Price Trends

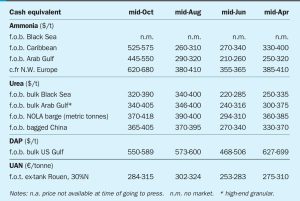

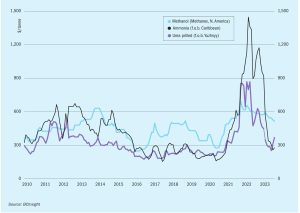

The ammonia market reverted to recent norms at the end of April, with prices more or less unchanged in the east, and several benchmarks west of Suez moving downward in line with May’s Tampa settlement. Following a trio of high-priced c.fr spot deals many wondered whether such business would be replicated in Asia, but the hype did not live up to the expectation, with the majority of tonnes continuing to move on a contract basis into the likes of South Korea and Taiwan, China. The $430/t c.fr concluded into China has been attributed to both supply uncertainty and an uptick in domestic demand, though several inland prices declined this week, rendering price direction difficult.