Sulphur 418 May-Jun 2025

3 May 2025

Price Trends

Price Trends

SULPHUR

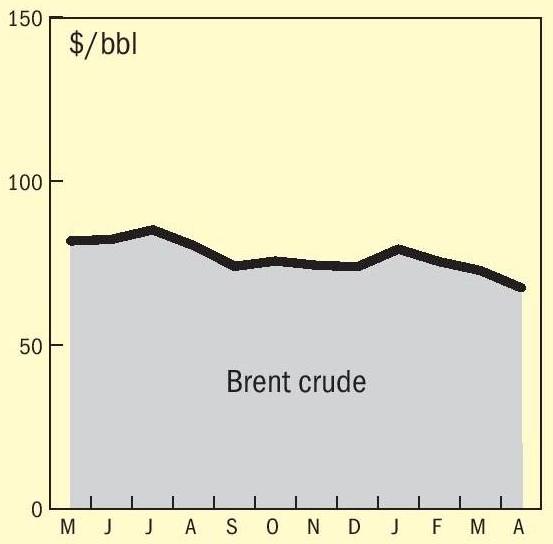

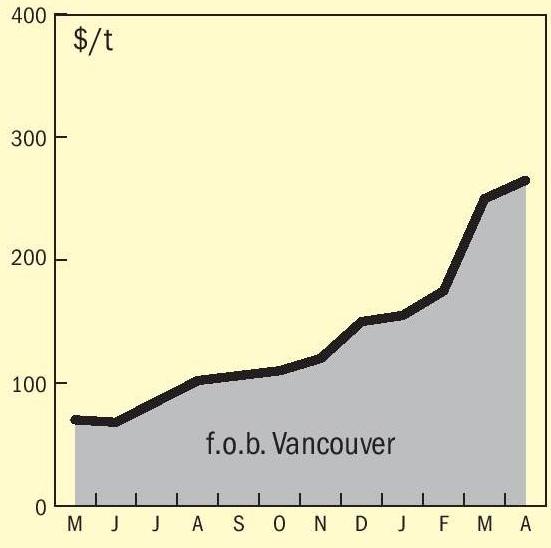

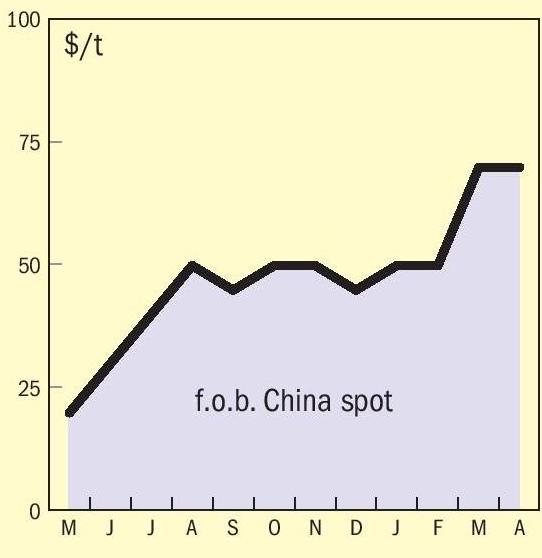

Sulphur markets have been on a tear over the past few months, driven by strong demand in Asia, with buyers primarily sourcing from the Middle East and Canada through late 2024 and into the early months of 2025. Steady buying from Indonesia and China, the two largest importers of sulphur, appears to have supported the market, in China’s case mainly for phosphate production as well as a variety of industrial processes, and in Indonesia’s case to feed the high pressure acid leach (HPAL) plants that are producing nickel for the battery and stainless steel industries. Prices saw a notable rally following the Chinese Lunar New Year celebrations. Nevertheless, this momentum finally began to shift as April began ago as the pace of price increases in Asia started to slow. As the spring fertilizer application season in China draws to a close, domestic prices began to drop, reaching the equivalent of a delivered price of around $272/t c.fr. As well as the narrowing window for spring application of phosphates, the decline was also driven by weakening demand amid uncertainty over tariffs and export restrictions. In southern China, phosphate producers continue to purchase import cargoes. A major phosphate producer in southwest China has been reported as having bought mainstream material at a price of $303/t c.fr, according to local market sources. Total sulphur port inventories in China had declined by 22,000 tonnes to 1.86 million tonnes by 16 April 2025. The volume at Yangtze River ports increased to 825,000 tonnes, while the port inventory at Dafeng decreased to 400,000 tonnes.

Demand in Indonesia appears to have also slowed, with no reports of transactions to the Southeast Asian country in mid-April. The most recent transaction at time of writing was priced at $299/t c.fr. Despite offers around $300/t c.fr, Indonesia has yet to commit to prices higher than those seen in the last transaction.

