Sulphur 418 May-Jun 2025

3 May 2025

Middle East sulphur

MIDDLE EAST

Middle East sulphur

The Middle East remains the world’s largest regional exporter of sulphur, with additional capacity continuing to come from both refineries and particularly sour gas processing.

The Middle East produced 21.9 million t/a of sulphur in 2024, up from 19.9 million t/a in 2023. With domestic consumption relatively small at 5.2 million t/a, mainly for phosphate production, and imports limited to 2.2 million t/a, mostly to Jordan and Israel, this mean that exports from the region were a record 19.1 million t/a of sulphur in 2024, up 15% on 2023, bolstered by stock drawdowns in Saudi Arabia.

Refinery production

While global demand for oil and oil products is heading towards a plateau, there is increasing output from refineries in the Middle East as the balance of refining capacity continues to shift, away from Europe, North America and Japan, where refineries are closing or converting to bio-based feeds and other renewable fuels, to Asia and the Middle East. The Middle East in particular has abundant low cost oil available for processing.

Historically the region focused on the export of oil, with relatively simple local refineries and very lax standards on sulphur content of fuels. However, refineries have been forced to recover more sulphur as sulphur standards continue to tighten in major export markets such as Europe, India and, increasingly, Africa. The global push to reduce sulphur levels in vehicle fuels has, over the course of the past three decades, brought sulphur content of fuels from around 800 ppm in Europe and North America down towards the so-called Euro-V standard of 10 ppm worldwide. Even where Euro-V is not implemented, most places have now adopted at least a Euro-IV standard of 50 ppm sulphur, including in most of southeast Asia and the Philippines, east and south Africa and parts of South America. Reduction in sulphur content for maritime fuels is also leading to increased investment in processing refinery bottoms with high sulphur content. The only real exceptions to these fuel standards are, ironically, Kuwait, Qatar and Saudi Arabia, where domestic fuel quality standards continue to lag international standards, meaning that fuels for the domestic market can still be sold with higher sulphur content, but these countries too are moving towards lower standards, with Saudi Arabia looking to implement Euro-V soon.

At the same time, most regional crudes are classed as sour. Abu Dhabi produces some of the sweetest crude, with its Murban grade having a sulphur content of around 0.7-0.8%, but the average sulphur content from Abu Dhabi closer to 2%. Qatar Land grade is 1.35% sulphur but Medium Saudi crude is 2.2-2.9%, and Iraq’s Basrah Heavy is as high as 3.8% sulphur. This means that, as with most refiners handling Middle Eastern crudes, refineries must recover more sulphur than, for example, US sweet crudes.

