Sulphur 419 Jul-Aug 2025

16 July 2025

Price Trends

Price Trends

SULPHUR

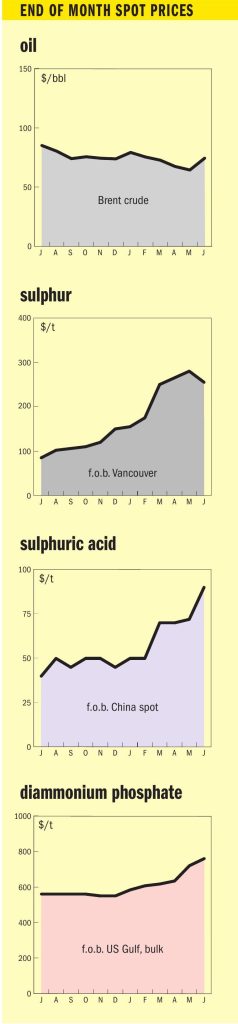

The end of June saw declines in sulphur prices in many regions amid subdued global demand across regions. Most import markets are sufficiently covered through July at least, resulting in limited activity while supply increases. These conditions have exerted downward pressure on prices as bearish sentiment spread across regions.

Middle East prices were assessed down due to weakening demand in Asia, which has led to improved levels of supply in the Middle East. Prices started on a downward trend towards the start of June, but this was temporarily limited by the escalation of the Iran-Israel conflict. However, following the de-escalation of the conflict, Asia returned to a wait-and-see approach to purchasing, causing Middle East prices to fall further. A QatarEnergy tender was awarded at $282-283/t f.o.b. as the conflict began to subside, with prices falling rapidly as QatarEnergy set its July selling price at $258/t f.o.b., down $28/t, and ADNOC at $265/t f.o.b., down $25/t, with Kuwait at $259/t f.o.b.

Demand for sulphur has been lacking from China particularly. Chinese stocks of sulphur have increased, with domestic prices at around $277/t c.fr, and domestic sentiment is bearish and expecting further decreases. Bids and offers between $265-270/t were circulating at the end of June. Total sulphur port inventories in China increased by 120,000 tonnes to 2.3 million tonnes by 2 July. The volume at Yangtze River ports increased by 134,000 tonnes to 1.09 million tonnes, while levels at Dafeng port inventory decreased by 11,000 tonnes to 373,000 tonnes.

Market sentiment has turned positive, driven by expectations of a second round of phosphate quota allocation, rumoured to be 1.5 million t/a of MAP and DAP combined.

Buyers in Indonesia are understood to be covered through July at least, with some covered through August, according to multiple industry sources. As a result, demand has weakened and activity has been limited. No transactions were reported into the country at the end of June, but market indications suggest that the price level has moved to around $275-285/t c.fr, with any future business likely conducted at these lower levels. Indonesia’s sulphur imports increased by 120% year on year from January through April, reaching 1.53 million tonnes, according to Global Trade Tracker (GTT).

In the Mediterranean, despite unchanged prices for weeks, bearish sentiment has grown, and it is likely that prices will soon trend downwards as most buyers in the region are understood to be covered in the short term. A Motor Oil tender was expected to send a clearer price signal, but the final price of the award could not be verified at the time of writing. With limited demand and decreasing prices in the Middle East, sulphur prices in the region are experiencing downward pressure.

Prices in the US Gulf were also unchanged, but early indications suggest that the price is likely to move lower soon, according to market participants. Adding to the bearish sentiment is the conclusion of the Tampa Q3 agreements at a $18/t lt decrease from Q2. Seaborne sulphur export prices from Canada were assessed unchanged at $255-265/t f.o.b., and the market remains bearish. Purchases of material by Indonesia and China have been limited following the ceasefire between Iran and Israel, with those markets taking a more cautious stance on purchases and largely adopting a wait-and-see approach to the market.

In Brazil, the latest CMOC tender is understood to have been awarded at $292/t c.fr, according to multiple market sources. As a result, the price was assessed higher, and appeared to be going against the global trend, but these price levels have so far been sustained by prices in the Baltic and the US Gulf, which have not fallen as in regions east of Suez. Still, the market is presently bearish with prices in the US Gulf expected to adjust soon.

Despite subdued demand, India imported 212,800 tonnes of sulphur in June, marking an 87% increase year on year. Oman accounted for 60% of these volumes, followed by Qatar (18%), with the remainder sourced from Yemen, China, and other origins.

