Nickel market developments

Indonesia has become the epicentre of the world nickel industry, and is now seeking to raise royalty rates to capture more value from this. Will this impact upon the continuing expansion of HPAL capacity there?

Indonesia has become the epicentre of the world nickel industry, and is now seeking to raise royalty rates to capture more value from this. Will this impact upon the continuing expansion of HPAL capacity there?

While the US tariff situation remains subject to considerable uncertainty, there has already been an impact on short term trade flows, as well as investment decisions.

The Sulphur Institute (TSI) held its World Sulphur Symposium in Florence from April 8th-10th.

The Middle East remains the world’s largest regional exporter of sulphur, with additional capacity continuing to come from both refineries and particularly sour gas processing.

• Global sulphur prices are expected to stay relatively stable as purchases in Asia slow down due to the closing of the purchasing window for the Chinese spring fertilizer application season.

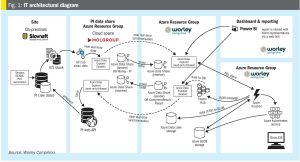

Together with Slovnaft, Worley Comprimo has developed a near real-time monitoring dashboard using data sharing via the Cloud. Using a two-year data set containing minute average data, trends and insights were used to optimise performance. This paper describes the main learnings and improvements with respect to energy optimisation, which supports sustainability targets for Slovnaft.

The Middle East’s premier event for the sulphur global industry, MEScon 2025, returns to the Conrad Abu Dhabi, Etihad Towers from 19 to 22 May 2025.

Rheinhütte Pumpen has further developed its GVRN sulphuric acid pump so it can also be used in high-temperature applications such as in heat recovery systems.

The Self-Cleaning Liquid Sulphur Candle Filter (LSCF) is setting a new benchmark in liquid sulphur filtration. With its innovative candle arrangement and advanced back-flushing technology, it enhances filtration rates significantly and minimises downtime for cake discharge. Jan Hermans of Sulphurnet explores the LSCF design, process parameters, and operational advantages.

Wood presents the pros and cons of leaving a refinery SRU on hot standby versus long-term idle taking into consideration reliability, safety, and operations responsibilities during extended downtime.