Sulphur 419 Jul-Aug 2025

16 July 2025

Changing patterns of sulphur trade

SULPHUR

Changing patterns of sulphur trade

New sulphur production from Chinese and Indian refineries and Middle Eastern sour gas and the ramp up of nickel leaching projects in Indonesia continue to change the direction of sulphur trade.

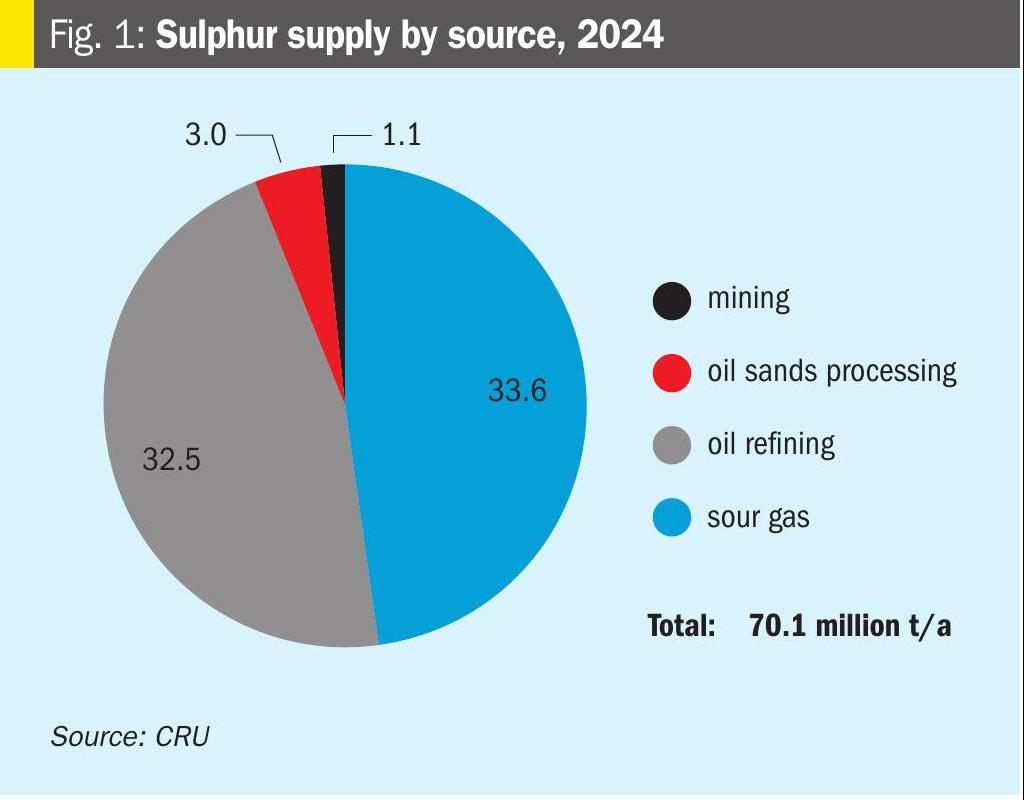

