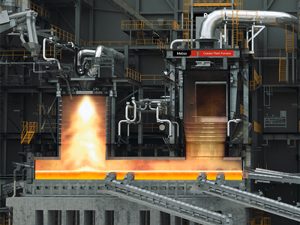

Mixed smelter for Tennessee

Korea Zinc says it will partner with the US government to construct a critical minerals smelter in Clarksville, Tennessee, producing zinc, lead, and copper. Korea Zinc will begin site preparation next year, followed by phased commercial operations from 2029. The plant is planned to process around 1.0 million t/a of raw materials and turn out 540,000 st/a of finished products. Processing of gold, silver, and key strategic minerals such as antimony, indium, bismuth, tellurium, cadmium, palladium, gallium and germanium, are also planned in what is being touted as a "state-of-the-art" facility. Sulphuric acid and semiconductor-grade sulphuric acid will also be produced. The output will include 300,000 t/a of zinc production, 200,000 t/a of lead, 35,000 t/a of copper and 5,100 t/a of rare and strategic metals. Development will be through Korea Zinc’s US subsidiary, Crucible Metals.