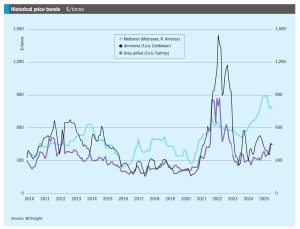

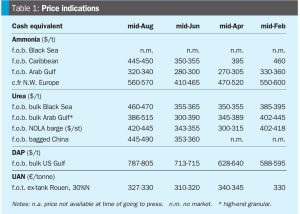

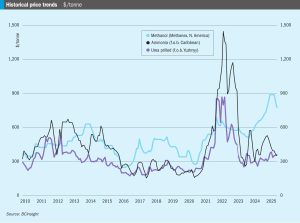

Price Trends

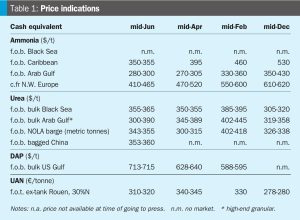

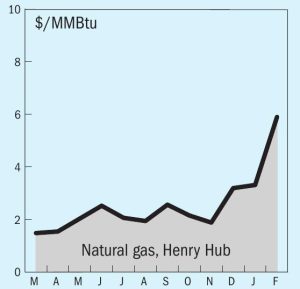

Ammonia values in the Middle East, Far East and Southeast Asia edged higher at the start of January, while other major benchmarks were largely unchanged amid a subdued market. Conditions at the start of the year mirror late2025, with prices supported by persistent supply tightness from the continued absence of Ma’aden’s MPC facility, which removes an estimated 300– 400,000 tonnes from the market. The unit is expected to return in midtolate January.