India, which has been experiencing upwards pressure in its prices as a result of the purchasing dynamics in China and Indonesia, has also turned bearish with a wait-and-see approach now taken by buyers in the country. Domestic supply has covered some of the demand gap while importers await clearer price signals in international markets.

As a result, both the Middle East and Vancouver prices were assessed unchanged. The two regions had supported the current price environment as they were key in meeting Asia’s sulphur demands. As this demand has weakened, so have the price increases across both supply locations. Indeed, the price in the Middle East has remained unchanged for around a month. While Indonesia continued purchasing from the region, China sought alternatives, sourcing from countries such as Iran and Uzbekistan. Indonesia’s demand had been sufficient to maintain the current price level, but future price movements will likely depend on whether Indonesia is willing to match the Middle East price or decide to venture into alternative regions to procure volumes.

The only other price movement in mid-April occurred in the Mediterranean where the delivered price increased to reflect the latest business in the region. Although the f.o.b. price was assessed unchanged, it is bullish and likely to move upward soon. The Mediterranean has functioned as a safeguard for countries in the vicinity that can purchase from either the Middle East or the Med. As a result, the region has been impacted by market trends but has remained mostly insulated from the volatility seen in other sulphur markets.

As far as tariffs go, sulphur produced in Canada complies with USMCA legislation, imports will be exempt from the 25% tariff on Canadian goods into the US. US sulphur consumption is primarily sourced by local availability, and only a minor share is met by imports: imports account for around 20% of total demand, and Canada is the primary supplier, making up 90% of total purchases.

SULPHURIC ACID

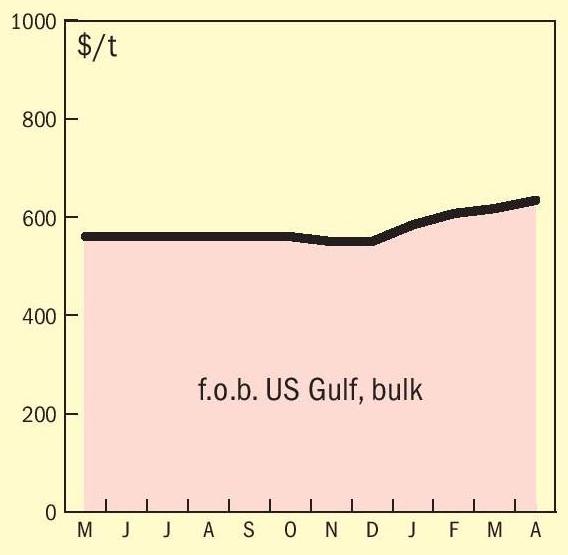

Global sulphuric acid benchmarks were mostly stable in April, with price changes concentrated in supplying countries in Asia. Meanwhile, demand in Chile has softened, as a wait-and-see approach takes hold of the South American market. Throughout most of 2024 Q4, the sulphuric acid market was marked by limited spot activity, as tight supply coincided with weak demand. However, this shifted towards the end of February when a surge of volumes from Turkey and Bulgaria entered the market, triggering a sharp drop in European prices, from $110–120/t f.o.b. to just $60–65/t f.o.b. within three weeks.

The influx of volumes quickly met demand across delivered markets, but a furnace issue at Chile’s Altonorte copper smelter forced a halt in operations, increasing demand from Chilean buyers seeking to replace lost supply. However, demand in Chile weakened recently as buyers have secured enough supplies to compensate for the volumes lost due to the Altonorte smelter shutdown, according to market participants. Even so, with the smelter still offline, demand could come back if the purchased volumes prove insufficient until the smelter resumes operations.

Prices in Europe remained unchanged. Despite tighter availability, a surge in demand from Chile previously helped push prices upward. With demand in Chile now softening, the volume of transactions from Europe has decreased, keeping prices stable. Still, with availability tightening, the price is sustained and prone to bullishness, according to market participants.

In Brazil, the recent award of the Timac tender has kept prices steady. A number of tenders across Latin America are believed to have been awarded within a similar price range, according to market participants, but this could not be confirmed at the time of writing. Demand remains stable in Brazil, and with Chile currently covered, other countries in the region are expected to help maintain the current price environment in the Western hemisphere.

Tight availability in Japan and South Korea has restricted spot transactions, and this situation is expected to persist throughout Q2. As a result, a number of forward transactions have occurred. While these transactions don’t meet CRU’s criteria for inclusion in its weekly assessments, they have still influenced the market, with indications suggesting a price increase.

By contrast, China is seeing more activity, but it is split between domestic and international markets. The domestic price had been driving volumes away from the export market, but improved availability has resulted in downward pressure as international market players reject higher quotations for volumes at and above $80/t f.o.b. The price range has narrowed with the previous higher end no longer considered viable.