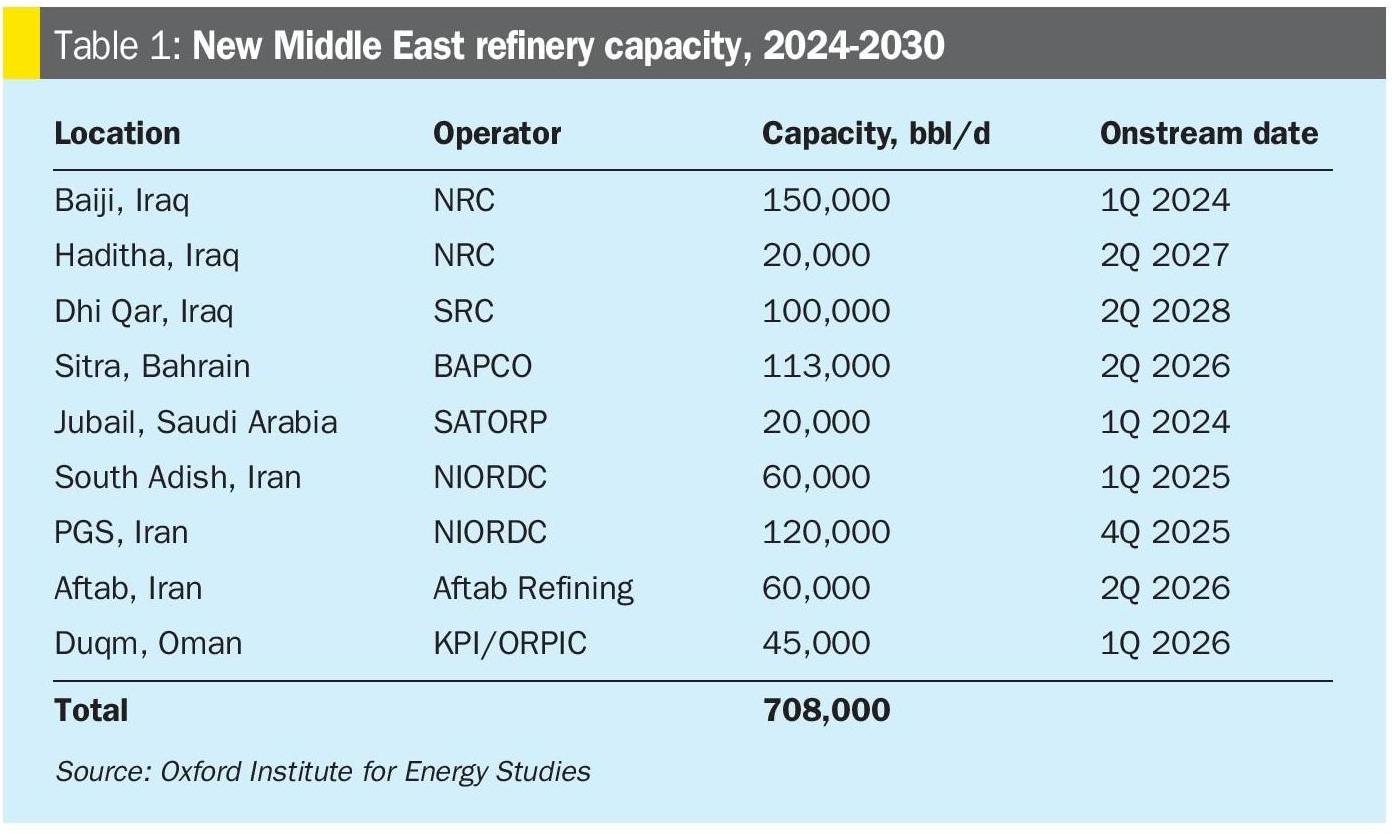

Overall, Middle Eastern refinery capacity continues to increase, as shown in Table 1. This is on top of recent large refinery startups, such as Al Zour in Kuwait (615,000 bbl/d), Abadan in Iran (205,000 bbl/d), Karbala in Iraq (140,000 bbl/d) and Duqm in Oman (230,000 bbl/d). New sulphur from oil refineries is expected to reach an additional 0.7 million t/a over the period 2024-2029, according to CRU estimates.

Sour gas

The other main source of sulphur is from processing of sour gas. Global natural gas consumption increased by 2.8%, or 115 bcm year on year in 2024, above the 2% average growth rate between 201020. Natural gas met around 40% of the increase in global energy demand in 2024 – a greater share than any other fuel. This relatively strong growth was mainly due to the Asia Pacific region, which accounted for almost 45% of incremental gas demand in 2024 on the back of continued economic expansion.

Gas expansions continue to happen across the Middle East, some of it to feed increasing domestic requirements for electricity. The UAE, for example, is expected to increase domestic gas consumption by 50% over the period 2020-2030. Saudi Arabia’s requirements are increasing by nearly 4% year on year as the country pivots away from generating electricity from burning oil to utilising gas instead. Saudi Arabia has already cut its share of energy production from oil from 65% in 2015 to 32% today, but this is projected to drop to 11% under the country’s Vision 2030 plan. Much of this gas production must come from non-associated gas, as associated gas production remains dependant on OPEC quotas. Globally around 40% of all gas resources are classed as sour, but in the Middle East this figure is as high as 60%, particularly for non-associated gas in Abu Dhabi and Saudi Arabia.

As well as for domestic consumption, the rise in global consumption of gas is also leading to increased exports of LNG from the region. Qatar, which operates the largest natural gas field in the world; the North Field, is developing the massive North Field Expansion Project. The field already feeds Qatar’s 77 million t/a of LNG exports, as well as domestic GTL production and the Dolphin export pipeline. Qatar is now aiming to lift LNG exports to 110 million t/a. Although North Field gas is only around 0.5-1.0% H2S, the large volumes that will be processed mean that there will nevertheless be significant sulphur produced.

