Nitrogen+Syngas 399 Jan-Feb 2026

27 January 2026

Predicting the unpredictable

“EU nitrogen producers will act in 2026 to secure strategic, long-term sources of low emissions ammonia…”

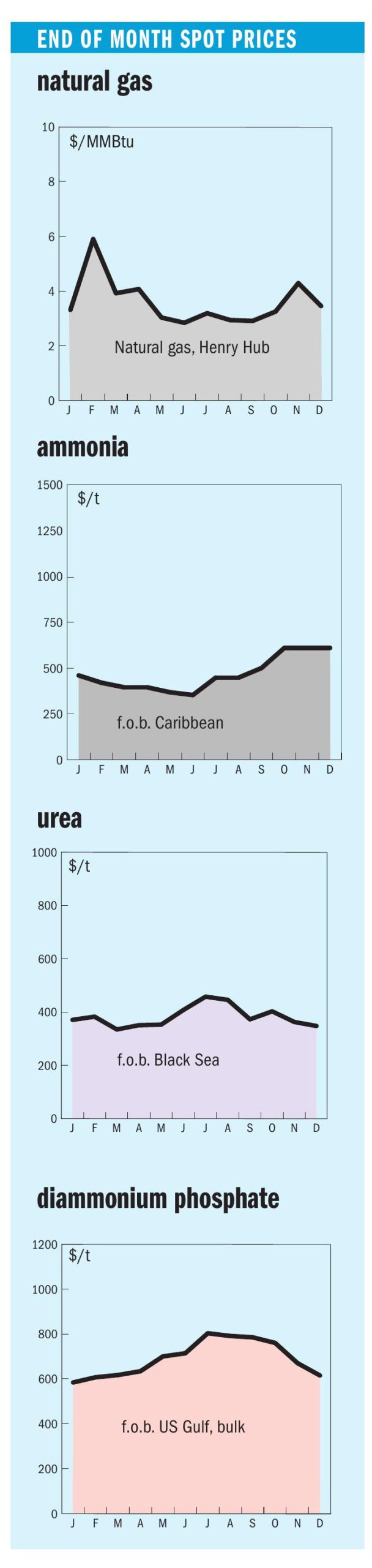

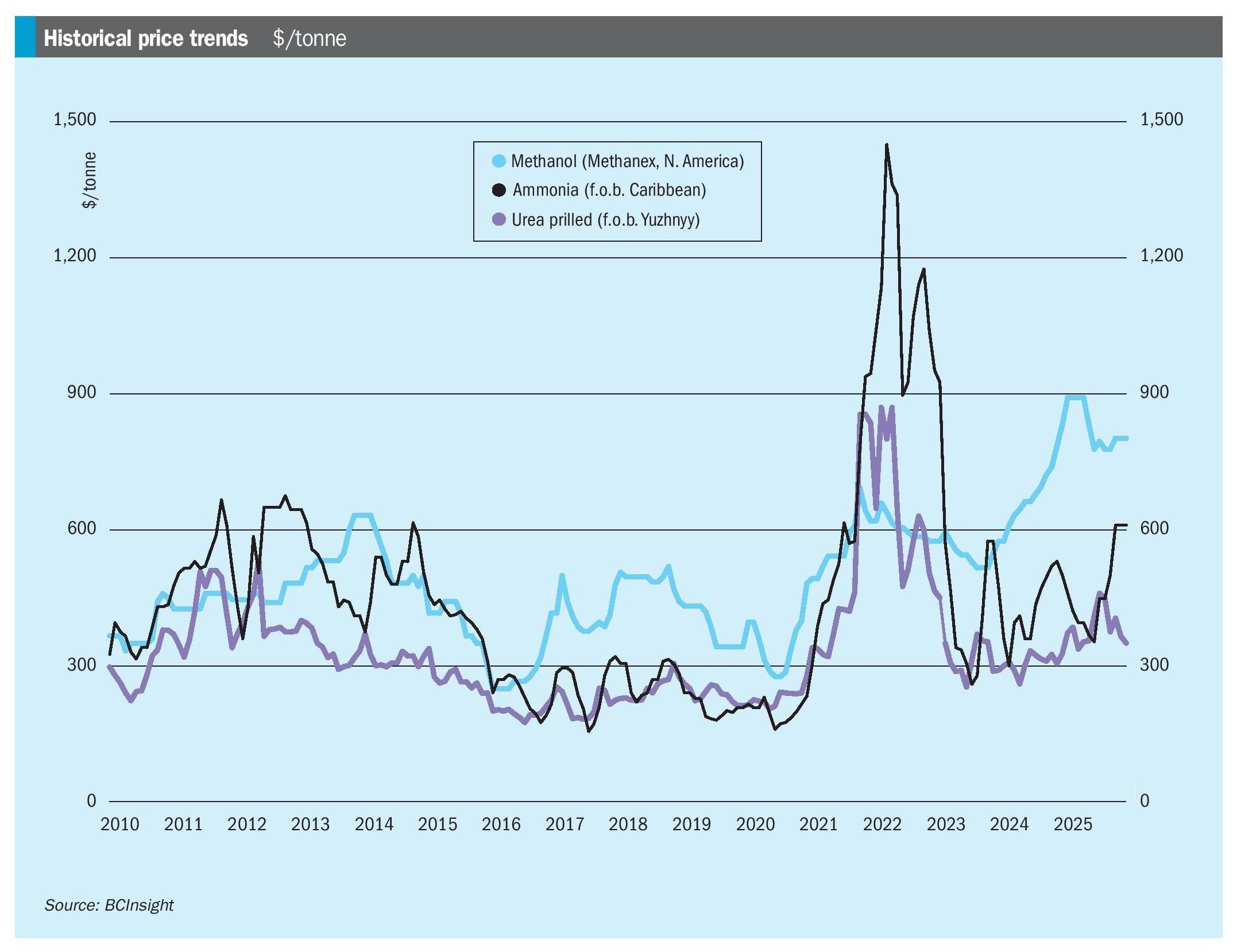

The start of the new year has shown that 2026 is already proving to be a very eventful one, beginning with the US abduction of Venezuela’s president Nicolas Maduro, which has prompted questions over production at the country’s ailing nitrogen assets, as well as the potential for a future boost to gas supplies to Trinidad. Meanwhile, the Iranian government faces its most sustained public challenge since the 1979 revolution, and possible US military intervention, threatening continued exports from the country. In Europe, the future of fertilizers’ inclusion in the Carbon Border Adjustment Mechanism (CBAM) has been thrown into doubt barely a week after the new regulations came into force, as France and Italy pushed for an exemption for crop nutrient imports.

Such multiple uncertainties continue to weigh heavily on nitrogen and other markets, and make the job of forecasters all the more difficult. Nevertheless, at the end of December CRU published its list of things to watch for in the fertilizer market for 2026, looking towards larger and longer-term trends that underlie the day-to-day market shifts of a rapidly changing world. On the nitrogen side, Indian urea imports are expected to remain high, as domestic supply faces limitations due to gas supplies. The baseline for Indian urea imports is expected to be 9.2 million t/a this year, just under the 9.4 million t/a of 2025.

