Phosphate markets

Intermittent supply from China due to export restrictions and US duty changes have kept markets guessing over the past couple of years, and there is no sign of that changing.

Intermittent supply from China due to export restrictions and US duty changes have kept markets guessing over the past couple of years, and there is no sign of that changing.

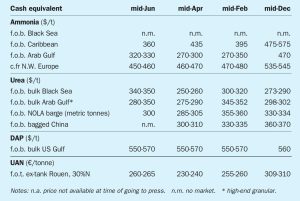

Ammonia markets were quiet in June, though both CF Industries and Grupa Azoty were reported to be looking for July tonnes and the enquiry will test how tight the market is going forward. Algeria has traded in the $400-405/t f.o.b. range, suggesting c.fr values in Europe might be slightly higher at $450-460/t c.fr. Supply from Algeria has been and continues to be somewhat restricted because of constraints caused by the hot weather. Gas supply however is easing in Egypt and further ammonia exports should emerge shortly.

Market as of 20th June 2024. Urea: Prices remain stable while the market awaits clear price direction on whether to hold current f.o.b. levels or to push higher.

Urea: Prices continued their global decline in mid-April, including at New Orleans. The notable exception was Brazil where prices firmed due to buyer interest in the market for May and beyond.

Prices in the West are unlikely to garner much support moving into the latter stages of Q2. The May Tampa ammonia settlement was settled by Yara and Mosaic at $450/t c.fr, down $25/t on the $475/t c.fr agreed for April. With seasonal domestic demand in the US drawing to a close 2H April, many had anticipated that either a rollover or a slight decline would be agreed.

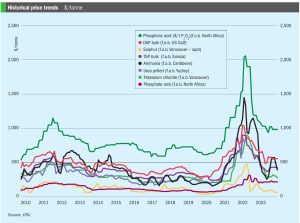

Sulphur prices reached a low point in mid-February, with buyers looking to the tender from Muntajat as well as the return of Chinese buyers following the Lunar New Year holiday for the direction that the market would turn. CMOC’s 5 February tender for 40,000 tonnes of sulphur for early-April arrival was indicated awarded in the upper $90s/t c.fr on supply from the FSU, though details were not confirmed.

Ammonia pricing in the US Mid-West stood at $625/st f.o.b. in February, with applications to field continuing to ramp up. Prices in the US Gulf remain pegged in the low-to-mid$400s/t f.o.b. Recent production outages in the region have largely subsided, though an unexpectedly early uptick in seasonal demand from local buyers is likely to provide a degree of price support moving forward. The Tampa ammonia settlement for March has been settled by Yara and Mosaic at a $445/t c.fr rollover, largely in line with market expectations. The North American market remains detached from the considerably more oversupplied global ammonia scene.

Qatar construction services company UCC Holding has signed a memorandum of understanding with the Kazakh Ministry of Energy for a gas treatment plant at the Kashagan field with a capacity of 6 billion cubic meters as part of the Phase 2B expansion. The memorandum was signed by Minister of Energy Almassadam Satkaliyev and Mohamed Moutaz Al Khayyat, chairman of UCC Holding.

Urea. As February ended, urea prices found support in the US and Brazil while Europe remained subdued and Egypt struggled to find buyers. New Orleans was the one bright spot in the urea market – with NOLA prices benefitting from the meeting of suppliers and buyers at the TFI’s domestic conference. With positive sentiment all round, prices moved up $30/st, peaking at $390/st f.o.b. for March.

The Saudi Arabian Mining Company (Ma’aden) has entered into a partnership with Metso and thyssenkrupp Uhde to develop and license an integrated process to reduce carbon emissions and recycle phosphogypsum in Saudi Arabia. A framework agreement between the three partners was jointly announced on 10th January.