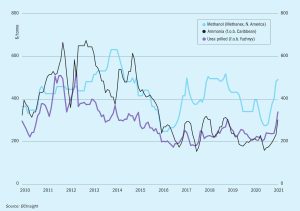

Price trends

Market Insight courtesy of Argus Media

Market Insight courtesy of Argus Media

The ammonia industry faced a difficult February, due to extremely cold weather conditions in the northern hemisphere. In the US, production outages resulting from winter storm Uri affected up to 7 million t/a of capacity.

Phosphogypsum is finding increasing use in plaster and cement manufacture, roadbed construction and afforestation. We look at how previously unwanted solid waste generated by the phosphate industry is being turned into a valued resource.

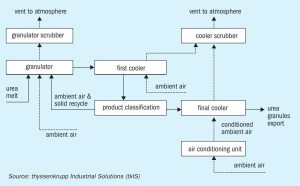

We highlight recent advances in ammonia and dust scrubbing systems for urea plants from Stamicarbon, thyssenkrupp Industrial Solutions and Toyo Engineering Corporation.

The economic conversion of phosphogypsum waste into a valuable product has been pursued for decades. Results of intensive research by thyssenkrupp Industrial Solutions (tkIS) in this area are presented by Peter Stockhoff, Dirk Koester, Stefan Helmle and Carsten Fabian. The approach developed by tkIS shows great potential as a controlled treatment process for phosphogypsum.

An industry-wide push for greater environmentally accountability is driving the need for improved fertilizer cooling methods. Not only is indirect cooling technology more environmentally-friendly, says Igor Makarenko of Solex Thermal Science, it also provides fertilizer manufacturers with a better product.

Market Insight courtesy of Argus Media

Globally, thyssenkrupp Industrial solution (tkIS) has engineered and built nine urea granulation plants during the last 10 years. Based on this experience, Benedict Jass, Marc Wieschalla and Ivo Mueller of tkIS describe two different cooling concepts for urea granules – fluid bed cooling and bulk flow cooling – and their contrasting advantages and disadvantages.

Fertilizer markets are rallying to an extent not seen in almost a decade. This is primarily being driven by strong demand fundamentals, with crop prices moving to their highest point since 2013. But low pipeline inventories and supply disruptions have also played a part. In this guest editorial, CRU’s Chris Lawson explains what’s driving this rally and highlights the key supporting factors.

ICIS, the independent commodity intelligence company, provides an overview of the nitrogen market. The world supply of urea looks set to outpace market demand in 2021, as several new projects come on-stream. Global ammonia demand, in contrast, is expected to rebound strongly this year after a difficult 2020. The flurry of recent green ammonia projects announcements is another significant market development.