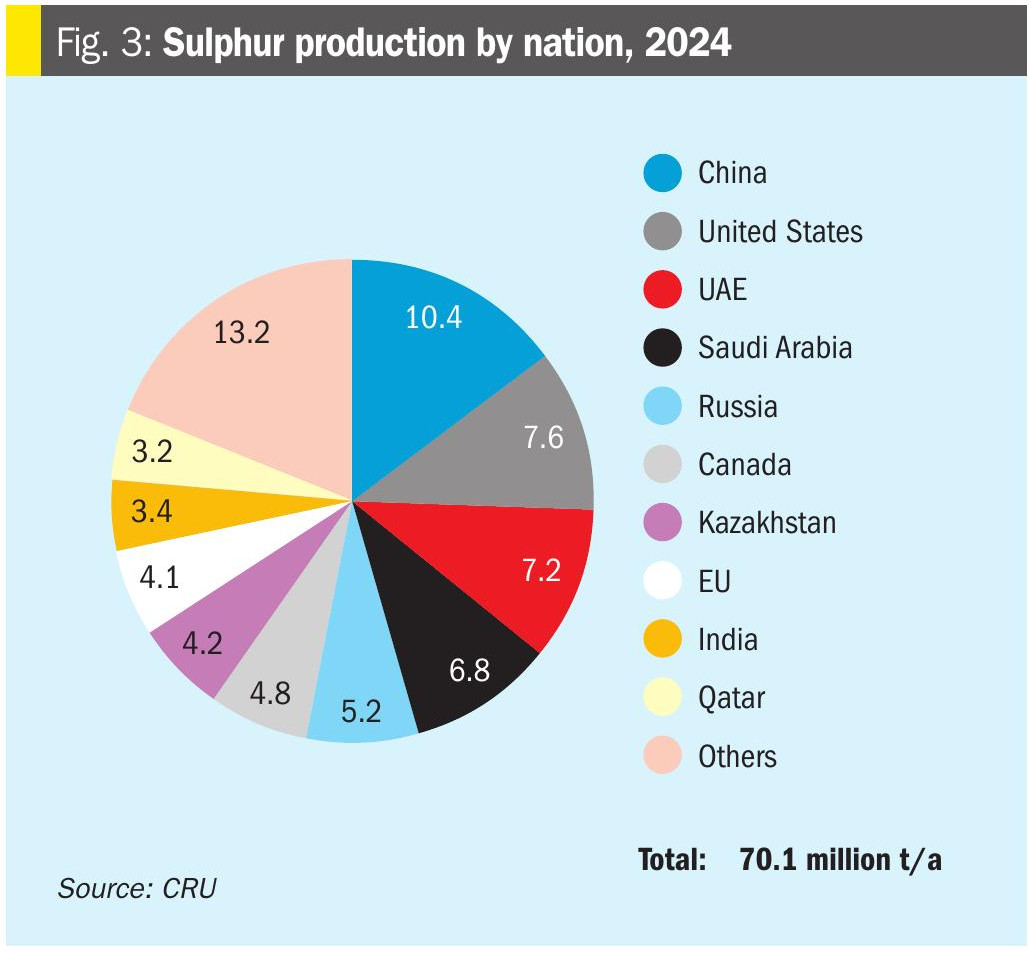

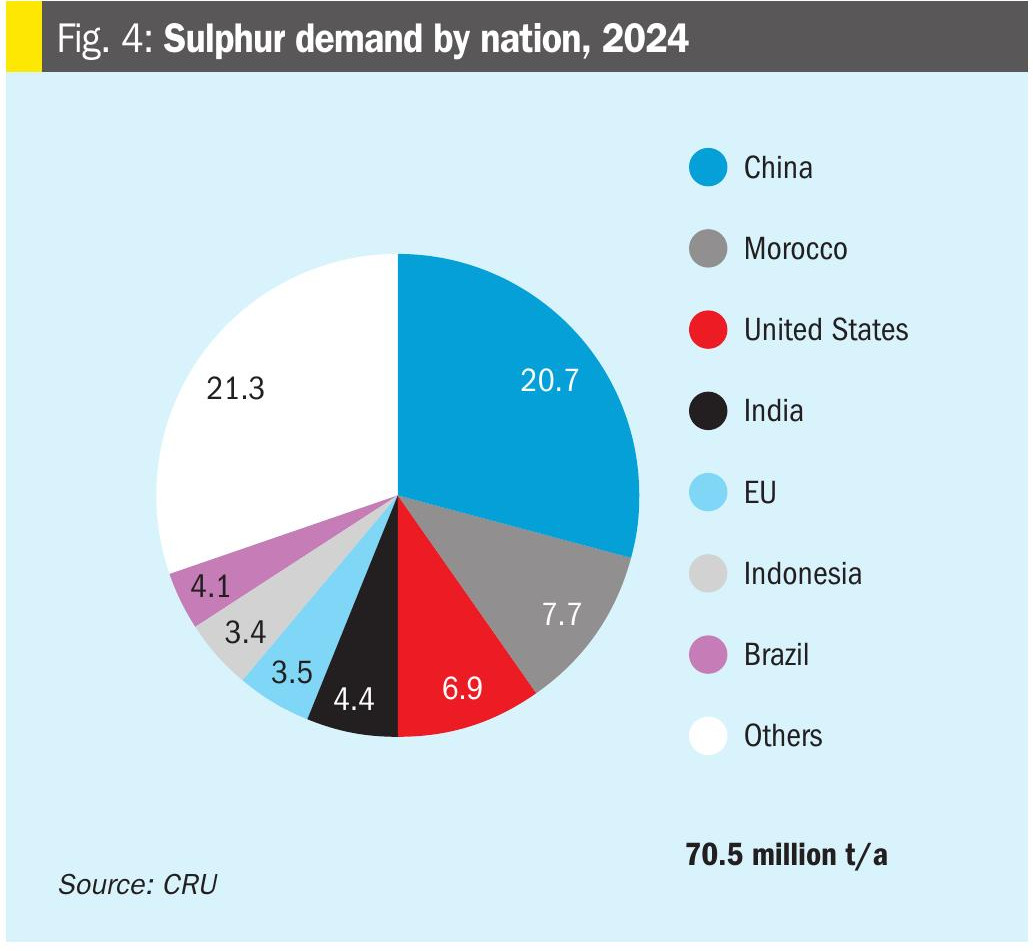

Sulphur is a widely traded commodity. Total elemental sulphur production in 2024 was just over 70 million t/a (see Figure 1), with most of that coming from oil refineries and sour gas processing. Total tonnage of sulphur traded across borders amounted to 39 million t/a, more than half of that total. While some additional sulphur is being produced in major consuming regions like China and India due to new refinery construction, much new demand is coming from countries without any large native sulphur production, such as Morocco and Indonesia, while new production is coming from countries without much sulphur demand such as the UAE, leading to increased volumes traded internationally.

