Middle East

22 January 2025

Syria's phosphate rock supply uncertain after regime ousted

12 Dec 2024

On 8 December, Syrian rebel forces led by Islamist group Hayat Tahrir al-Sham (HTS) ousted the government of Bashar al-Assad.

The now thirteen-year long civil war in the Middle Eastern nation has proven hugely disruptive to its phosphate rock production. During the 2020s exports recovered strongly amid Russian intervention and a lull in hostilities. Syria has once again become a key rock supplier to some regions amid globally tight export availability. Still, the fall of the Assad regime and Russia’s probable pull back from the country may once again prove detrimental to Syria’s phosphate rock exports, potentially placing further upwards pressure on already high global prices.

Syria’s civil war disrupted rock output, exports recovered during the 2020s

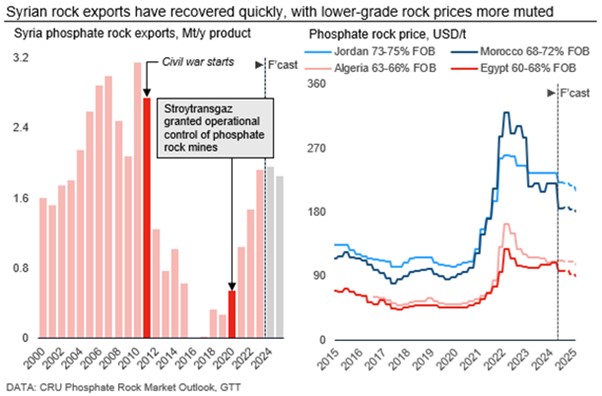

Prior to the onset of Syria’s civil war in 2011, phosphate rock exports from the Middle Eastern country grew quickly during the 2000s, peaking at more than 3.1 Mt in 2010 – representing more than 10% of global trade. The onset of the conflict saw rock output plummet, falling to near zero in 2016 as so-called Islamic State (IS) swept across large parts of Syria, seizing the rock mines near Palmyra at the height of the fighting.

The Syrian government retook control of the operations in 2018 – thanks in large part to Russian military intervention – and assigned management of some facilities to Russian-owned company Stroytransgaz. As hostilities in the country gradually ground to a stalemate during the late 2010s and early 2020s, rock production recovered. In 2023, Syrian rock exports surpassed 1.9 Mt, their highest level in 12 years.

Stroytransgaz has faced substantial western sanctions for its involvement in Syria and support of the Assad government (it was separately sanctioned as early as 2014 due to involvement in Russia’s annexation of Crimea). However, measures have stopped short of outlawing the import of Syrian phosphate rock, instead focusing on prohibiting transactions specifically with Stroytransgaz and various affiliated individuals. This has led to the emergence of a web of third-party traders which have facilitated the export of Syrian phosphate rock to a number of end markets since the late 2010s.

Syria became key rock supplier to some markets despite sanctions

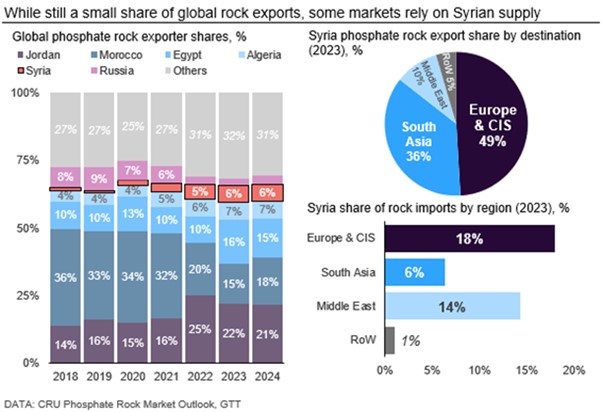

Although Syrian rock exports today only make up a small share of global trade – around 6% in 2023, its influence on the rock market during the 2020s has been greater than its diminutive scale might suggest. Since late 2021, key supplier Morocco has limited rock exports. A number of producers stepped up output as a result, with Jordan, Egypt, and Algeria all raising exports, in addition to the sharp recovery seen in Syrian volumes.

All four countries mostly provide lower-grade rock (65-69% BPL) and the combined jump in export availability has lessened the uplift in lower-grade phosphate rock prices since 2021. Higher-grade rock prices saw a much sharper rise during 2021/22. They have also remained more elevated throughout 2024 compared to their historical averages between 2015 and mid-2021, with fewer suppliers able to plug the gap left by Morocco (and Russia in the igneous rock sector).

Moreover, a number of end markets have become increasingly reliant on Syrian rock during the 2020s. Perhaps surprisingly, given the sanctions applied to Stroytransgaz by the EU, Europe has been by far the largest recipient of Syrian phosphate rock. In 2023, half of all Syrian rock exports were delivered to European consumers. Although the majority of volumes went to non-EU nations, some EU member states have received Syrian tonnes. Supply from the Middle Eastern nation accounted for nearly a fifth of Europe’s total rock imports last year.

Syria’s rock supply faces renewed uncertainty with upside risk to global prices

The aftermath of the overthrow of the Assad government remains at a very early stage. The next steps taken by HTS, and the reaction of international governments to the group’s actions, is extremely difficult to predict. However, it appears likely Russia’s involvement in Syria will diminish. Consequently, Stroytransgaz seems unlikely to retain control of the phosphate rock operations.

Should an HTS-affiliated entity assume control of the rock mining in Syria, two key factors remain highly uncertain:

- Whether such an entity will be capable of managing the output at the mines or if production will ultimately grind to a halt as it did in 2016 under IS

- Whether western nations will be more or less receptive to rock supplied by an HTS-backed organisation, particularly given it is currently designated a terrorist organisation by a number of jurisdictions.

Regardless, a drop in output during 2025 appears likely and CRU currently expects Syrian phosphate rock exports to decline modestly by 5% in 2025. However, we acknowledge the downside risk is substantial and there is a genuine possibility production could fall to near zero once again.

Along with Algeria, Egypt and Jordan, the rise in Syrian phosphate rock exports during the 2020s lessened price upside in the lower-grade sector of the market and Syria returned as a key supplier to a number of consumers, especially in Europe. Should Syrian rock output contract substantially in 2025, this would tighten lower-grade rock export availability significantly.

Consumers would have to seek alternative suppliers, many of which are already running at historically high operating rates. We would expect lower-grade rock prices to rise in such a scenario, potentially narrowing the wide disparity between higher- and lower-grade rock prices which has proven so persistent during the 2020s.

To request a demonstration of the Phosphate Rock Market Outlook please contact Maria Gamboa maria.gamboa@crugroup.com.