Sulphur 398 Jan-Feb 2022

31 January 2022

Market Outlook

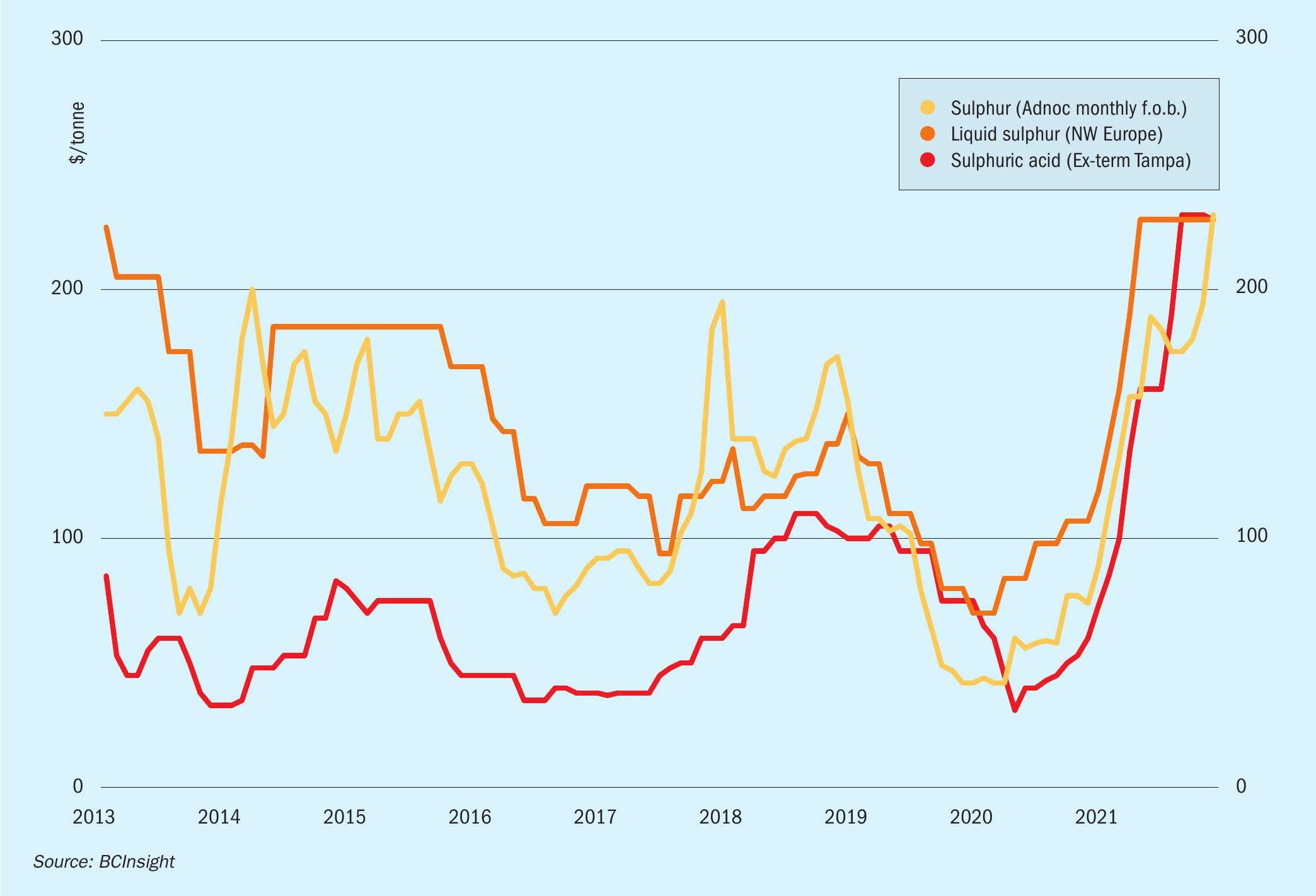

Historical price trends $/tonne

SULPHUR

- The processed phosphates market will be a major indicator for price direction for sulphur markets in 2022. A significant downward correction is expected in DAP prices with early signals prices could soften in the February-March period.

- The timing of increased processed phosphates exports from China will also be a key driver for the market in 2022. Small volumes have been cleared for export and expectations this will ramp up through the first half of the year, ahead of the end of the export restrictions.

- Metals markets are expected to add to global sulphur consumption in 2022. The nickel market is forecast to add around 900,000 t of sulphur this year, this is largely being driven by Indonesia with numerous projects already ramping up. This remains supportive for trade and pricing in the short term.

- Outlook: Global sulphur prices are likely to firm further in the early part of the quarter before plateauing in March and going into a potential downward correction from the second quarter. There is strong support for prices to run up through the remainder of January and in February because of supply disruption and strong demand. Later in the year, capacity is expected to increase in the Middle East and normalise at existing operations as fuel demand improves.

SULPHURIC ACID

- Firmer sulphur prices continue to support the need for merchant acid but a price premium remains in most markets for acid. The ramp up of new sulphur capacity in 2022 could provide downward pressure for sulphuric acid as availability at sulphur burners is expected to improve.

- In December, the US Federal Open Market Committee decided to tighten its monetary policy with the phasing out of a stimulus programme by March – faster than previously planned. This signal that the US might raise interest rates more aggressively is dampening the sentiment in the copper and nickel futures markets, which came under pressure in late December from rising numbers of Covid-19 cases across Europe and the growing likelihood of further lockdown restrictions.

- Market participants are also weighing up the likely impact of planned production hikes for both copper and nickel. The global nickel market is expected to shift to a surplus in 2022, compared with the deficit in 2021. Indonesia will be the largest contributor to the production growth, especially across nickel sulphate feedstocks – nickel-cobalt mixed hydroxide precipitate (MHP) and nickel matte – and nickel pig iron (NPI). This will be a key driver for sulphur and sulphuric acid consumption growth.

- Outlook: Sulphuric acid prices are likely to firm further in Europe through the first quarter because of planned maintenances and ongoing curtailments at key smelters. Higher molten sulphur prices in the region will also support acid pricing. In Asia prices may soften further and the gap between European and Asian markets is set to continue in the near term as acid availability from China continues to improve through the year.