Sulphur 411 Mar-Apr 2024

31 March 2024

Sulphuric Acid News Roundup

Sulphuric Acid News

KAZAKHSTAN

Acid shortage impacting uranium production

In January, Kazakh uranium producer Kazatomprom warned of potential adjustments to its 2024 uranium production due to challenges with sulphuric acid availability and construction delays at new uranium mining operations. In a statement the company said that its projected uranium output for 2024 will be between 21,000 t/a and 22,500 t/d U3 O8 , around 20% lower than the amount it had been expecting to be able to mine. Kazatomprom’s uranium output was 21,100 t/a U3O8 in 2023, down 1% on 2022 figures, with output flat during 4Q 2023. While it said it had sufficient inventory in stock to cover contracted deliveries in 2024, there could be problems for 2025 deliveries.

Kazatomprom is the world’s largest producer of uranium, with over 40% of global output, and frequently uses in-situ mining for uranium in carbonate rocks, which consume relatively large volumes of sulphuric acid. In a statement Kazatomprom said that due to increased domestic consumption and the demand for sulphuric acid for fertilizer production over the past few years, a shortage of acid has developed in the domestic and regional markets, with a combination of factors such as supply chain disruptions and geopolitical uncertainty. Kazatomprom also says it is actively pursuing alternative sources of sulphuric acid, with the deficit expected to alleviate as a result of the potential increase in supply from local non-ferrous metals mining and smelting operations. The company also has plans to increase its own acid output, with a new 800,000 t/a plant under development, but this will not be completed until 2026.

Uranium markets have been under-supplied, and the price of uranium doubled during 2023 to a 16-year high of around $106/lb. Japan has been bringing its nuclear power stations, many of them idled in the wake of the Fukushima nuclear accident, back online, and there is also strong demand from US utility companies, as well as a great deal of new reactor construction in Asia, especially China. High oil and gas prices over the past couple of years and an increased push for lower carbon electricity generation are leading to a boom in nuclear generation at a time when a run of lower prices had led to uranium mine closures. Meanwhile, supply from Niger, the 7th largest uranium producer, have been interrupted by a military coup last year.

Some supply relief may come from Australia, where additional production is expected this year from Boss Energy’s Honeymoon project in South Australia. Elsewhere, Paladin Energy plans to restart its mothballed Langer Heinrich mine in Namibia in the first half of this year. There are also projects by Deep Yellow, Bannerman Energy and Elevate Uranium in Namibia, and Peninsula Energy in Wyoming, USA.

CANADA

First Phosphate produces first phosphoric acid

First Phosphate Corp. has started up a pilot plant to convert high purity phosphate concentrate produced from its La a Paul phosphate deposit in Quebec into battery-grade purified phosphoric acid (PPA) for the lithium iron phosphate (LFP) battery industry. The merchant grade phosphoric acid (MGA) pilot plant, designed by Prayon Technologies SA, successfully achieved start-up in September 2023, transforming First Phosphate’s phosphate concentrate. Subsequently, Prayon completed the second stage of the process to transform the MGA into PPA in conformity with the Prayon food grade/battery-grade specification.

“Our full transformation process from Quebec igneous phosphate rock to PPA for LFP batteries is now complete,” said First Phosphate CEO, John Passalacqua. “We can now engage our partners to begin the pilot process of producing LFP cathode active material and LFP battery cells from a fully North American source of battery-grade PPA.”

First Phosphate is engaged in a feasibility study for the large scale production of merchant-grade acid and lithium iron phosphate at Saguenay, further south, on a tributary of the St Lawrence river.

JORDAN

New phosphoric acid tank for JIFCO

The Jordan India Fertilisers Company (JIFCO) intends to build a phosphoric acid storage tank at the southern Jordanian port of Aqaba, on the Red Sea, according to local press reports. JIFCO operates a 1,500 t/d phosphoric acid plant and 4,500 t/d sulphuric acid plant at its site at Eshidiya in the southeast of the country. The company exports phosphoric acid and imports sulphur to operate the phosphate processing complex.

BULGARIA

Aurubis awards contract for flash smelter rebuild

Aurubis Bulgaria AD has awarded Metso a contract for a copper flash smelting furnace rebuild project for its smelter in the Zlatitsa-Pirdop valley. Metso says that the value of the contract exceeds EUR 10 million. An Outotec® flash smelting furnace and related technologies were implemented at the Bulgarian primary copper smelter already in 1987. Since then, various upgrades and improvements have been done at regular intervals in close cooperation between the two companies. The previous flash smelting furnace rebuild was executed in 2016. The scope of this new order includes the delivery of new Outotec® cooling elements and the related advisory services to support the rebuild project.