In Europe, fertilizer affordability remains challenging, with crop price indices flat and fertilizer price indices up 25% relative to pre-2023 averages. Extra tariffs on imports of Russian nitrogen fertilizers and the EU’s CBAM are imposing additional costs on the import of all nitrogen-containing fertilizers. To provide relief for farmers, the EU could consider targeted exemptions or softening of CBAM rules for fertilizers, or could consider the removal or lowering of tariffs to entice more supply from potential trade partners like Nigeria or the US. As we discuss in the article on pages 22-23, EU grey ammonia production and imports will come under increasing pressure from 2026 as the EU phases out ETS free allowances and phases in CBAM. To avoid the significant cost escalation expected from 2030 onwards, EU nitrogen producers will probably act in 2026 to secure strategic, long-term sources of low emissions ammonia, either through investment in capacity or offtake agreements. The US benefits from low-priced natural gas, a strong nitrogen industry, advanced carbon capture and storage (CCS) infrastructure and generous 45Q tax credits for CCS operations. These factors, along with relative proximity, make the US a natural partner for EU nitrogen producers seeking low carbon ammonia volumes to hedge against increasing carbon costs.

Elsewhere, China’s urea production is expected to reach a record 72 million t/a in 2025, far exceeding domestic demand, as domestic capacity increases. The Chinese government seems to have been satisfied with urea export management in 2025: low domestic prices benefited local farmers, while producers and traders realised significant profits in the international market. If prices remain lower than in prior years, as seems likely, and with the rapid growth in domestic urea capacity, restrictions on export sales may well be eased. As a consequence, CRU expects Chinese urea exports to increase to 5.9 million t/a in 2026, with the export window possibly opening as early as May.