Mosaic opens new Tocantins distribution hub

The Mosaic Company opened a new fertilizer distribution plant in Palmeirante, Tocantins, Brazil, in July.

The Mosaic Company opened a new fertilizer distribution plant in Palmeirante, Tocantins, Brazil, in July.

Anglo American has set out three pre-conditions for a final investment decision (FID) on its Woodsmith polyhalite project.

The ammonia train at the under-construction Beaumont ammonia project in Texas is now 95% complete, according to owner Woodside.

Chinese electrolyser manufacturer LONGi Green Energy has begun construction on a $325 million green methanol project in Inner Mongolia that will combine biomass gasification with hydrogen from the company’s electrolysers. The project, being developed at the Urad Rear Banner Industrial Park, will process 600,000 t/a of agricultural waste to produce 190,000 t/a of green methanol in the first phase. Phase 2 will expand ethanol capacity to 400,000 t/a, with hydrogen coming from new electrolysers powered by 850 MW of wind and 200 MW of solar power. LONGi says that the project will cut carbon dioxide emissions by 1.2 million t/a, while adding more than 1 GW of wind and solar capacity to the region’s energy mix.

Clariant has signed a strategic cooperation agreement with Shanghai Boiler Works, a subsidiary of Shanghai Electric which specialises in energy conversion and the development of new energy applications, to jointly foster innovation in sustainable energy solutions. The partners say that they will combine their expertise to advance green energy projects in China.

Suiso, a South African company specialising in blue ammonia production, is set to invest $1.7 billion in a coal-to-fertiliser facility in Kriel, Mpumalanga in the east of South Africa. The proposal is for a 1.5 million t/a ‘blue’ ammonia-urea plant which will replace South Africa’s annual imports of 1.2 million t/a of urea, as well as producing 235,000 t/a of blue methanol for fuels, using advanced decarbonisation and carbon capture technologies. Suiso is partnering with Sinopec Ningbo Engineering, Stamicarbon, and ETG – the latter will distribute Suiso’s fertilisers across Africa, supporting local agriculture and long-term food security.

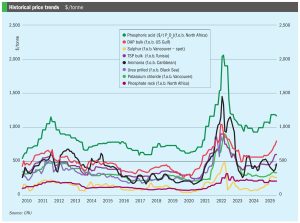

Price trends and market outlook, 21st August 2025

Leaching /crystallisation is a preferable beneficiation process for complex and hard-to-liberate potash ores, according to ERCOSPLAN’s Dr Eike Kaps.

A model developed by ERCOSPLAN can help select the most efficient mining method for potash ore deposits.

Casale’s integrated revamp solutions for ammonia and urea plants are designed to unlock latent potential and boost operational performance.