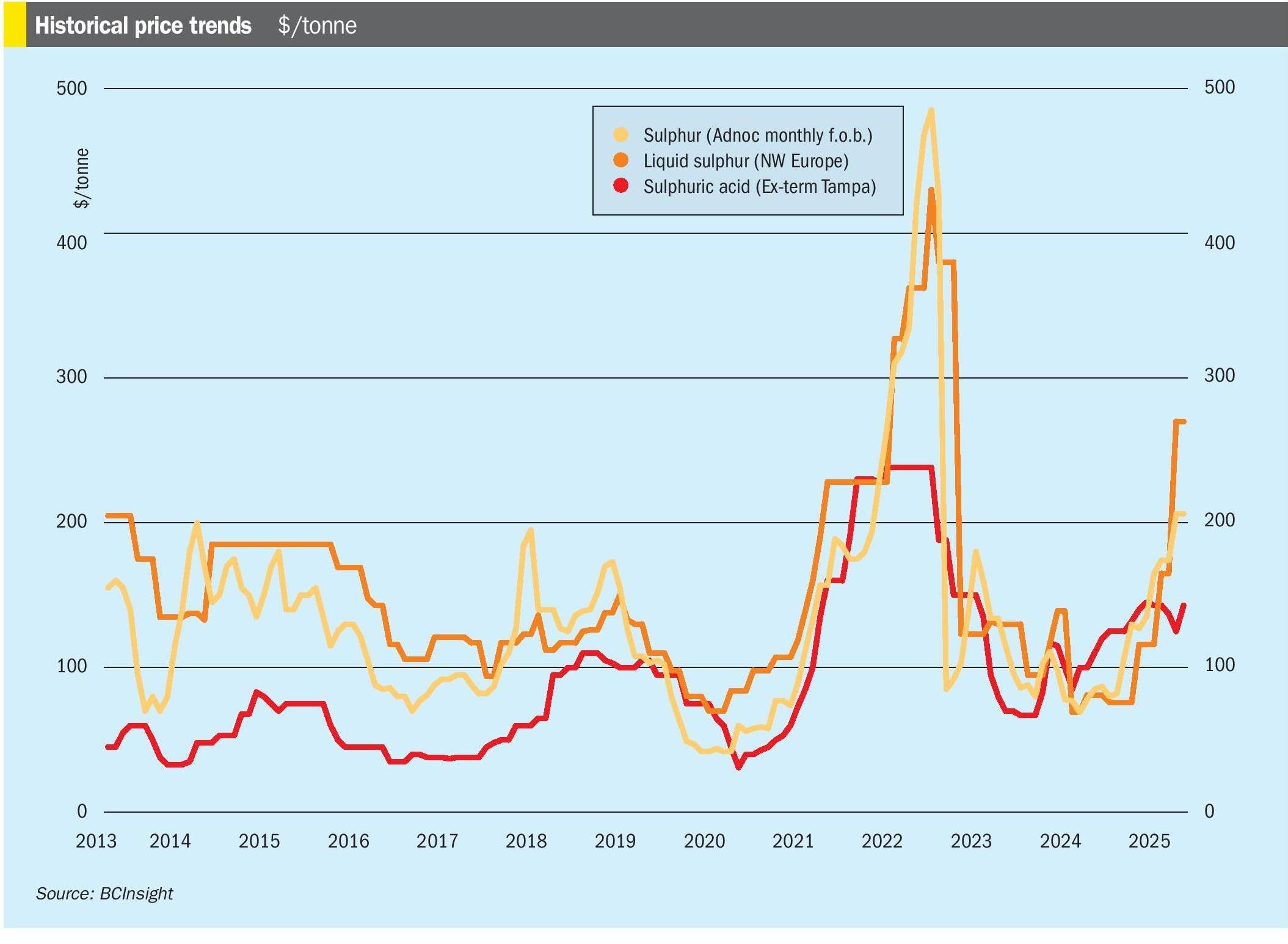

• Global sulphur prices are expected to stay relatively stable as purchases in Asia slow down due to the closing of the purchasing window for the Chinese spring fertilizer application season.

• Overall, the number of transactions worldwide is likely to remain limited, as other markets adopt a wait-and-see approach to prices in supplying regions.

• On the supply side, China’s below average port inventories have drawn attention from Russian exporters. This shift in trade flows could add another layer to eastern hemisphere markets, with more Russian volumes likely heading to East Asia in the near term.

• The increasing importance of Indonesia is reflected in record sulphur imports, which surged 248% year-on-year in January–February, reaching 914,000 tonnes, according to Global Trade Tracker (GTT). The volumes imported during February, which were 565,000 tonnes, represent the highest volumes imported during a single month in the last five years. In 2024 Indonesia imported a total of 3.6 million t/a, which surpassed the previous annual record of 2.7 million t/a in 2023, and which itself was a 31% increase on the previous year.

• With global market prices largely stagnant, market participants are closely watching the outcome of the latest tender in Qatar as a possible price signal. It has been suggested that the tender was awarded at a price above $300/t f.o.b., but this could not be verified at the time of writing.

SULPHURIC ACID

• Overall, global sulphuric acid prices are expected to remain relatively stable in the coming weeks.

• In Chile, demand is likely to persist, but its strength will depend on the timing of the Altonorte smelter’s restart. The market will likely see limited activity for the next few weeks as buyers await further developments, according to market players.

• In China, the interplay between domestic and export prices will likely limit transaction activity across the Eastern hemisphere. Availability has improved, regardless of whether placed locally or for exports, according to market participants. As a result, the price is feeling a degree of downward pressure, particularly on the high end with the market reluctant to purchase at higher than $75/t f.o.b.

• Indian buyers have also returned to the market, adding upward pressure to a supply-constrained environment. East coast demand remains quieter for now but may pick up in anticipation of future cargo requirements.

• Additional domestic availability may emerge from Adani’s copper smelter, which is expected to come online around June-July. The smelter could provide incremental relief if commissioning proceeds as scheduled. The smelter has a capacity of 1.5 million t/a of acid n