Fertilizer International 530 Jan-Feb 2026

26 January 2026

Market Insight

Market Insight

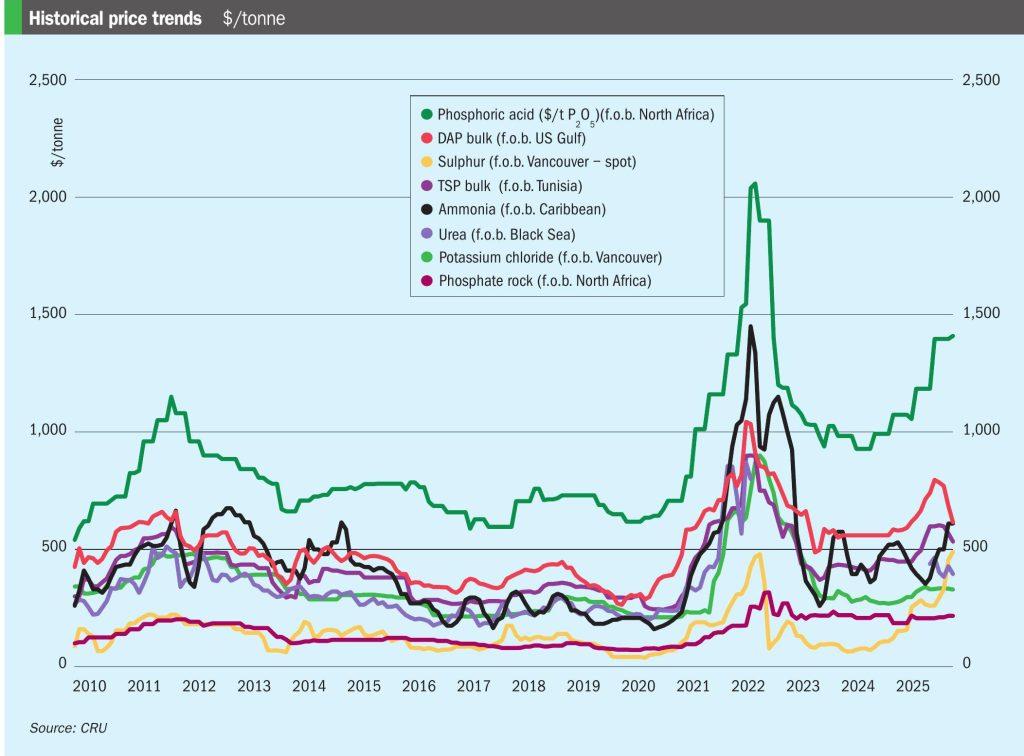

PRICE TRENDS

Market snapshot, 18th December 2025

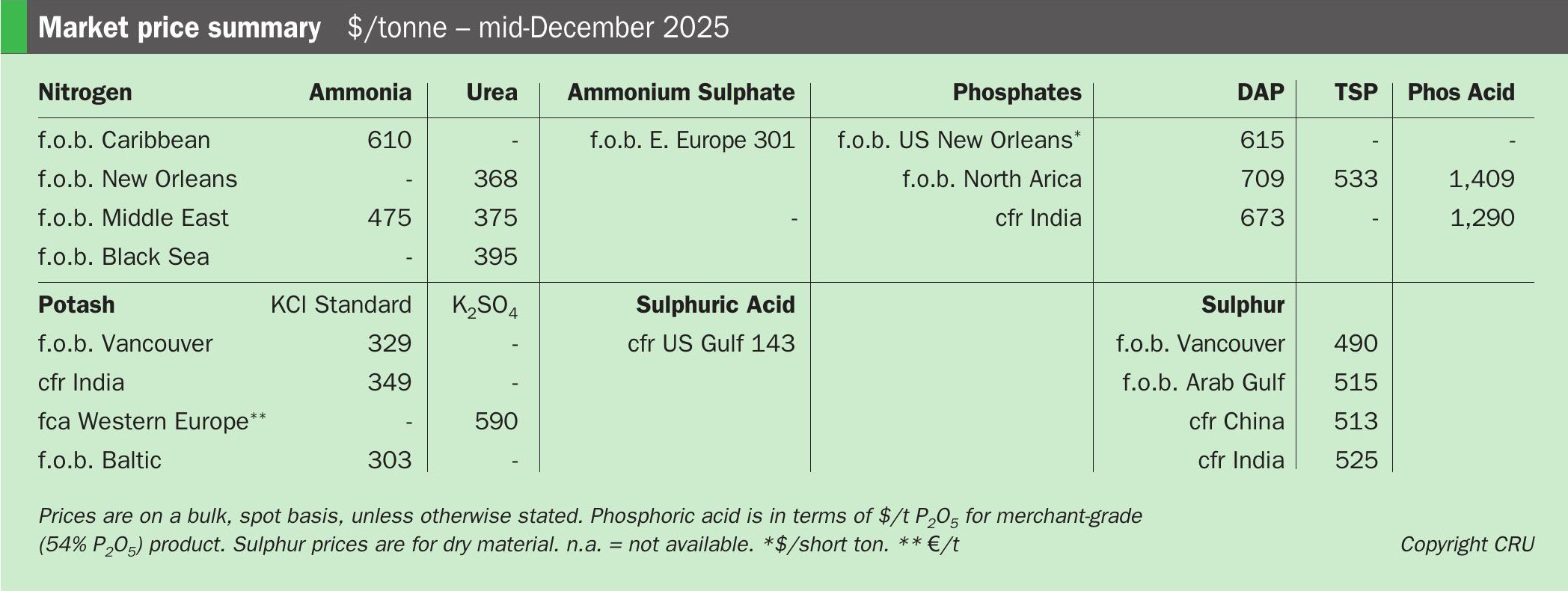

Urea slowdown upended by fresh Indian tender. The urea market was surprised on 16th December by the news that India’s National Fertilizers Limited (NFL) had returned to the market with a tender for 1.5 million tonnes – this having been expected in late December or early January. NFL has also requested shipment from load ports prior to 20th February, a tight timetable given the number of previously acquired cargoes that are yet to ship to India.

China’s likely participation in the NFL tender is unclear. Remaining urea availability under its existing export quota allocation is put at 100,000 tonnes with no indication – so far – that the Beijing authorities will approve more export volumes.

In Southeast Asia, Brunei Fertilizer Industries (BFI) reportedly committed to two 6,000 tonne granular urea lots in the $380s/t f.o.b. range for January shipping. Petronas in Malaysia was also linked to January lots at $395-400/t f.o.b. In the Middle East, Oman’s SIUCI has agreed a 40,000 tonne granular urea cargo for late January-early February shipping at a rumoured $395/t f.o.b.

West of Suez, Mopco sold two lots of granular urea (10,000 tonnes and 6,000 tonnes) in mid-December and Abu Qir another granular lot (6,000 tonnes), all at $440/t f.o.b. for January loading out of Egypt. Algeria’s Sorfert also sold 6,000 tonnes of granular urea at $450/t f.o.b.

In the US, business was upended India’s return to the urea market, with December-January barges trading as high as $376/st f.o.b.

Ammonia up in the Middle East as CBAM rattles US. Middle East ammonia prices were up at $500-539/t f.o.b. – their highest level since February 2023 – on confirmation of a sale by Sabic. The Saudi producer was also said to have suffered an unplanned outage that may last for a month.

The NW European ammonia benchmark retreated to $668/t cfr in mid-December from its end-November peak of $693/t cfr, its highest level since February 2023. This high point, which came amid a number of global supply failures, was 41% above the benchmark’s 2025 low of $435/t cfr.

The most significant ammonia market news was the publication of official default values for the carbon border adjustment mechanism (CBAM) by the European Commission. These values effectively price US tonnes out of Europe.

DAP/MAP price falls slow despite limited demand. Global DAP and MAP benchmarks showed signs of stability following the rapid falls of recent months. The Brazil MAP benchmark appeared to have reached a bottom, although the key DAP India benchmark declined further. Overall, while global spot demand remained lacklustre, expectations of exceptionally tight 2026 availability added price support. The recent news that China will restrict DAP, MAP and NP exports until August has added to bullish market sentiment.

