Sulphur 420 Sep-Oct 2025

19 September 2025

Market Outlook

Market Outlook

SULPHUR

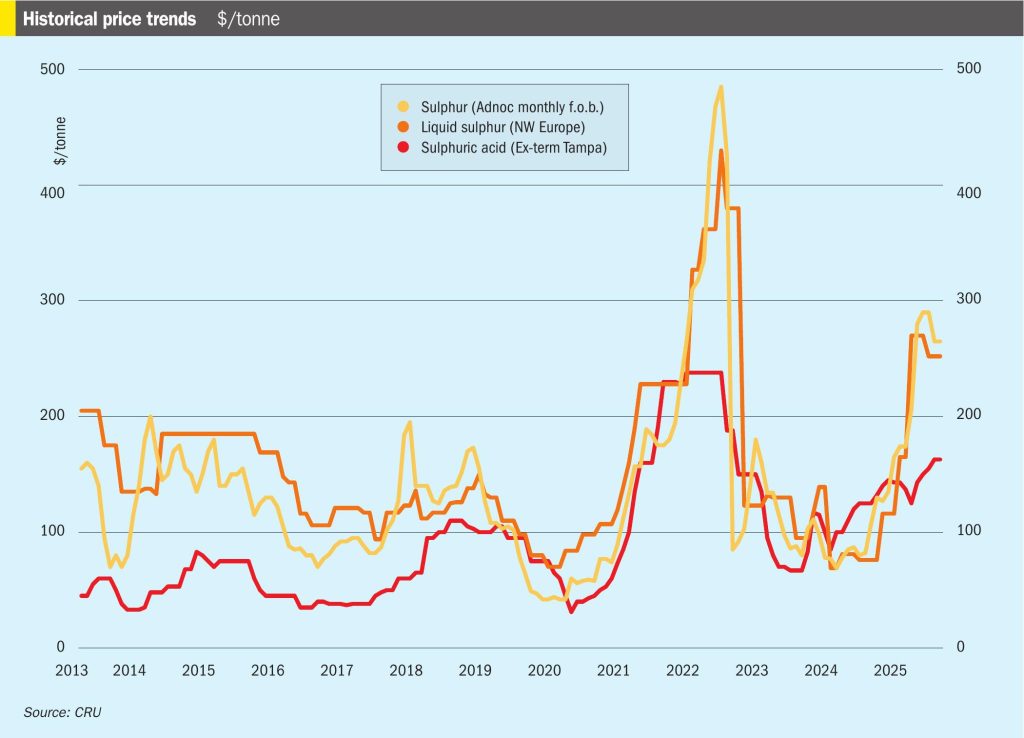

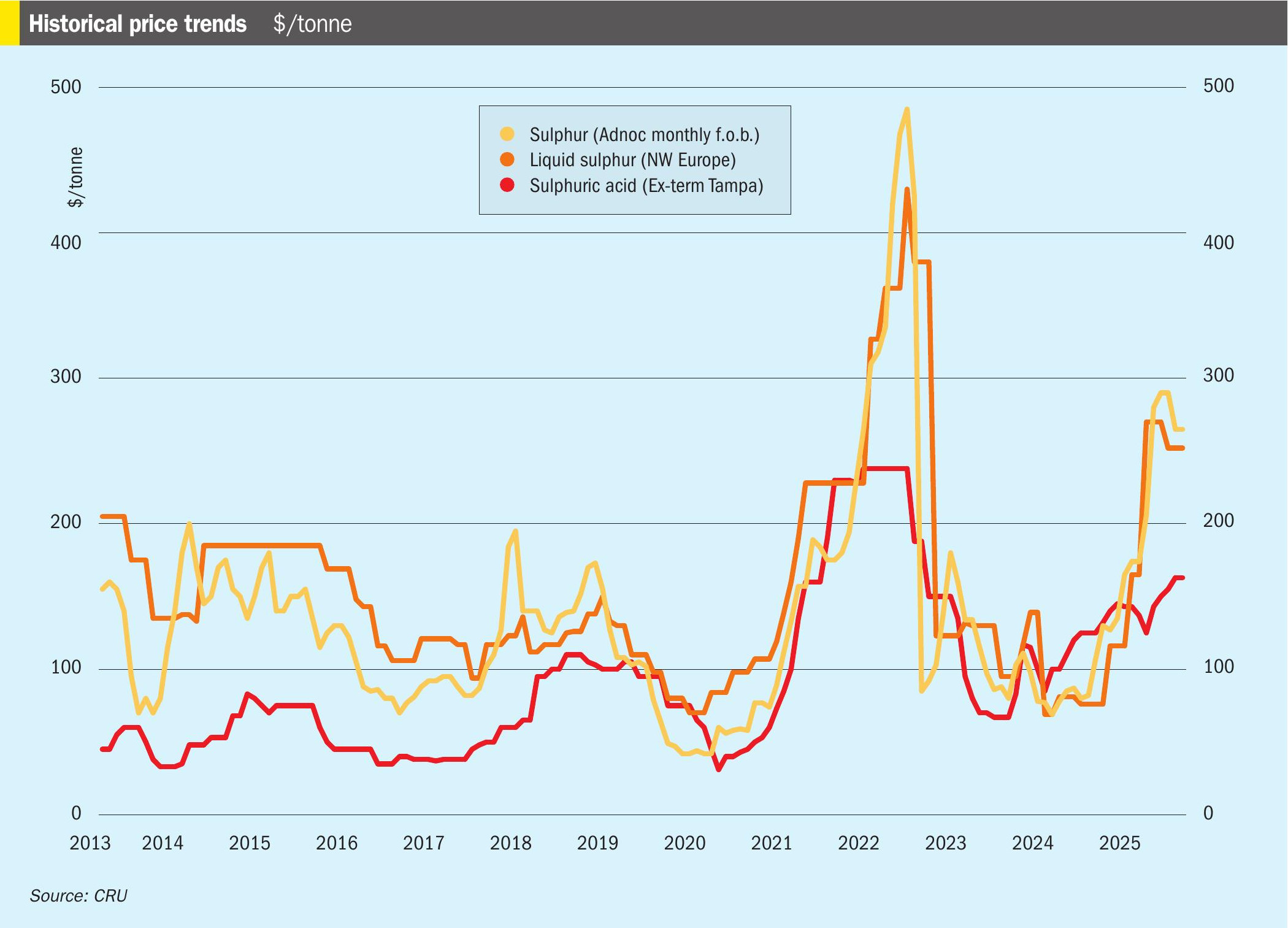

• The global sulphur market is forecast to enter a downward trend as supply from Saudi Arabia normalises following the summer months, while demand decreases alongside demand for phosphate fertilizers. The price is expected to fall towards the end of the year, with a low of around $220/t by May 2026.

• Prices in Canada are expected to follow a similar trend driven by demand in Asia. The forecast sees this downward trend holding until April 2026 at a level close to $210/t f.o.b.

• In China, sulphur prices have been increasing domestically as the announcement of a second round of phosphate export quotas alongside requirements for the autumn application season were met with volumes that had been purchased previously at higher price levels. Offers of imports into the country have also been increasing and the forecast now expects the price to average $315/t c.fr during September but decreasing towards November as demand becomes subdued with most requirements for the Autumn application season met.

• Brazil has seen limited activity and has as of late purchased predominantly US Gulf material. The latest CMOC tender is understood to have received a reduced number of offers of FSU material due to the limited availability in that region. With this supply limitation anticipated to continue, it is likely that prices will increase.

SULPHURIC ACID

• Prices in the global sulphuric acid market are expected to decrease further in the coming weeks. Demand is likely to remain opportunistic leading to a market of overall limited transactions. The outlook forecasts that prices in both Europe and Chile will trend downwards and expected to decrease from September through April 2026, possibly as low as $60/t by early 2026.

• European volumes are being offered across delivered markets amid subdued demand but uncertainty regarding a potential return of a buyer in Morocco for Q4 has proven sufficient to limit the pace of the fall this month. We also expect the number of transactions to be relatively limited through September before the downward trend is cemented as Q4 steps in.

• Purchases in Chile over the last two months have been limited despite firm offers for material in the market, as sufficient inventory levels capped need for spot tonnes. With negotiations for annual contracts soon to kick off, the market is likely to limit spot purchases through September.

• The domestic sulphuric acid market in China has stabilised on healthy availability. As a result, some material has been introduced to the export market, which has helped cover some of the supply missing from Japan/South Korea. Offers of Chinese material were heard in the $80s/t even high $70s/t f.o.b., but current time frames see material available for October loading.