RUSSIA

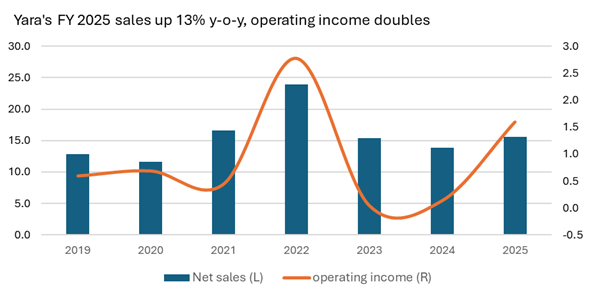

PhosAgro increased acid production in 2023

Russian phosphate company PhosAgro has announced production figures for financial year 2023. It says that its total mineral fertilizer production increased by 2.1% year-on-year to 11 million t/a, with the production of other agrochemicals amounting to about 300,0000 t/a. This growth was driven primarily by an 8.4% increase in DAP/MAP production to more than 4.5 million t/a, as well as a 4.4% increase in ammonium nitrate production to 723,000 t/a and a 1.6% increase in urea production to 1.7 million t/a. The DAP/MAP figures included a 12.9% increase in MAP production, due to the start-up of a new plant at Volkhov, part of the company’s long-term development programme.

In tandem with output of finished fertilizer, production of key feedstocks rose 2.1% year-on-year in FY 2023, mainly due to a 4.6% increase in production of phosphoric acid and a 2.5% increase in the production of sulphuric acid to more than 8.1 million t/a. PhosAgro says that this increase was the result of improved operation efficiency at the sulphuric acid production unit in Cherepovets, and the launch of a new sulphuric acid plant at Balakovo at the end of 2023.

INDIA

Coromandel to build new sulphuric, phosphoric acid plants

Coromandel International’s board has approved the construction of new phosphoric acid and sulphuric acid plants at the company’s site at Kakinada, Andhra Pradesh with a total investment of 10.3 billion rupees ($120 million). Existing capacity at the plant is 1,550 t/d of phosphoric a and 4,200 t/d of sulphuric acid, but has reached 100% capacity utilisation. The capacity addition will be 750 t/d of phosphoric acid and 1,800 t/d of sulphuric acid, with completion set for 2026. In a stock market filing, Coromandel said that the projects, to be funded through internal accruals/loans, will reduce dependence on imports and make Kakinada an integrated facility. The company further said that the investment is in line with its long-term objectives to secure key raw materials for its fertiliser production.

SAUDI ARABIA

Lithium plant will use alkaline leach

EV Metals Group has selected Metso as its technical partner for a lithium chemicals plant to be built at Yanbu Industrial City in Saudi Arabia. Metso will provide technical, operational, maintenance, and systems support to operational performance and asset management. Metso will supply its alkaline leach technology to produce the high-purity chemicals required by electric vehicle and battery cell manufacturers. It will collaborate with EVM through all phases of the project, from project sanction to steady state operations.

“The technical partnership with Metso is a significant development to accelerate the progress of our lithium chemicals plant. EVM will take a collaborative approach to securing all requirements necessary to ensure successful start-up and operation of the LCP, fully aligning with the goals of Vision 2030. Metso is the ideal partner to provide processing technology and equipment for the entire lithium production chain, from mine to battery materials,” said EVM’s CEO Luke Fitzgerald.

AUSTRALIA

Metal price crash puts projects at risk

The slide in the price of nickel has put several nickel extraction projects at risk, with BHP in Australia taking a massive hit in 2H 2023 profits and considering the closure of its Nickel West operation. Nickel prices peaked after the Russian invasion of Ukraine at around $32,000/t, although they slumped through the rest of the year before rallying to $29,000/t at the end of 2022. During 2023, however, increasing supply from Indonesia has increasingly made itself felt, while the Chinese economy has slowed, and the nickel price is now below $19,000/t, and set to stay low for a couple of years at least.

BHP reported a net profit of $927 million for 2H 2023, with the underlying profit of $6.6 billion for the full year being masked by a one-off impairment of $3.5 billion related to their nickel operations. The company is reviewing its operations at Nickel West, which include a mine and a smelter, in spite of healthy demand for electric vehicles, and the Australian government has been considering production tax credits, royalty relief and loans to keep the operation going in the short term.

