MOPCO invests in carbon capture at Damietta

MOPCO has selected thyssenkrupp Uhde to supply advanced technology for its Damietta ammonia-urea complex in Egypt.

MOPCO has selected thyssenkrupp Uhde to supply advanced technology for its Damietta ammonia-urea complex in Egypt.

Metso launches Cu POX leaching process for copper extraction industry - solution maximises copper recovery while reducing environmental impact

In Part 4 of this series on stripper efficiency issues, we continue to look at the causes of lower stripper efficiency with a discussion on the high delta-P range of liquid dividers.

Carbon Recycling International (CRI), which operates a geothermally powered green methanol plant at Svartsengi, 40km southwest of Reykjavik, had to evacuate its site in late November when a 3km fissure opened in the earth a few kilometres away and lava began spilling across adjacent land. Satellite photos of the area taken on November 24 show a large field of molten and cooled lava to the north, west, and south of Svartsengi, though the plant itself remained undamaged. CRI’s Iceland facility runs on CO2 , water, and renewable electricity from the Svartsengi geothermal power station. CRI says the low-carbon energy source allows it to produce 4,000 t/a of methanol with a greenhouse gas footprint just 10–20% that of conventional methanol.

While there is still a considerable push for use of biomass waste as a lower carbon feedstock for chemical production via gasification to syngas, biological processes such as fermentation are increasingly gaining traction as an alternative.

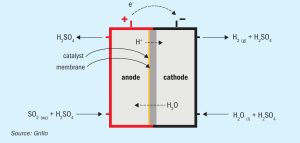

New concepts focused on the transfer and combination of existing sulphur and sulphuric acid technologies to support decarbonisation of the sulphuric acid industry are being investigated. In this article three research projects are discussed: sulphur dioxide depolarised electrolysis for green regeneration of spent acid, use of renewable heat and catalyst to the splitting process from sulphuric acid to SO2 for reduction of fossil fuel consumption, and sulphur as an energy vector.

Van Iperen International is pursuing an ambitious sustainability strategy to cut its carbon footprint by 50%.

As a tumultuous 2024 draws to a close, CRU’s fertilizer team to make a few predictions for the year ahead.

We look ahead at fertilizer industry prospects for the next 12 months, including the key economic and agricultural drivers likely to shape the market during 2025.

12 Dec 2024 On 8 December, Syrian rebel forces led by Islamist group Hayat Tahrir al-Sham (HTS) ousted the government of Bashar al-Assad. The now thirteen-year long civil war in the Middle Eastern nation has proven hugely disruptive to its phosphate rock production. During the 2020s exports recovered strongly amid Russian intervention and a lull […]