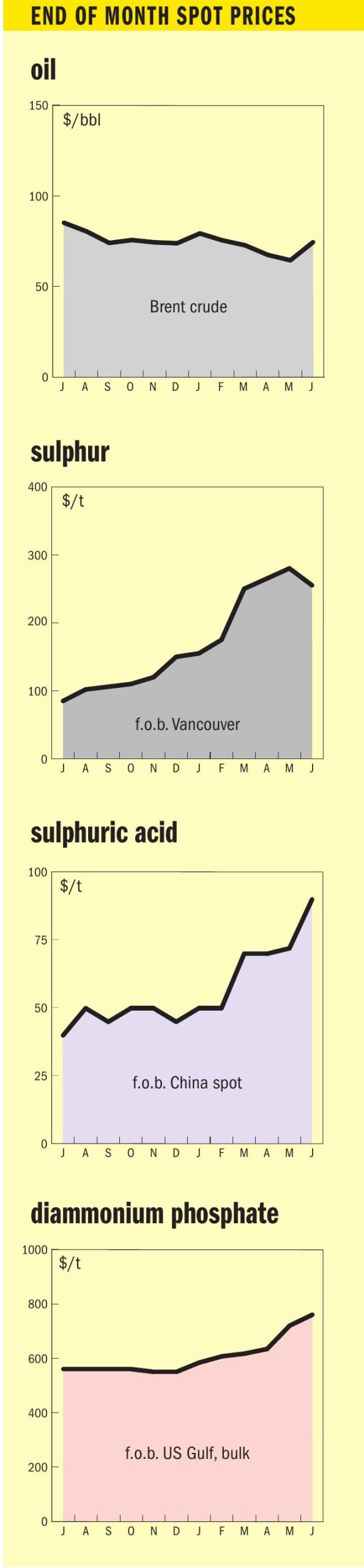

SULPHURIC ACID

In contrast to sulphur markets, sulphuric acid prices registered increases in North Africa, Chile, India and South Korea in June, with the market largely expectant of the latest Tongling tender award in China. Bullish sentiment remains in China despite an unchanged price assessment. The final award price for the latest Tongling tender could not be confirmed at time of writing, but some market participants believe it could reach $100/t f.o.b. Others note that producers have been signalling this price for over three weeks without any confirmed transactions at that level. Still, prices in the domestic market have kept climbing and are now indicating levels above $100/t f.o.b. As a result, any international deal is likely to have to match that price level.

Prices increased for Japan/South Korea on the latest transaction, which is understood to have taken place at a level of $87-88/t f.o.b. Availability in the region is very tight, and producers are now indicating no material left until the end of September.

The price range for delivered material into India was assessed higher. India’s sulphuric acid market is exhibiting a firm upward trend, with offer levels rising to as high as $130-135/t c.fr. The increase in offers is largely attributed to limited availability and firming freight rates, particularly from Far East origins. Trade flow data suggests that some volumes from South Korea and Japan are now being diverted to Latin American markets, tightening availability across the Indian subcontinent. India imported approximately 113,000 tonnes of sulphuric acid in June. Of this, 36% originated from Japan, 35% from South Korea, and 18% from China, with the remainder sourced from domestic suppliers, according to Interocean vessel tracking data.

Prices in Europe were unchanged, with no transactions taking place at higher levels than currently published. The return of Aurubis’ Pirdop plant in mid-July is likely to reflect in increased liquidity in the market and some downward pressure in prices but current prices in Asia could limit the downside of prices in Europe, according to market participants. The plant is scheduled to come back onstream on 15-20 July.

In Chile, prices were assessed higher on the latest transaction into the South American country. Although demand remains mostly muted, the current global price environment sees prices in Chile move beyond $160s/t as they are no longer considered viable. Demand is expected to increase during Q3, but most buyers are understood to be covered in the short term. Chile’s imports of sulphuric acid in January-April 2025 decreased by 4% to 1.17 million tonnes, compared to the volumes imported during the same period in 2024, according to Global Trade Tracker (GTT) data.

Brazil’s imports of sulphuric acid for January-June 2025 were down 12% year on year at 263,302 tonnes, with Spain and Belgium again the main suppliers, though both down on volumes for 2024. Imports from Turkey and Italy increased significantly. Brazil’s sulphuric acid imports have held a downward trend after registering record high volumes of 845,000 tonnes in 2022. During 2023, annual imports plunged 33% year on year to 564,000 t/a, and in 2024 imports further declined by 1.5% year on year to 556,000 t/a.

Market activity in the US Gulf is limited. The market is in balance, but barely so, according to market participants. Although it is likely that any future business takes place at higher levels than currently published, buyers in the region have been able to extend their purchases of material. As a result, with no transactions having taken place, the price was assessed unchanged.

The US imported 1.3 million tonnes of sulphuric acid during January-May 2025, decreasing by 9% compared to the volumes imported during the same period in 2024, according to data via Global Trade Tracker (GTT). Canada was the main exporter of volumes into the US, totalling 746,408 tonnes, a decrease of 5% year on year. This was followed by Mexico, which saw its exports of acid into the US increase by 8% to 319,318 tonnes. Japanese volumes totalled 85,369 tonnes, increasing by 52% year on year, while volumes from Finland were 39,330 tonnes, decreasing by 21%. Poland exported 33,286 tonnes. The US did not import any material from Poland during January-May 2024. Volumes from Spain were 31,000 tonnes, a decrease of 73% year on year. The US imported a total of 3.48 million t/a of sulphuric acid during 2024, an increase of 6% compared to the total imports of 2023.

Price Indications