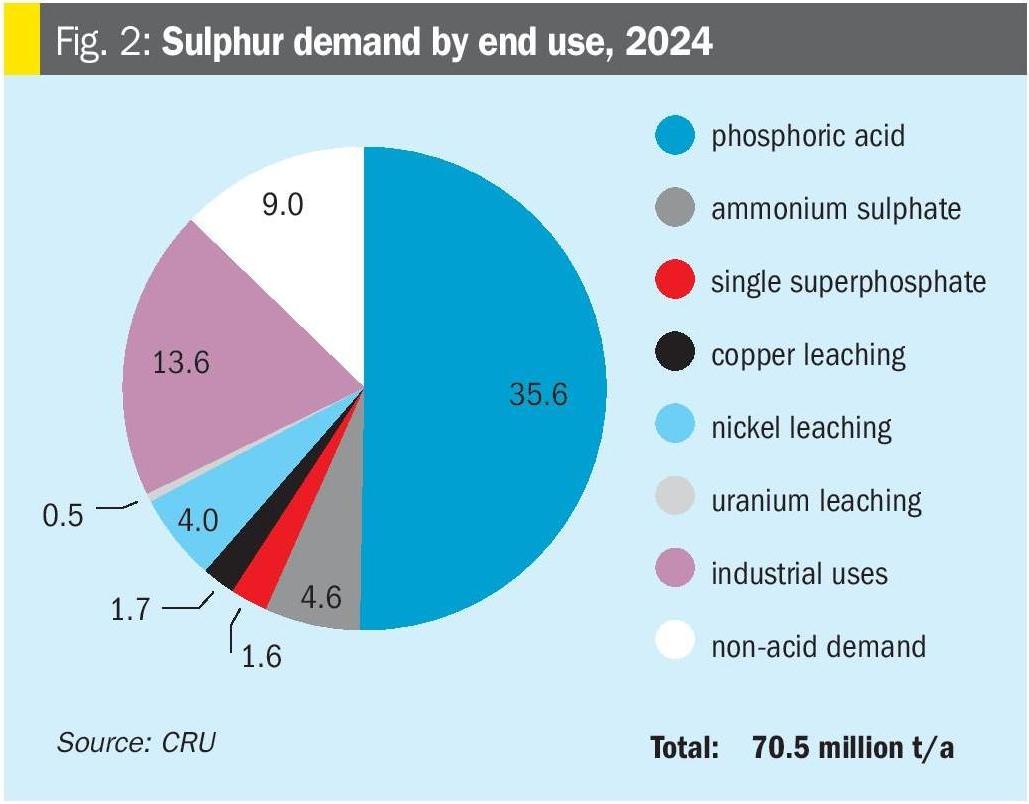

Demand remains primarily from phosphate processing for fertilizers, as shown in Figure 2, but nickel processing for electric vehicle batteries has become a major growth area for sulphur and sulphuric acid demand, and Indonesia, the world’s largest nickel producer, is attracting the lion’s share of this. Sulphur demand for nickel processing, which stood at 4 million t/a in 2024, is forecast to more than double to 8.2 million t/a in 2029, with Indonesia representing most of this growth, and hence requiring more cargoes of sulphur and acid over that period. Indeed, while fertilizer demand for sulphur is expected to increase by 6.7 million t/a from 2024-2029, metal processing will add 5 million t/a over the same period – almost as much.

Supply – North America

North America was the traditional exporter of sulphur to the rest of the world, primarily from Canadian sour gas processing, but also from refining. While the region remains a net exporter, supply is on a declining trend. Canadian sour gas fields are mature and production is falling there, though the rate of decline has slowed and some additional production from British Columbia is balancing continued declines in Alberta. Canadian sour gas sulphur production is expected to stabilise at around 1.4 million t/a by 2029. Sulphur from oil sands processing is likewise relatively stable, at around 3 million t/a. US refinery production is falling due to closures and refinery conversions to biofuels, as well as lower sulphur content of oils being processed. The closure of the Phillips66 refinery in Los Angeles is expected to be completed by the end of 2025. LyondellBasell ceased operations at its Houston refinery in 2025 Q1. Total US sulphur production is set to decline by 300,000 t/a out to 2029. All of this is set against increasing demand from metals processing, particularly new lithium mines. The US is set to become a net sulphur importer from 2026, with import volumes increasing over the next few years, some of it likely to come from Canada. Canada has exported around 4 million t/a and will continue to do so. Large stocks of sulphur remain in northern Canada and how much of that is melted down for sale remains an open question.

Supply – Europe

Europe is also a net exporter of sulphur. European production comes primarily from refining, totalling 2.7 million t/a in 2024, though the Grossenknetten gas field in Germany contributes 270,000 t/a, and there is the last remaining Frasch sulphur mine in Poland which produces another 330,000 t/a. Grossenknetten is forecast to close in 2027, while Europe’s refineries also face closure and conversion to biorefineries. Overall, Europe is projected to become a slight net sulphur importer by 2028.

Supply – Central Asia

In spite of logistical difficulties and higher transport costs, Central Asia remains a net sulphur producing region, particularly Kazakhstan. After reaching a historical high in 2024, Kazakhstan’s exports are expected to decrease this year to 4.0 million t/a as the stock drawdown seen last year slows. Kazakhstan started a stock drawdown programme in 2023 with crushed lump sulphur sales which pushed exports to 4.8 million t/a in 2024. The sale of inventory is expected to conclude in 2025, and exports are anticipated to return to typical levels of 3.5 million t/a. Kashagan production remained unchanged in 2024, at 1.2 million t/a, but production at Tengiz rose to 2.6 million t/a across the year.