Tariffs have the possibility of affecting the US market, which faces a significant structural deficit, with imports consistently totalling over 3.0 million t/a for the last decade. Acid production in the US has declined in the last three years due to a weak performance of the phosphate sector, which has led to reduced sulphur burnt acid supply. Total consumption has not declined at the same pace, and sulphuric acid import requirements have increased. The US imported 3.5 million t/a of acid in 2024, and Canada and Mexico were the primary sources, with a share of 55% and 18%, respectively. The EU also sourced a significant allocation, accounting for 20% of total sales. Sulphuric acid imported from Canada and Mexico should also remain exempted from tariffs as the product is understood to be covered by the USMCA legislation. However, implementing tariffs in the EU would directly impact the cost of seaborne sulphuric acid, as the region will be levied a 10% tariff.

The North American acid industry has developed with a mutual interdependence between US importers and Canadian/Mexican exporters. The introduction of tariffs would be unlikely to change these physical flows as logistical alternatives for both buyers and sellers would be near impossible to find. Canadian volumes typically enter the US in the northeast from smelters in eastern Canada, but the end-use markets span all major demand areas including southern US states. Mexican acid typically enters the US via Texas and Arizona with consumption focussed on the copper market. Mexico has more potential options to sell acid to alternative markets, but at this point some of these are theoretical. Mexico has historically exported acid through the port of Guaymas, but this route has been closed since an acid spill at the port in 2019. Seaborne exports from Mexico have fallen from around 40% of total sales in 2018 to only 20% in 2024.

The final challenge in any consumers’ attempt to replace Canadian or Mexican acid is the availability of supply in the international market and limits to import infrastructure at US ports. The global sulphuric acid market is expected to have some increase in availability in 2025, but the scale of change is relatively minor. Import infrastructure is a larger challenge as seaborne imports to Texas were already at the highest ever recorded level in 2024. Similarly, volumes moving through California are at historical highs. Imports to Louisiana, Georgia and Florida are currently below historical highs, but the gap only equates to around 200,000 t/a. n

END OF MONTH SPOT PRICES

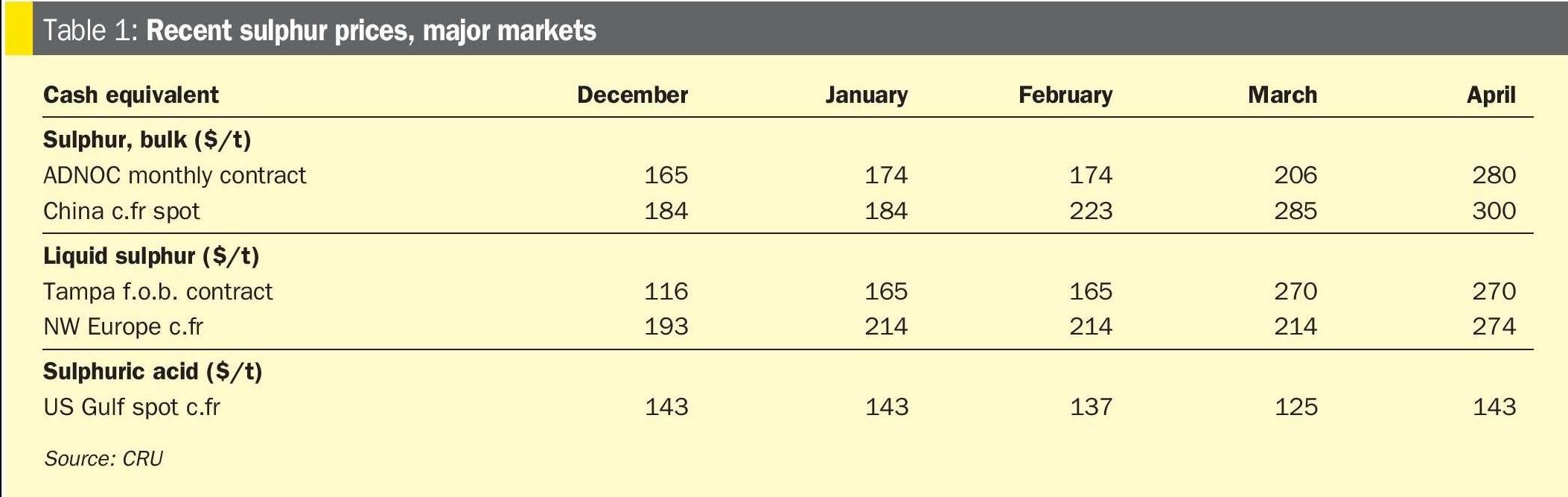

oil

sulphur

sulphuric acid

diammonium phosphate

Price Indications