The future of the European nitrogen industry

Expensive feedstock, overseas competition and tightening environmental regulations all pose potential threats to Europe’s nitrogen industry.

Expensive feedstock, overseas competition and tightening environmental regulations all pose potential threats to Europe’s nitrogen industry.

Nitrogen+Syngas went to press just a few days before Donald Trump’s swearing-in as the next president of the United States. While it is sometimes difficult to sort the truth from the hyperbole in his public pronouncements, nevertheless, if taken at face value, they would seem to indicate that we may be in for a turbulent four years in commodity markets in particular. While he is an avowed military non-interventionist, on the economic policy side he has emerged as a firm believer in the power of tariffs to alter markets in the favour of the US, and has promised 20% tariffs on all goods entering the US, potentially rising to 25% for Canada and Mexico, and 60% for his particular bugbear, China, sparking a scramble for wholesalers to stock up in the last few weeks of the Biden presidency. Trump previously raised tariffs on Chinese goods entering the US to 20% during his first term, and the Biden administration made no attempt to reverse this, and even added some additional ones, for example 20% on Russian and Moroccan phosphate imports.

The start of a new year is a traditional time to take stock of the previous 12 months and look ahead to the next. In this regard, CRU’s most recent annual client survey, conducted at the end of December last year, makes interesting reading as to your own concerns for 2025 and beyond. There were numerous responses across commodity and financial sectors, and broadly based worldwide, if slightly skewed towards Europe and North America, but across all of these the key worry for the coming year clearly emerged as trade tariffs and protectionism. This is perhaps unsurprising, given incoming US president Donald Trump’s avowed intent to impose blanket 20% tariffs on all goods entering the US, and up to 60% on China. While most clients did not think tariffs would rise as much as some of Trump’s rhetoric might suggest, most expect rises of 5-10% across the board, and Asian businesses are most concerned. CRU’s most recent position paper on US tariffs highlights some of the internal political and legal challenges in implementing these, but does acknowledge that some rises will be inevitable, and may well produce the kind of reciprocal measures last seen in the previous Trump administration’s trade war with China and the EU in 2018.

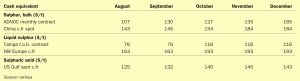

Global sulphur prices were mostly assessed flat in mid-January, with only slight changes for China, Indonesia and India, while the first quarter contracts for the Middle East, North Africa and Tampa increased from the previous quarter. Overall, the number of transactions taking place globally has declined as subdued demand has limited trading activity in most delivered markets. The current sulphur price environment has been shaped by the combination of rising Chinese demand and higher Middle East f.o.b. prices in the second half of last year. As a result, some consumer markets such as Indonesia and India have been subject to upward pressure in order to remain attractive destinations. But demand remained lacklustre across delivered markets, leaving prices relatively stable.

Sulphur prices may remain stable before decreasing on muted demand and transactions may increase in frequency contributing to price decreases in the first half of 2025.

Brazil’s state-controlled oil company Petrobras plans to resume construction of its UFN-III nitrogen fertilizer unit in Tres Lagoas, Mato Grosso do Sul state.

As a tumultuous 2024 draws to a close, CRU’s fertilizer team to make a few predictions for the year ahead.

CRU will host the 2025 Fertilizer Latino Americano conference at the Windsor Oceanico Hotel, Rio de Janeiro, 26-29 January 2025. Join key market players at Latin America’s biggest fertilizer networking event.

We look ahead at fertilizer industry prospects for the next 12 months, including the key economic and agricultural drivers likely to shape the market during 2025.

Market snapshot, 2nd January 2025