Meanwhile, higher sulphur prices are expected to lead to more exports from Turkmenistan, partially offsetting the decline in Kazakhstan sales. Turkmen exports are expected to reach 1.4 million t/a in 2025. Russian production was 8.7 million t/a in 2024, but is on a declining trend, while Russian exports face difficulties with sanctions. At the same time, domestic phosphate production continues to increase, leading to higher domestic demand and lowering export volumes.

Supply – Middle East

Middle Eastern production remains the driving force behind new sulphur supply, with an additional 8.3 million t/a of sulphur expected between 2024 and 2029. Most of this will come from sour gas processing, including an expansion of the UAE’s Shah sour gas field and Saudi Arabia’s Al-Fadhili expansion, each generating around 0.4 million t/a of new production in 2024. This year Saudi Arabia will see the ramp-up of capacity at Jazan, adding another 0.3 million t/a. Longer term, the addition of Ghasha in 2027/28 and the next phase of expansion at Shah in 2025/26, both in the UAE, will add a total of 4.7 million t/a of sulphur capacity between them, most of that at Ghasha. In Saudi Arabia, the Tanajib gas plant is expected to add 900,000 t/a of sulphur supply in 2026/27. Qatar’s North Field Expansions (0.6 million t/a capacity) will be added in 2026 to support expanded LNG exports. There is also new refinery capacity in Saudi Arabia this year.

Demand – China

China remains the largest sulphur importer in the world by a long margin, importing 9.95 million t/a of sulphur in 2024. However, this is down from its peak of 11.7 million t/a in 2019, as Chinese domestic sulphur and sulphuric acid supply continues to increase. Total sulphur supply in China is forecast to climb by 870,000 t/a in 2025, driven by increased oil-based availability. New capacity at the Yulong refinery is expected to come online in 2025 with a capacity of 0.60 million t/a. Gas-based supply will also increase by 300,000 t/a this year as increased gas feedstock from the Tianshanpo field boosts utilisation rates at Puguang. By 2029, availability is set to follow an upward trend as new refinery capacity commissions. Chinese sulphur production will actually overtake North American and CIS production by 2026, by which time it will be 12.9 million t/a.

Domestic demand is projected to continue to increase as well, particularly from the ammonium sulphate sector, as China continues positioning itself as the dominant global supplier and, as we describe elsewhere in this issue, from the titanium dioxide industry. There will also be continued increases in phosphate demand, mainly from the battery industry. The lithium iron phosphate (LFP) sector is expected to account for around 900,000 t/a of sulphur consumption in 2025. Even so, sour gas and refinery additions as well as increased acid availability from smelting, are expected to reduce overall Chinese import demand by around 3 million t/a by 2029 to around 7 million t/a.

Demand – Morocco

Morocco is the world’s second largest importer of sulphur, all of it used for processing phosphates. Phosphate giant OCP commenced operations at its two new sulphur burners at the Jorf Lasfar site in 2024, increasing its sulphur consumption capacity by 800,000 t/a. Sulphur consumption in 2025 is expected to increase further, driven by a high phosphate pricing environment. An expansion of phosphate production over the period to 2029 will lead to an increase in demand of about 900,000 t/a. Sulphur purchases slowed in 2025 Q1, reaching 1.6 million tonnes, down 8% year on year and 24% on the previous quarter, as import trends in late 2024 suggested that Moroccan sulphur purchases exceeded the rate of product exports, resulting in higher inventory levels. For 2025, imports are expected to remain stable at 8.3 million t/a, but out to 2029 they are expected to increase to 9.9 million t/a, overtaking China as the largest importer of sulphur in the world.

