Kakinada green ammonia project inaugurated

Construction has officially begun on India’s largest green ammonia project. The foundation stone was ...

Construction has officially begun on India’s largest green ammonia project. The foundation stone was ...

India's state-owned Rashtriya Chemicals and Fertilizers Ltd (RCF) has granted in-principle board approval to set up a new ...

China's Xingfa Chemicals Group is planning to invest $2bn in a three-phase project for phosphate ore exploration, extraction and downstream production in ...

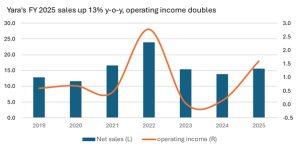

Yara’s full-year earnings (EBITDA) surged to $2.75bn in 2025, driven by stronger nitrogen margins, lower fixed costs and solid volumes.

At the CRU Nitrogen + Syngas conference, CRU spoke with Syed Aamir Abbas, Chief Technical Officer at Fauji Fertilizer Company Limited (FFC), about how Pakistan’s fertiliser sector is navigating tightening natural gas availability and what that means for future supply security.

National Fertilizers Ltd (NFL) says its board has given in-principle approval to set up a bentonite sulphur (BS) plant at its Vijaipur unit, with a capacity of 25,000 t/a and an estimated capital cost of INR 1.04bn ($11.5m). NFL said there is currently no BS capacity at Vijaipur, and described the project as being at […]

Metso says it has won a €180 million order for the delivery of engineering and key process equipment for a new primary copper smelter investment at an undisclosed location in Asia. The planned production capacity of the copper smelter complex is 300,000 t/a of copper cathodes and 1.1 million t/a of sulphuric acid, based on licensed Outotec® Flash Smelting, PS Converting and Lurec® technologies. It includes the design and supply of key process equipment for the main areas of the smelter complex, and the gas cleaning and sulphuric acid plant, copper electrolytic refinery, and precious metals refinery. The delivery also comprises site services and spares.

Australia’s Nickel Industries is to sell a 10% share of the Excelsior Nickel Cobalt high-pressure acid leach (HPAL) project in Indonesia to South Korea’s Sphere Corp. The $240 million price tag represents a $2.4 billion valuation for the company. Sphere will acquire the stake from Hong Kong-based Decent Resource, while Nickel Industries will retain its 44% stake in the project, according to Nickel Industries.

PT Vale Indonesia Tbk says it has officially received the first two autoclave units for the Pomalaa high-pressure acid leaching (HPAL) project, a key component of the Indonesia Growth Project (IGP) Pomalaa. This delivery marks a critical milestone in preparing Indonesia’s high-tech nickel processing facility for operation. The welcoming ceremony was attended by PT Vale and PT Kolaka Nickel Industry (KNI) management, along with strategic project partners including Indonesia Pomalaa Industrial Park (IPIP), Huayou Southern Construction Command, MCC20, and other stakeholders.

Metso has booked the third part of its order for JSC Almalyk Mining and Metallurgical Complex’s copper smelter project based on the equipment and project services delivery contracts announced on August 9, 2024. The first parts of the order, worth €146 million were booked in 4Q 2024, and the second part, worth €50 million in 1Q 2025. The order value recorded in 4Q 2025 is €70 million.