Ammonia markets face continuing disruption

The curtailment of ammonia production in Europe and reduction in export supply from Russia has led to an unprecedented year for the merchant ammonia market.

The curtailment of ammonia production in Europe and reduction in export supply from Russia has led to an unprecedented year for the merchant ammonia market.

Market Insight courtesy of Argus Media

As we near the end of the third quarter of 2022, the attention of the nitrogen industry is focused on the coming northern hemisphere winter, and the prospects for higher natural gas prices as temperatures fall and power and heating demands rise. Vladimir Putin has been stoking these worries to try and force a climbdown from European countries over the sanctions that followed his invasion of Ukraine, with the flow of gas through the Nordstream 1 pipeline across the Baltic Sea gradually dwindling over the summer and finally stopping altogether at the end of August due to “technical issues” – an explanation somewhat undermined by the subsequent statement from spokesman Dmitry Peskov that gas would flow again once sanctions were eased. This is a familiar enough tactic; Russia has used gas stoppages to pressure Ukraine and Europe several times over the past two decades.

Overall the market finds itself in a period of illiquidity, and is exposed to further uncertainty in 4Q because of the European energy crisis. Spiralling natural gas costs in Europe, with Dutch TTF gas prices trading around e200/MWh, are forcing European fertilizer producers to close ammonia capacity and buy in from overseas.

The war in Ukraine has severely affected the supply of ammonium nitrate and CAN from Russia and Ukraine, with particular potential impact on Europe and Latin America. Can urea make up the difference?

T he high-price environment for fertilizers and other commodities, including natural gas, is having very different consequences globally.

Market Insight courtesy of Argus Media

Saudi Arabia’s Ras Al-Khair Industrial City has signed an industrial land agreement with local firm Gulf Copper to develop a copper smelting and casting plant at an investment $319.30 million. The project would be developed on a plot spanning more than 250,000 square metres in the industrial city. No construction timelines were given. The Saudi government has previously signed agreements with Trafigura and Saudi-based Modern Mineral Holding to develop a 400,000 t/a copper smelter at Ras Al Khair which would also include 200,000 t/a of zinc and 55,000 t/a of lead smelter capacity at a projected cost of $2.8 billion.

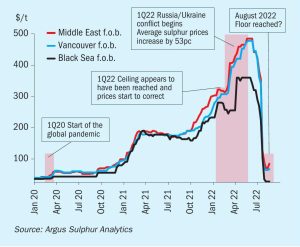

Reduced appetite for sulphur from processed phosphates producers in China will continue to place downwards pressure on pricing in the near term. l Phosphates-based demand is likely to remain low in the second half of 2022 as issues surrounding affordability persist, slowing import requirements.

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.