Sulphur 422 Jan-Feb 2026

28 January 2026

Market Outlook

Market Outlook

SULPHUR

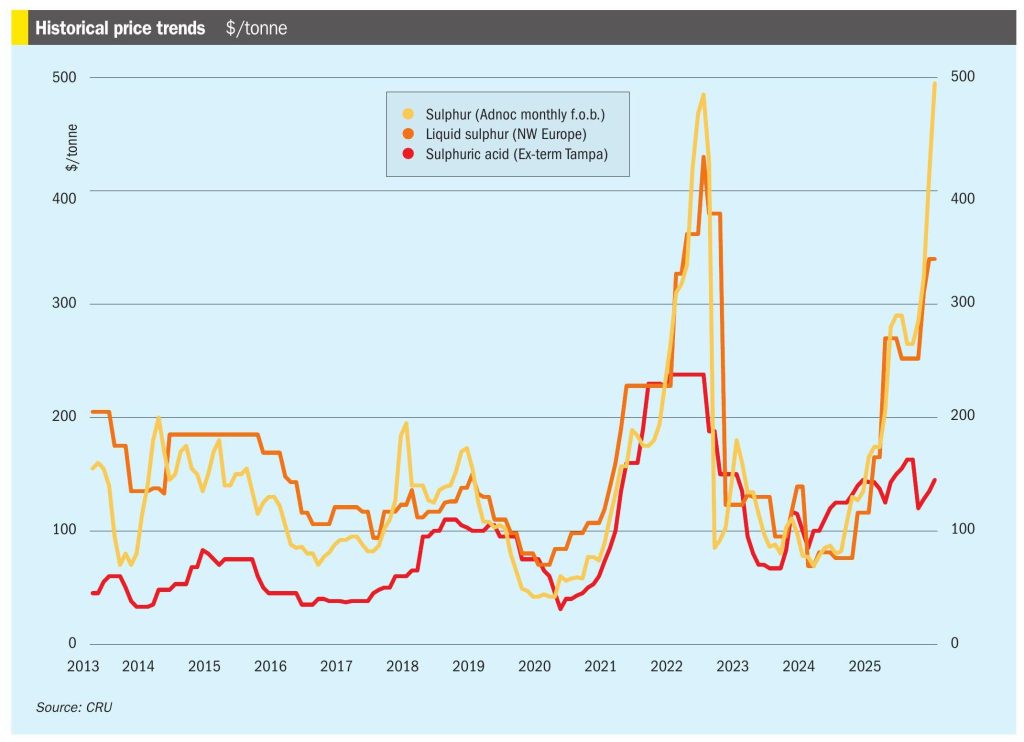

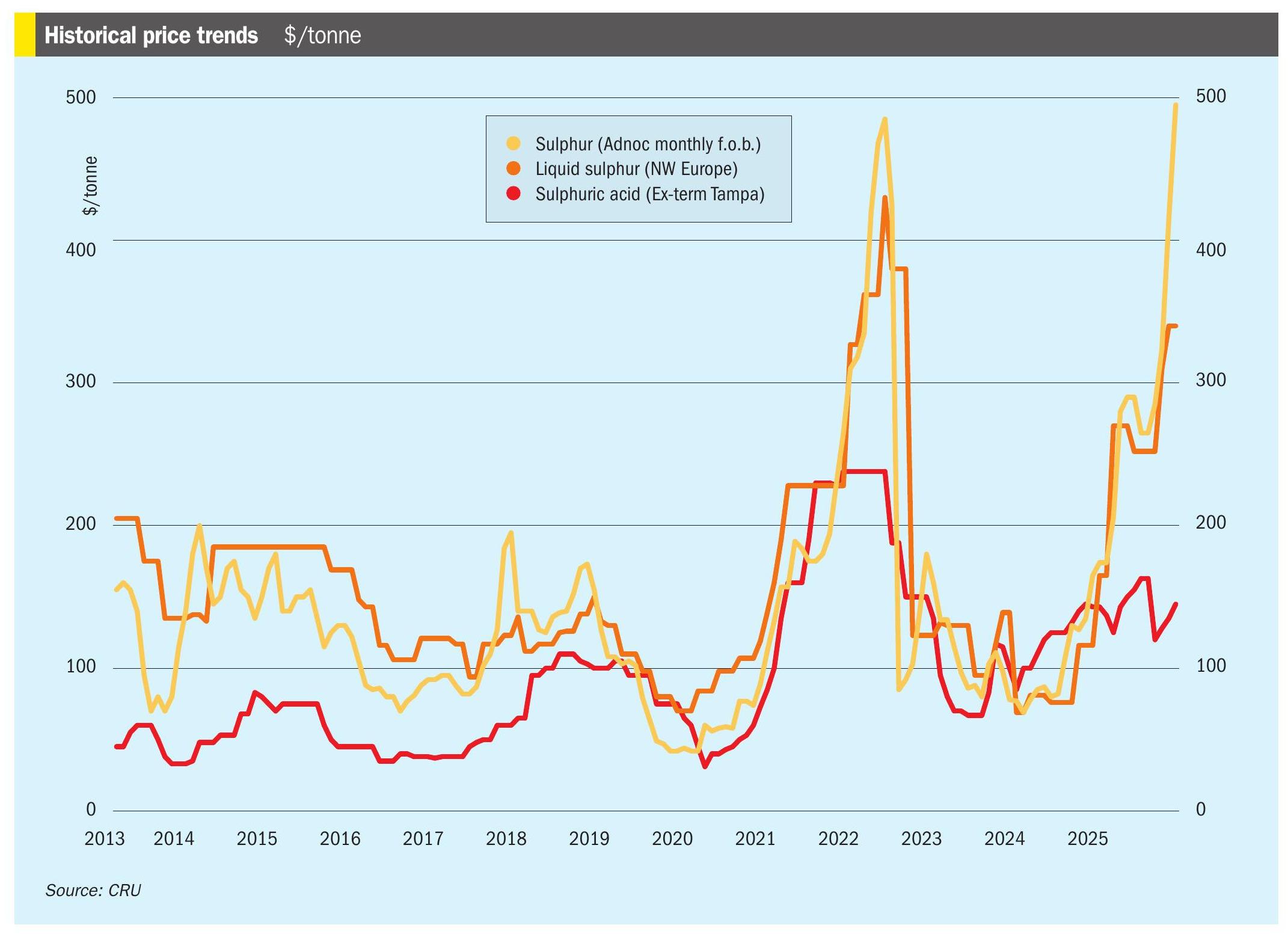

• CRU’s latest global sulphur forecast is for a January price peak before a decline, with the key downside risk being a sharper correction if the supply deficit closes faster than expected. The global sulphur market’s upward momentum has been slowing, with attention shifting to geopolitical risks in Iran. Despite limited physical disruption being reported, the upside risk to prices could be substantial. Following the US bombing of an Iranian nuclear facility back in June, supply from Iran became bottlenecked, despite good production levels, as vessel owners became unwilling to call at ports like Bandar Abbas due to the increased risk.

• More political risk emerged on 12 January when the Trump administration threatened a 25% tariff on goods from any nation with commercial ties to Iran. This is creating uncertainty for key sulphur buyers, who may now hesitate to commit to future cargoes, such as China and India.

• Otherwise, markets have quietened in Brazil and the Middle East, where the market’s attention was captured by the unusual absence of a February spot tender from QatarEnergy.

• In China, bullish sentiment is strong, fuelled by rising domestic prices and geopolitical tensions. However, with international offers climbing to $560-570/t c.fr, buyers are resisting fresh purchases and drawing down port inventories.

SULPHURIC ACID

• CRU’s latest forecast suggests sulphuric acid prices will peak in January before trending lower for the remainder of the year, with the primary upside risk remaining expectations that Chinese government policy will cap January-April exports at 50% of last year’s volumes, compounding existing tightness in the region. This has created major uncertainty over whether prior term contract commitments will be honoured, let alone if any spot volume will be available. This situation is amplified by ongoing tightness in Japan and South Korea, which has lifted the regional f.o.b. assessment to $110-120/t this week.

• This supply-side concern has overshadowed quiet spot activity in most markets, with the exception of a burst of buying from Indonesia. In Europe, underlying momentum remains bullish, underpinned by a tight supply situation in the region. In turn, this strength in European f.o.b. prices has lent clear support to delivered prices in key import markets such as Chile and the US Gulf.

• In contrast to quiet spot activity elsewhere, Indonesia has emerged as a demand hot spot. The recent issuance of import licenses has reportedly triggered a wave of buying, with prices reported in the $145-155/t c.fr range.

• On the contract front, negotiations are drawing to a close, with assessments yet to be updated. In Chile, annual 2026 contracts are understood to be largely concluded, with market indications pointing to a range of $162-175/t c.fr.