Market Insight

Urea: Prices continued their global decline in mid-April, including at New Orleans. The notable exception was Brazil where prices firmed due to buyer interest in the market for May and beyond.

Urea: Prices continued their global decline in mid-April, including at New Orleans. The notable exception was Brazil where prices firmed due to buyer interest in the market for May and beyond.

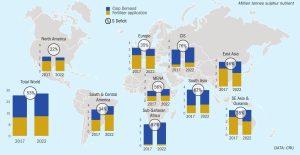

Sulphur plays an important role in crop nutrition. Indeed, sulphur is increasingly being recognised as the fourth major crop nutrient alongside N, P and K. However, a combination of intensive agricultural practices, increasing application of high-analysis fertilizers and tighter air quality regulations has led to increasing sulphur deficiency in soils. In this insight article, CRU’s Peter Harrisson looks at what’s driving sulphur deficiency and whether there’s a gap in the market for sulphur fertilizers.

Sulphur is a necessary nutrient for strong and healthy plant-growth and disease resistance. Fertipaq manufactures the liquid suspension fertilizer S-600 using sulphur recovered wastewater and biogas streams. This organic product is an ideal nutrient source for crops with a high sulphur requirement.

More than 370 delegates from over 150 companies and 40 countries gathered at the Hilton Warsaw City Hotel, Warsaw, Poland, 26-28 February, for CRU’s Phosphates 2024 conference.

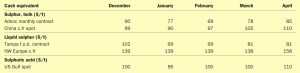

Sulphur benchmarks firmed around the globe in April. Although availability remains ample, downstream production is expected to rise in the weeks ahead and further upside for prices is expected, at least in the short term. Prices increased the Middle East, Indonesia, India, Brazil, and the Mediterranean. The Middle East spot price was assessed up an average $3/t at $83-88/t f.o.b. The previous low end of the range was no longer considered achievable. The price has climbed 27% since mid-February this year. The benchmark is down 53% from early December 2022, but had climbed 47% from the end of July 2023 to its mid-October average of $110/t f.o.b. before declines set in once again. Chinese buyers returned to the international spot market in late April following weeks of inactivity, lifting c.fr prices.

At the end of April, Australian mining giant BHP made waves in the business world by offering US$39 billion to take over its London-based rival Anglo-American, creating the world’s largest diversified mining company. For its part, Anglo’s board announced that it was rejecting the offer, saying that it was “opportunistic” and that it “significantly undervalued” their company. A revised bid was said to be in preparation at time of writing.

Downstream phosphate production is expected to climb, with further sulphur price recovery expected. Overall, global demand remains lacklustre as downstream demand has yet to increase substantially in key markets and sulphur availability from most origins is ample.

Morocco’s OCP is continuing to expand its phosphate fertilizer production capacity. This includes the construction of new sulphur-burning acid capacity to support phosphate production and provide carbon-free power.

Sulphur plays an important role in crop nutrition. Indeed, sulphur is increasingly being recognised as the fourth major crop nutrient alongside N, P and K. However, a combination of intensive agricultural practices, increasing application of high-analysis fertilizers and tighter air quality regulations has led to increasing sulphur deficiency in soils. In this insight article, CRU’s Peter Harrisson looks at what’s driving sulphur deficiency and whether there’s a gap in the market for sulphur fertilizers.

The Sulphur Institute (TSI) held its World Sulphur Symposium in Charleston from April 2nd to 4th.