SulGas® Kuala Lumpur 2025

SulGas® KL, South-East Asia’s sulphur recovery and gas treating conference organised by Three Ten Initiative Technologies LLP, made its debut from 2-3 July 2025, at Impiana KLCC, Kuala Lumpur, Malaysia.

SulGas® KL, South-East Asia’s sulphur recovery and gas treating conference organised by Three Ten Initiative Technologies LLP, made its debut from 2-3 July 2025, at Impiana KLCC, Kuala Lumpur, Malaysia.

Advanced SRUs and decarbonisation technologies position LNG for net-zero goals by 2050. Mahin Rameshni and Stephen Santo of RATE USA review sulphur management strategies for LNG, from ppm-level H2 S scavenging and non-conventional liquid redox to Claus SRUs, and introduces RATE’s patented technologies to achieve >99.9% recovery, operational stability, and decarbonisation alignment amid regulatory and market challenges.

CRU's analyst Viviana Alvarado discusses the effect of smelter outages and maintenance, a copper concentrate shortage, and Asian capacity ramp ups, on sulphuric acid supply and prices.

Matrix PDM Engineering discusses the importance of management and control of sulphur dust during the forming and handling of sulphur throughout the entire solid sulphur lifecycle while maintaining commercially acceptable product that contains less than 2.0% overall moisture.

Although elemental sulphur is relatively non-toxic, it presents significant risks when stored or transported. DuBois Chemicals Canada highlights advancements in both dust suppression and acidity control, including the development of novel agents designed specifically for use with elemental sulphur.

UreaKnowHow.com reviews the main production options for incorporating sulphur into urea, the world's most widely applied commodity fertilizer.

Metso describes how digital solutions can profit from the deep integration of using a digital process twin in sulphuric acid technology, helping to improve operation, monitoring and reporting.

MEScon 2025 took place in Abu Dhabi from 19-22 May 2025, providing delegates with renewed energy, new connections, and fresh ideas to apply across the sulphur value chain.

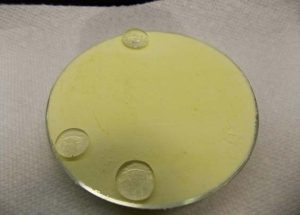

IPCO highlights the reasons for converting sulphur into a solid form, and compares two of the technologies most commonly used to achieve this.

New sulphur production from Chinese and Indian refineries and Middle Eastern sour gas and the ramp up of nickel leaching projects in Indonesia continue to change the direction of sulphur trade.