SulGas® Kuala Lumpur 2025

SulGas® KL, South-East Asia’s sulphur recovery and gas treating conference organised by Three Ten Initiative Technologies LLP, made its debut from 2-3 July 2025, at Impiana KLCC, Kuala Lumpur, Malaysia.

SulGas® KL, South-East Asia’s sulphur recovery and gas treating conference organised by Three Ten Initiative Technologies LLP, made its debut from 2-3 July 2025, at Impiana KLCC, Kuala Lumpur, Malaysia.

CRU's analyst Viviana Alvarado discusses the effect of smelter outages and maintenance, a copper concentrate shortage, and Asian capacity ramp ups, on sulphuric acid supply and prices.

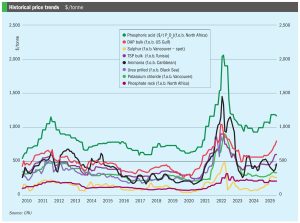

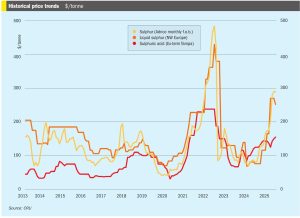

Price trends and market outlook, 21st August 2025

Producing food sustainably will require concerted collaboration across the whole value chain, concludes a new landmark report.

Dr Karl Wyant, Nutrien’s Director of Agronomy, looks at past innovations and what the future holds for phosphorus in farming.

SulGas® KL 2025 - 17 speakers, dedicated exhibition area, panel discussions...

MEScon 2025 took place in Abu Dhabi from 19-22 May 2025, providing delegates with renewed energy, new connections, and fresh ideas to apply across the sulphur value chain.

New sulphur production from Chinese and Indian refineries and Middle Eastern sour gas and the ramp up of nickel leaching projects in Indonesia continue to change the direction of sulphur trade.

The progressive closure of smelter capacity in Australia poses potential problems for acid consumers across the country.

• Global sulphur prices are expected to experience decreases over the next few weeks. Buyers in Asia report that they are covered for contracted supply throughout July, and domestic prices in China are likely to decrease further, putting downward pressure on sulphur prices.