Nitrogen+Syngas 397 Sep-Oct 2025

16 September 2025

Price Trends

Price Trends

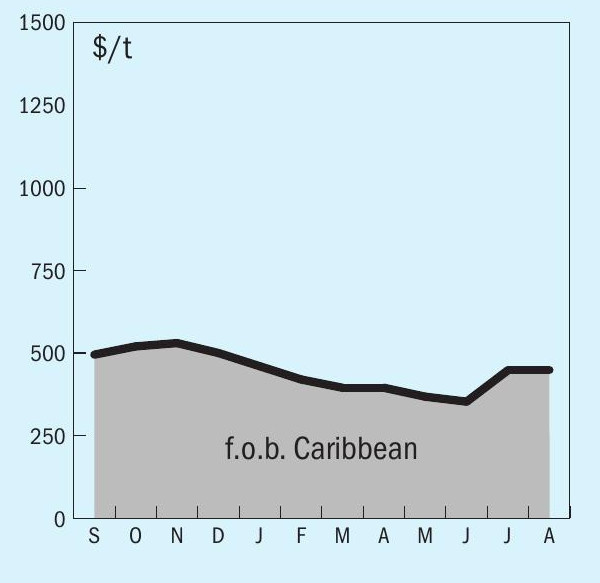

Ammonia prices in both hemispheres had levelled out by the end of August, with the exception of a few marginal upticks in some regions on the basis of the latest supply-demand dynamics. All eyes are now on September’s Tampa settlement, which should spell out the extent of the upside pressure set to emerge over the coming weeks.

Whilst no new spot business was reported out of Algeria, availability looks to be heavily constrained on reported outages at all three of Fertial’s plants in the country, as well as uncertainty over the exact status of production at Sorfert. Delivered values into NW Europe have moved upwards towards the $600/t c.fr level. Regional imports continue, with Trammo discharging a spot consignment for CF in the UK, whilst Koch is shipping a Trinidadian cargo to Finland after agreeing a formula priced spot deal with Yara.

Across the Atlantic, market participants expect a moderate increase at Tampa for September, with Yara and Mosaic tapped to agree to at the very least a 5% premium on the $487/t c.fr fixed by the pair for August. The import line-up into Florida is strong at present, with phosphate major Mosaic increasingly active on the spot and contract market in recent weeks. Export-wise, shipments out of the US Gulf are also robust, with a multitude of cargoes departing or set to load from Texas and Louisiana. However, despite assertions to the contrary, an August shipment from the Gulf Coast Ammonia (GCA) complex is unlikely to emerge before the end of the month.

In the Black Sea, contract cargoes from Trinidad and Algeria will soon arrive for Agropolychim. East of Suez, exports continue to flow out of the Middle East at a steady rate.

There was little change to normal proceedings in Southeast Asia, although prices in Indonesia have ticked up based on the latest supplier targets and on the ongoing turnaround at Parna Raya’s 1,500 t/d KPI unit. In the Far East, both contract and notional prices edged up in Taiwan, China, although delivered values into South Korea, where imports have picked up of late, were unmoved.

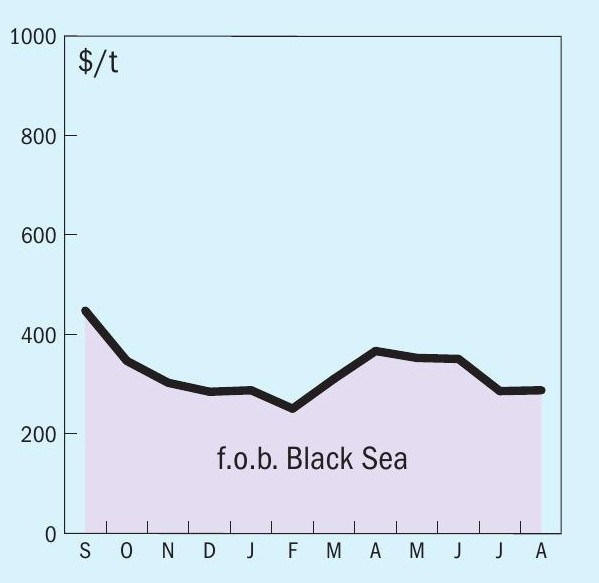

Urea market sentiment has reversed on news trickling out of China, that there would be an additional export quota and shipments to India would be allowed. Confirmation is still awaited that India can receive the cargo but the prospect of this happening triggered a price correction. Looking forward to the next Indian tender with NFL scheduled to tender on 2 September, talk amongst market players is of seeing prices slide below $500/t c.fr. Not all producers, however, are ready to accept that the market is moving down. Pupuk Indonesia offered 45,000 tonnes granular for September shipment and refused to accept that no one could pay the owner’s estimate of $503/t f.o.b., and the tender was scrapped. The highest bid came in at $475-479/t f.o.b. Bontang from Hexagon. There was talk of a $500/t f.o.b. price secured in Oman for October shipment, but this could not be confirmed and seemed to make little sense as forward prices came under pressure on news that China would have additional quantities to place. n