Demand – Indonesia

Indonesia’s surge in sulphur demand is continuing, as new Chinese-backed high pressure acid leach (HPAL) plants for nickel processing continue to open and ramp up production. Imports up to April have surged by 120% year on year, reaching 1.5 million tonnes, and already representing 42% of total 2024 purchases. Nickel production figures for Q1 2025 suggest that buyers may have purchased sulphur ahead of their requirements. The upward trend has been driven by purchases to Obi Island and Weda Bay, explained by the increase in capacity at PT Lygend and the commissioning of the PT Huafei project in 2023. There will be further growth in sulphur burning capacity at PT Lygend and Huayue, along with the start start-up PT Meiming project in 2025. An additional project (PT Blue Sparking) will come online in 2026. Another project is the PT ESG in Morowali, which is expected to be commissioned in 2026 with 300,000 t/a of sulphur demand. Additionally, the ENC project, with a 1.0 million t/a capacity, is likely to start up in 2026 in the same region. There is also growth in non-acid sulphur demand, driven by the increase in nickel matte conversion, which uses around 0.6 tonnes of sulphur to produce 1 tonne of nickel.

Overall, Indonesian imports are expected to continue increasing as new nickel projects start or ramp up. For 2025, purchases are set to beat previous records at 4.3 million t/a, rising to 7.7 million t/a by 2029, potentially pushing China into third place in imports.

Demand – India

India is another major importer, mainly for phosphate production. India’s import requirements remain strong in 2025, totalling 600,000 tonnes in Q1 2025, up 200,000 tonnes year on year. Most of these tonnes were for Iffco’s Paradip operations, followed by PPL’s Paradip site and CIL’s Vizag plant. Sulphur requirements have increased due to the start start-up of new burners in 2024 or the expansion of sulphur sulphur-burning capacity in 2025. Indian sulphur demand is expected to remain stable at 4.4 million t/a in 2025. By contrast, supply will increase by 400,000 t/a due to the ramp-up of Indian Oil’s Panipat refinery expansion. But production will not be able to meet the sustained growth in demand, which will be reflected in an increase in import requirements, forecast to reach 2.1 million t/a by 2029.

Demand – Brazil

Brazilian imports have remained robust this year, with figures to May up 26% on 2024 The state of Minas Gerais has been the primary driver of this growth. Consumption is set to increase as the phosphate sector continues recovering and a new phosphate plant continues its initial ramp -up. Euro-Chem’s Serra do Salitre phosphate plant was launched in mid mid-March 2024, and it is expected to reach full output by the end of this year, with sulphur consumption capacity of 330,000 t/a. Growing demand will maintain import growth throughout the forecast period, reaching 2.8 million t/a in 2029, up from 2.5 million t/a in 2024.

Sulphur trade

From the foregoing, it seems clear that Middle Eastern exports will continue to dominate the traded market Since 2016, the Middle East region has accounted for 41-46% of global trade. The addition of new capacity pushed this share up to 49% in 2024 and is set to continue increasing to 59% by 2029. The UAE – i.e. Abu Dhabi – will be the major slice of this. UAE exports are expected to increase from 7.0 million t/a in 2024 to 11.4 million t/a in 2029, reinforcing its position as by far the region’s leading exporter. Additional capacity at Ghasha plans to transport sulphur to forming capacity at Ruwais via pipeline but additional forming and loading infrastructure at the port is likely to be necessary by 2028/29.

Saudi Arabia will be the second major exporter, with sales increasing from 4.8 million t/a to 5.5 million t/a in the same time frame in spite of increased domestic phosphate production. Similarly, the boost in supply will be reflected in Qatar’s exports jumping from 3.1 million t/a in 2024 to 4.1 million t/a in 2029.

In terms of the direction of this trade, Morocco’s growth in phosphate production will see it become the largest sulphur importer in the world by 2029, closely followed by Indonesia as it ramps up nickel production for car batteries. China will remain a major importer, but will drop behind Morocco and Indonesia due to increased sulphur supply within China.