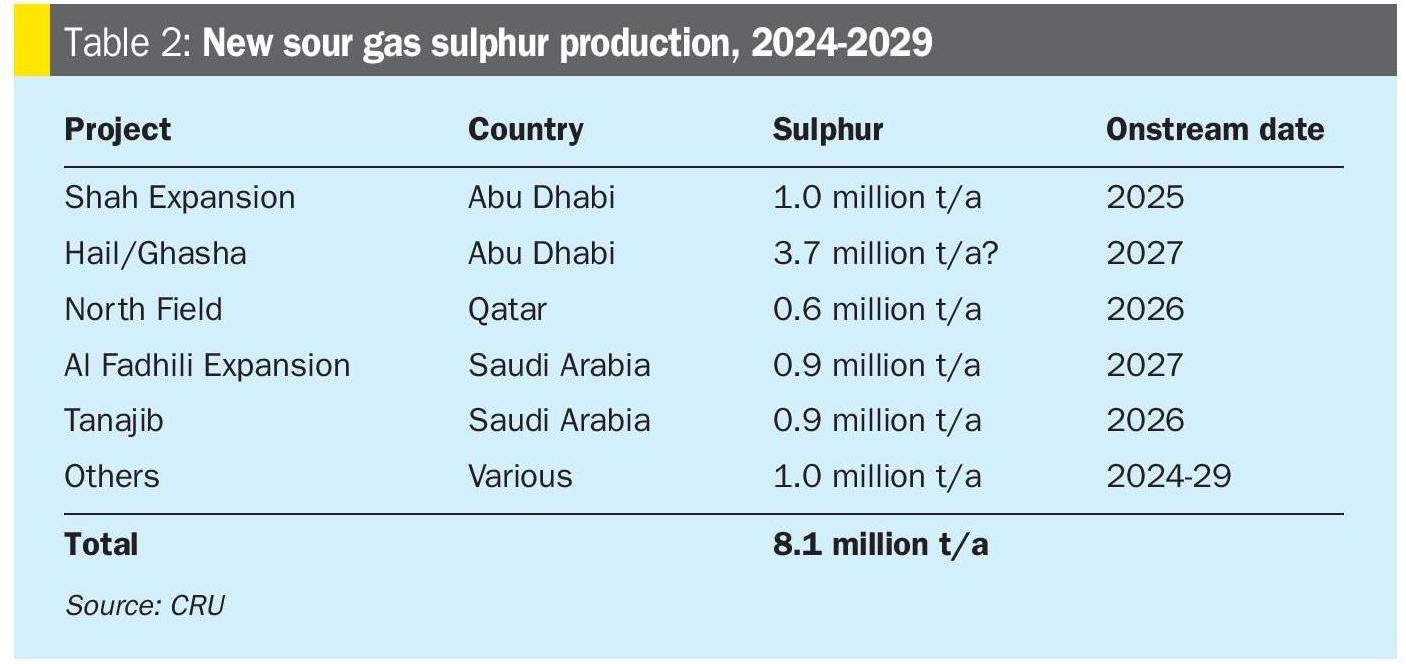

Other major new sour gas projects that will produce additional sulphur volumes are centred on the UAE and Saudi Arabia. Abu Dhabi in particular has pioneered sour gas extraction to supply the UAE’s own burgeoning gas demand at the same time that it exports LNG. The massive Shah project is undergoing an expansion. Gas at Shah is highly sour; around 23% H2S. Production has already been lifted from an initial 1.0 bcf/d in 2016 to 1.28 bcf/d, and is set to rise to 1.45 bcf/d. Sulphur capacity, currently at 4.2 million t/a, will rise concomitantly. Further down the timeline is the offshore Hail/Ghasha field expansion in Abu Dhabi. Here ADNOC is targeting production of 1.5 bcf/d gas with 15% H2S content, partnered by Eni (25%), Wintershall (10%), OMV (5%) and Lukoil (5%). EPC contracts are expected this year and ADNOC says that first gas may flow as early as 2027, though production will take a couple of years to ramp up. Final sulphur output could be up to 3.7 million t/a.Saudi Arabia is also developing the Tanajib gas plant as part of the Marjan oil field expansion programme. Output is to rise from 500,000 bbl/d to 800,000 bbl/d, with the Tanajib plant processing associated offshore gas. It will have a capacity to process 2.5 billion scf/d, and completion is expected in 2026. Sulphur production capacity is around 1.0 million t/a.

Overall, new sulphur from sour gas processing could reach 8.1 million t/a over the next few years (see Table 2).

Sulphur exports

Middle East exports will continue to dominate the traded market for sulphur, and indeed, are likely to expand their share of globally traded sulphur. Since 2016, the Middle East region has accounted for 41-46% of global trade. The addition of new capacity has pushed this share up to 49% in 2024 and is set to continue increasing to 59% by 2029; of the 12.8 million t/a of additional sulphur production expected over the period 2024-29, two thirds will come from the Middle East.

The UAE in particular will reinforce its position as the world’s leading exporter of sulphur. UAE exports are expected to increase from 7.0 million t/a in 2024 to 11.4 million t/a in 2029. Additional capacity at Ghasha plans to transport sulphur to forming capacity at Ruwais via pipeline but additional forming and loading infrastructure at the port is likely to be necessary by 2028/29. Saudi Arabia will be the second major exporter, with sales increasing from 4.8 million t/a to 5.5 million t/a in the same time frame. Similarly, the boost in supply will be reflected in Qatar’s exports jumping from 3.1 million t/a in 2024 to 4.1 million t/a in 2029. n