MAP sales to Brazil have remained flat at $630/t cfr for several weeks. News that Mosaic is idling SSP production at its Fospar and Araxá sites in Brazil – due to recent sharp sulphur price increases – is likely to cause concern about phosphate fertilizer availability in the coming months.

Spot prices for DAP sales to India were down at $670-675/t cfr in mid-December. Since August, the Indian DAP benchmark has fallen from $810/t cfr.

Potash prices steady despite Belarus sanctions shift. US MOP prices remained stable, with NOLA values holding at $305-315/st f.o.b., as market activity remains subdued amid thin spot demand and comfortable inventories. The immediate impact of the recent US decision to lift sanctions on Belarusian potash is expected to be muted. Historically, volumes from Belarus into the US have been modest, with Canada accounting for roughly 80% of US deliveries.

Brazil remains the focal point of the global potash market, with prices heard in the $355-370/t cfr range as suppliers continue to push offers higher. This raises questions about potash affordability, given that farmer buying interest was limited even at $350-355/t cfr price levels.

MOP prices in Southeast Asia were broadly stable as the tender season draws to a close. Standard MOP held steady at $360-380/t cfr, while granular MOP remained unchanged at $380-400/t cfr.

Sulphur prices reach new highs. Market prices have surged to new multi-year highs. The clearest price signal came from Indonesia, where a tender award from PT Lygend reportedly landed in the mid-$540s/t cfr. The strong Asian market has directly supported Middle East export prices, with these rising to $505-525/t f.o.b., their highest level since September 2008.

In China, the government has intervened and instructed acid smelters to use 11th December sulphur prices as a benchmark and to prioritise domestic buyers. It has also told sulphur producers to decouple their pricing from international markets. Sulphur prices for the Chinese import market, meanwhile, held steady at $515/t cfr.

Sulphur prices in Brazil surged to a new multi-year high of $530-540/t cfr, surpassing the previous June 2022 peak. Mosaic’s announcement that it is idling single super phosphate (SSP) production at two of its sites in Brazil, citing the sharp increase in sulphur prices, is a clear sign of the margin squeeze facing Brazil’s fertilizer producers.

OUTLOOK

Urea market poses questions. Prices are forecast to rebound in the first quarter of 2026, as Chinese exports are halted and regional demand picks up, only to soften by the middle of the second quarter with China’s return to the market. Indian demand and seasonal Egyptian outages are then expected to provide price support towards the end of the second quarter and into the third.

Ammonia prices to remain firm before slumping on returning supply. Ammonia prices are forecast to decline significantly in the coming months, following their dramatic run up in the fourth quarter of 2025. Prices are poised to ease in January on expectations of improved supply, although news of the Sabic outage may temper this decline. Prices should correct significantly lower, if and when supply additions are confirmed, but are expected to remain broadly stable until then.

Phosphates prices expected to remain high on supply shortage. DAP/MAP prices have continued to fall more quickly than expected, with further downside likely early in 2026. Prices are, however, expected to begin increasing again later in the first quarter, supported by tight availability, with prices likely to remain historically high even during the low points of the coming year. Prices could go even higher, and remain there for longer, if supply is tighter than expected due to stronger export restrictions from China.

China’s surprise contract settlement sets tone for potash. Despite recent stagnation, CRU has revised its forecast for MOP prices upwards on the anticipation of strong demand in key markets – the higher floor set by the earlier-than-expected China contract settlement being one example. Extra potash supply will largely rely on higher utilisation rates from existing producers, given the limited new capacity arriving in 2026.

Sulphur prices to peak in January before declining. CRU is forecasting a sulphur price trajectory that peaks in January followed by a period of gradual price softening throughout 2026. This projection has, however, been revised upwards on a stronger-than-expected price surge supported by supply constraints. Nonetheless, high sulphur prices are starting to cause demand to fade in countries like China. Sulphur prices could be pushed lower in 2026, if the eventual correction is more aggressive than currently projected.