Market Outlook

Sulphur prices may remain stable before decreasing on muted demand and transactions may increase in frequency contributing to price decreases in the first half of 2025.

Sulphur prices may remain stable before decreasing on muted demand and transactions may increase in frequency contributing to price decreases in the first half of 2025.

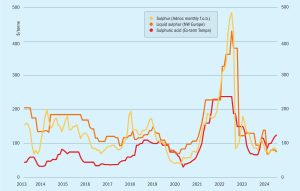

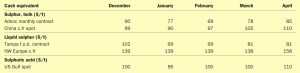

Global sulphur prices were mostly assessed flat in mid-January, with only slight changes for China, Indonesia and India, while the first quarter contracts for the Middle East, North Africa and Tampa increased from the previous quarter. Overall, the number of transactions taking place globally has declined as subdued demand has limited trading activity in most delivered markets. The current sulphur price environment has been shaped by the combination of rising Chinese demand and higher Middle East f.o.b. prices in the second half of last year. As a result, some consumer markets such as Indonesia and India have been subject to upward pressure in order to remain attractive destinations. But demand remained lacklustre across delivered markets, leaving prices relatively stable.

Global sulphur prices are expected to continue rising in certain regions but at a reduced rate of increase. Recent higher spot prices in the Middle East are likely to carry over to other markets. Sulphur affordability in key markets such as China remains good, reinforced by recent increases in phosphate prices.

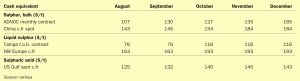

Global sulphur prices underwent increases in some key benchmark markets during October, but spot activity nevertheless remained muted, with demand subdued and availability tight. Market participants continue to closely track geopolitical developments.

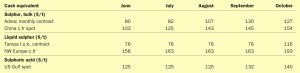

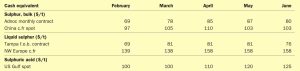

At the end of August, the Qatar Chemical and Petrochemical Marketing and Distribution Company (Muntajat) tendered for 35,000 tonnes of sulphur for September loading from Ras Laffan, with offer prices reported at or around $130s/t f.o.b., according to market sources. Bids were received at multiple levels, with market participants initially anticipating awards around the mid-$120s/t f.o.b. The tender result was higher than market expectations and would equate to delivered prices to key Asian markets at $150-155/t c.fr. But prices in China and Indonesia remained lower this week at around $140-145/t c.fr, with India at $145-150/t c.fr. Prices have increased steeply since Muntajat’s 25 June session, which was indicated awarded in the mid-$80s/t f.o.b.. and Muntajat posted its Qatar Sulphur Price (QSP) for September at $125/t f.o.b., up $19/t from $106/t f.o.b. in August. This represents the highest QSP since March 2023 at $133/t f.o.b., and reflects delivered levels to China nearing $150/t c.fr at current freight rates. Tight supply and strong downstream demand have pushed tender prices higher. Muntajat tenders were previously awarded at $92/t f.o.b. in April, up from $88/t in March and the low $80s/t f.o.b. in February.

Muntajat announced its QSP for September at $125/t f.o.b., an increase of $19/t from its August price. This was following its tender earlier this week, which market sources indicated to have achieved at or around $130s/t f.o.b. Over the past two weeks, KPC in Kuwait closed two sales tenders, with both indicated awarded in the high $120s/t f.o.b. Middle East spot f.o.b. prices are at their highest level since March 2023 and have climbed 58% over the past two months.

Sulphur prices are expected to recover from declines in May and June and continue climbing over the coming months, though good availability will limit upside.

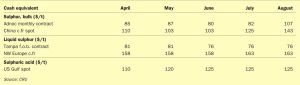

Sulphur prices in China are expected to recover with downstream demand anticipated to surge in the second half of the year and good affordability to support raw materials purchasing. Chinese nitrogen, phosphate, and potash prices have surged, driven by heightened demand for the summer corn application season. In particular, average 11-44 MAP prices jumped 16% from $390/t ex-works to $463/t in Hubei province. However, sulphur prices have taken a while to follow the trend on phosphate prices. Port prices have fluctuated in the range of $126-130/t c.fr since late March, and import prices fell from a high of $112/t c.fr to $100/t c.fr, capped by high port inventory and sufficient supply. Port inventories in China remain around 2.8 million tonnes, well above the 2022 average of 1.4 million tonnes and the 2023 average of 2.07 million tonnes. These elevated stock levels limited the upside for prices in China and provided buyers with options. At the start of July, Sinopec’s Puguang, the largest sulphur producer in China, increased its sulphur sales prices at Wanzhou port up $4/t RMB980/t, while its factory price at Dazhou was up RMB20/t at RMB950/t ex-works. These prices are considerably down from RMB1,600/t in December 2022 and RMB 2,945/t from mid-June 2022 and are the lowest since July 2023, but are still up from a low of RMB605-655/t at the end of August 2020.

Downstream phosphate production is expected to climb, with further sulphur price recovery expected. Overall, global demand remains lacklustre as downstream demand has yet to increase substantially in key markets and sulphur availability from most origins is ample.

Sulphur benchmarks firmed around the globe in April. Although availability remains ample, downstream production is expected to rise in the weeks ahead and further upside for prices is expected, at least in the short term. Prices increased the Middle East, Indonesia, India, Brazil, and the Mediterranean. The Middle East spot price was assessed up an average $3/t at $83-88/t f.o.b. The previous low end of the range was no longer considered achievable. The price has climbed 27% since mid-February this year. The benchmark is down 53% from early December 2022, but had climbed 47% from the end of July 2023 to its mid-October average of $110/t f.o.b. before declines set in once again. Chinese buyers returned to the international spot market in late April following weeks of inactivity, lifting c.fr prices.