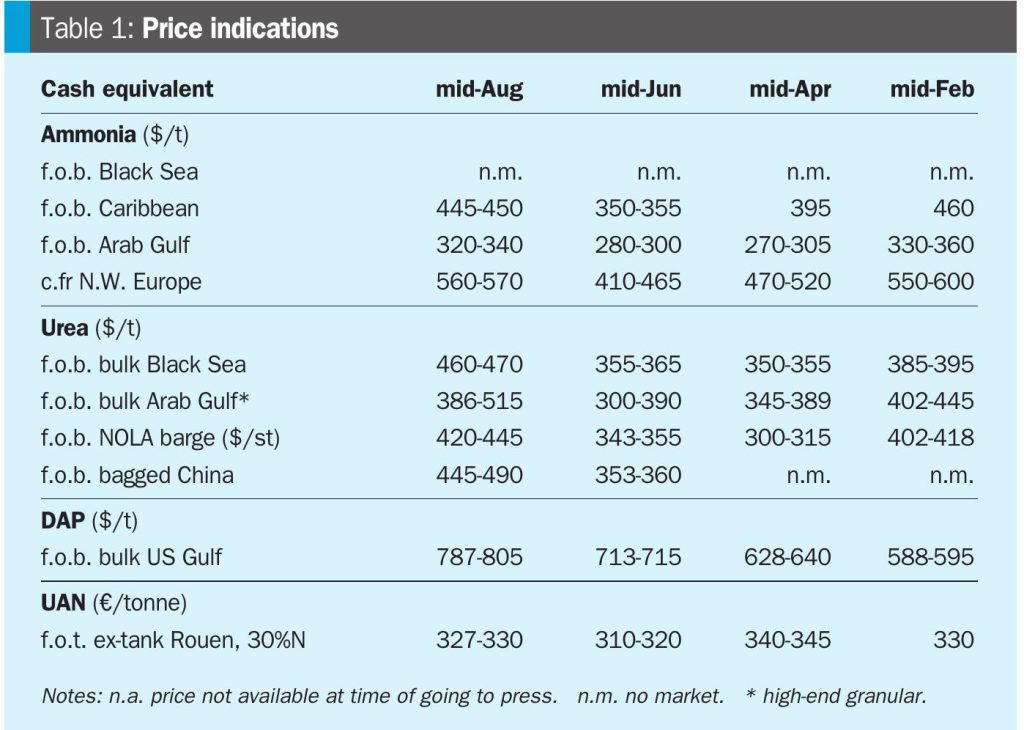

END OF MONTH SPOT PRICES

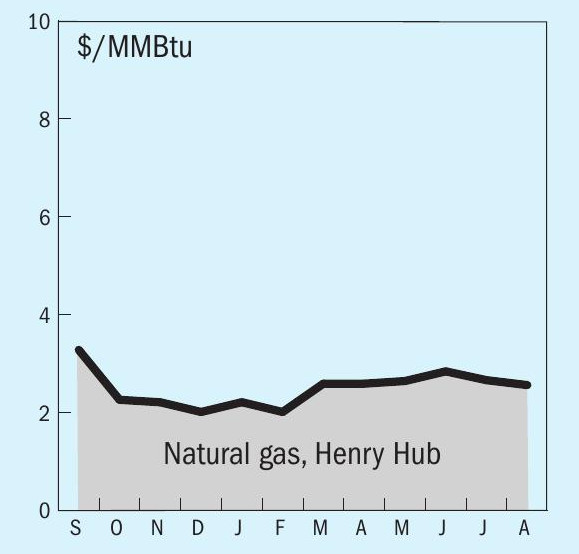

natural gas

ammonia

urea

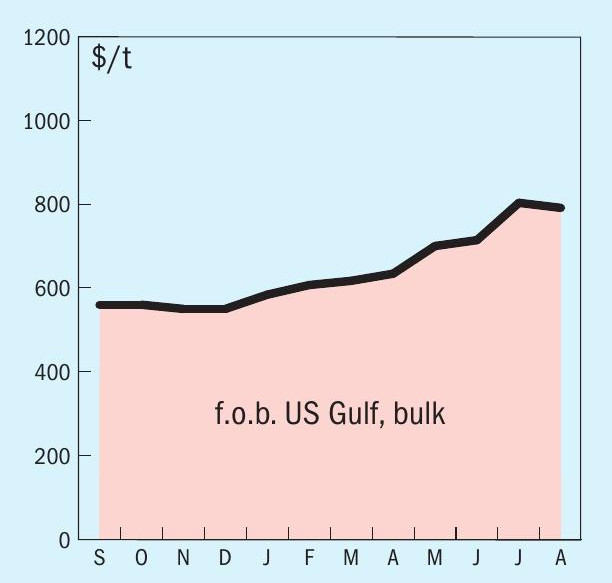

diammonium phosphate