Price Trends

Meena Chauhan , Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

Meena Chauhan , Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

The ongoing recovery from Covid-19 has led to an uptick of sulphur from refineries in regions including the US compared with a year ago. As travel around the global improves, increasing fuel demand points to higher operating rates and improved sulphur recovery.

More than 400 representatives from across the global sulphur community convened in Abu Dhabi from 24-26 May 2022 for an exciting new event, the Middle East Sulphur Conference, devoted to exploring best practice operations across the entire sour gas and sulphur value chain.

The Sulphur Institute’s (TSI’s) annual Sulphur World Symposium was held in Tampa, Florida this year, from May 9th-11th.

E. Almeida and B. Ferraro of Clark Solutions discuss how regular monitoring by simple testing of the towers in sulphuric acid plants can improve the reliability and lifespan of the plant.

Clariant has announced a reorganisation into three global business units instead of the previous five, with the business unit presidents to be located in the regions with the largest customer base and highest growth potential for the respective businesses. It will also create a new executive steering committee that will include the CEO, the CFO and the presidents of the new business units. The company says that the new structure aims to reduce hierarchical layers, foster greater accountability, speed up decision-making processes and enhance customer proximity, while strengthening diversity.

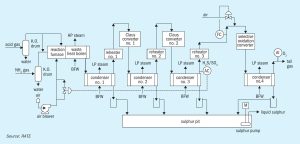

M. Rameshni and S. Santo of Rameshni & Associated Technology & Engineering (RATE USA) report on advanced catalysts for increasing the sulphur recovery efficiency of new and existing sulphur recovery units to meet stricter environmental regulations.

Acid output is expected to increase as copper mining and smelting increases; the copper market is moving moves from deficit to surplus, with copper output expected to rise 5% in 2022 as demand increases for electric vehicles.

Condensate formation in sulphuric acid plants can cause severe corrosion problems leading to high maintenance and plant downtime. Santhosh S . of Metso Outotec discusses the importance of carrying out regular monitoring and maintaining accurate and detailed data about condensate to increase equipment life and avoid downtime. Different sources of condensate formation in the plant are discussed as well as the typical locations in the plant where the condensates end up.

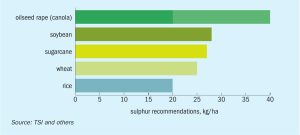

Sulphur is becoming an increasingly vital crop nutrient, due to a combination of lower sulphur deposition from the atmosphere, the increasing prevalence of high-analysis fertilizers and higher cropping intensity.