Nitrogen+Syngas 399 Jan-Feb 2026

27 January 2026

Market Outlook

Market Outlook

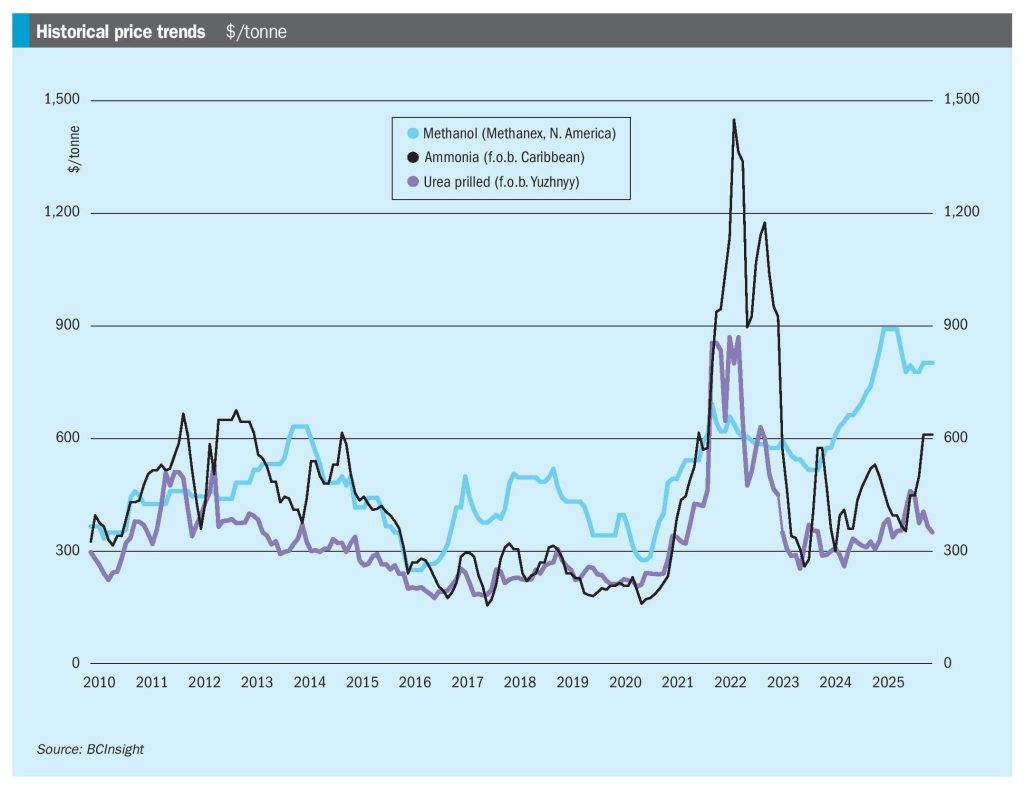

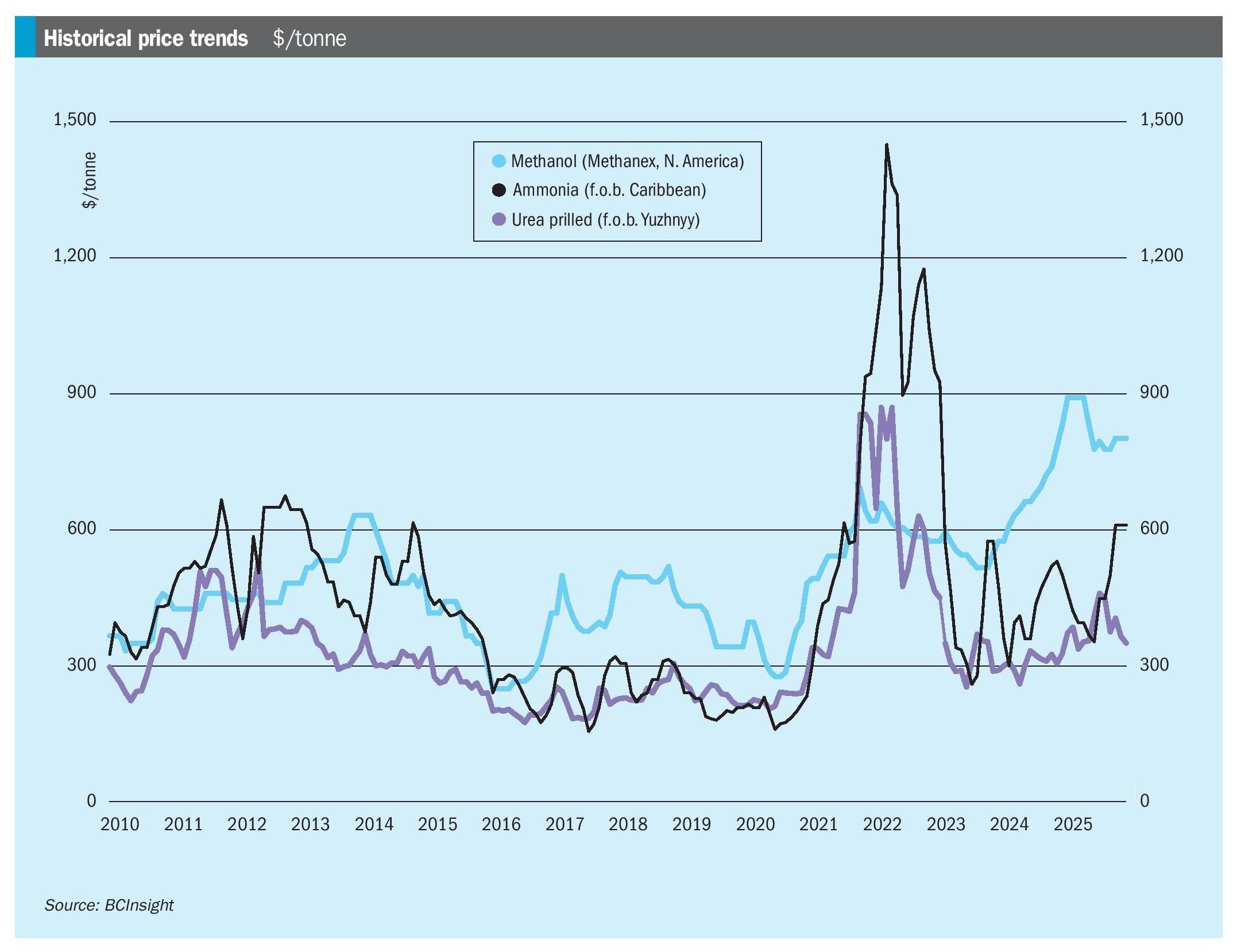

AMMONIA

• Ammonia prices are expected to ease through January as new supply comes online. Woodside’s Beaumont facility produced its first ammonia at the end of December and is poised to start commercial production in early 2026, and there is also new supply from Gulf Coast Ammonia (GCA). In Saudi Arabia, the expectation is that both Ma’aden and Sabic will return to the market mid-to-late January.

• CBAM remains an issue in Europe. Importers are expected to prioritise Egyptian and Algerian material, which carry the lowest default values, though supply from both origins is tight. Market participants expect liquidity to remain thin through January as buyers and sellers adapt to the new regulatory framework.

UREA

• Prices should remain flat-to-firm in the near term, with low offers into India providing a positive boost for the market.

• Supply from China was constrained, with no further quota allocations for exports expected to be issued by Beijing in the near term, and remaining volumes under China’s fourth quota allocation of 2025 are said to be very minimal.