Prices of rare earths have also been similarly affected, and also potentially at risk is Lynas Rare Earths’ $780 million Kalgoorlie plant, which would use sulphuric acid to produce around 9,000 t/a of rare earth materials and 330,000 t/a of gypsum. Lynas says construction costs have increased at the site and recently unsuccessfully attempted merger negotiations with MP Materials Corp, a US-based rare earth minerals company.

IRAQ

Bids to be invited for phosphate project

Khalid Battal Al-Najim, Iraq’s Minister of Industry and Minerals, has said that the country will reopen its call for bids from domestic and foreign businesses to construct a $3 billion phosphate plant in the western part of the country. Iraq received bids from five companies last year that it considered too low, and is now seeking to widen the offer to more bidders, Al-Najim said at a press conference. The announcement of the request for bids will take place within two months. The capacity of the facility was not disclosed.

Iraq has the world’s second-largest phosphate reserves, according to Iraqi Geological Survey Commission. The deposits, located in the western desert, account for 9% of the global total. Prior to the US invasion in 2003, Iraq operated a large scale phosphate mine at Akashat which produced 2.4 million t/a at its peak in the 1990s, but damage and lack of investment meant that production slumped from 200,000 t/a to just 500 t/a from 2003-6. There was also a State Enterprise for Phosphate plant at Al-Qaim with the capacity to produce phosphoric acid and TSP, although production of both has been idle since 2002. Previous plans were to reopen the Akashat mines along with 1.0 million t/a of downstream phosphoric acid and DAP production. Sulphur to produce sulphuric acid for phosphate processing would come from the revitalisation of the Mishraq sulphur mine near Mosul, as well as revamped refinery projects, but the destruction of Mishraq during the fight against ISIL put those plans on the back burner.

GHANA

New refinery includes acid alkylation unit

China’s Sentuo Group has commissioned the first phase of a new grassroots refinery at Tema, approximately 30 km east of the capital Accra in Ghana. The Sentuo Oil Refinery Ltd. (SORL) will process 40,000 bbl/d of crude oil as part of a public-private partnership to reduce the nation’s dependence on petroleum product imports from abroad, according to president Nana Addo Dankwa Akufo-Addo. Ghana currently relies on foreign sources to meet 97% of its overall demand for finished petroleum products, Akufo-Addo said. The first phase is believed to include diesel hydrogenation, and 60,000 t/a of sulphur recovery as sulphuric acid to feed acid alkylation at the plant. A second phase, which will increase capacity to 120,000 bbl/d, is reportedly under development and due for completion by 2026.

CHILE

Codelco and SQM to partner on Atacama

Codelco and SQM have signed a memorandum of understanding to establish a new operating company for the Salar de Atacama brine operation. Under the terms of the MoU, Codelco will own 50% plus 1 share of the company. State-owned Codelco is the world’s largest copper producing company, accounting for ~8% of global mined copper supply. Early in 2023, the Chilean government gave Codelco the mandate to negotiate on behalf of the state all future contracts and potential partnerships with third parties for the operation of Atacama.

SQM’s current agreement for the Atacama Salar is set to expire at the end of 2030 and it is uncertain if it would have been granted an extension. The new agreement will allow capacity to be expanded beyond the envisaged 250,000 t/a lithium carbonate equivalent (LCE) by an additional 60-70,000 t/a towards the end of the decade, a time when the current slump in the lithium market is expected to have been corrected by new demand. It will represent almost 20% of global lithium supply.

The MoU says that the new company will produce and commercialise products derived from the brine extracted from the mining concessions in the Atacama Salar. The main products currently produced at the mine site include lithium chloride (or a concentrated brine with ~6% lithium concentration), potassium chloride and potassium sulphate.

MAURITANIA

India seeking phosphate supply deal

India is negotiating a long-term phosphate rock supply contract with the government of Mauritania, according to state Chemicals and Fertilizers Minister Mansukh Mandaviya. India already has existing supply deals with Morocco, Morocco, Senegal, Israel, Oman, Canada, Saudi Arabia and Jordan, but is seeking to ensure supply security and price after phosphate markets have been volatile over the past few years due to the covid19 outbreak, the war in Ukraine and more recently the attacks on shipping in the Red Sea. Speaking to local press, Mandaviya also said that a three year supply deal with Egypt is also possible to improve the domestic availability of phosphate fertilizers like DAP. India relies upon foreign imports for 90% of its phosphate needs and imports nearly 5 million t/a of phosphate rock, 2.5 million t/a of phosphoric acid and 3 million t/a of DAP.