• Iranian supply is also offline for the time being; Khorasan Petrochemical Company (KHPC), Kermanshah Petrochemical Industries Company (KPIC), Lordegan Urea Fertilizer Company (LUFC), Razi Petrochemical Company (RPC), Masjed Soleyman Petrochemical Industries (MIS) and Shiraz Petrochemical Company (SPC) were all down due to domestic natural gas shortages, with Pardis said to be operating at 50%.

• The Carbon Border Adjustment Mechanism (CBAM) also affected urea shipments into Europe. Until further clarification is given, fresh import business is likely to be limited, although previously imported material in warehouses should be sufficient to cover local demand.

METHANOL

• Methanol markets were well supplied in December in spite of winter gas curtailments in Iran. China absorbed most seaborne flows, with import levels high, leading to high coastal inventories and episodic unloading delays that limited the upside for prices.

• US Gulf producers retained a structural cost advantage as Henry Hub gas prices remained low, while coal prices softened in China, improving coal-to-methanol margins. Demand was mixed: China restocking lifted nearterm buying, but downstream margins stayed weak. Naphtha prices also eased, narrowing the cost advantages for MTO producers, while polymer market weakness also capped the upside for production volumes. Chinese c.fr prices rebounded to the lowmid $240s/tonne.

• Iranian and Trinidadian outages tightened marginal supply, while Venezuelan exports flowed amid sanction uncertainty.