Fertilizer International 530 Jan-Feb 2026

26 January 2026

Fertilizers exempted from US tariffs

The US ended ‘reciprocal tariffs’ on fertilizer imports on 14th November.

With a stroke of a pen, President Trump reversed a seven-month-long experiment that pushed up the cost of fertilizers and made the US one of the highest-priced destinations for nitrogen and phosphates in the world.

The policy shift – made via an amendment to Executive Order 14257 – should provide price relief for US farmers struggling with poor crop nutrient affordability by opening the door to more product from overseas producers.

The most significant impact is expected to be felt in the US phosphate market. DAP prices at New Orleans – immediately prior the announcement – were up 27% since the start of 2025 and at their highest level since Russia’s full-scale invasion of Ukraine in 2022.

The imposition of US import tariffs in April added to an already tight domestic DAP/MAP market caused by countervailing duties (CVDs) on Moroccan and Russian imports. While President Trump’s tariff exemption for fertilizers does not remove CVDs, it does make DAP/MAP imports from Saudi Arabia, Jordan and Lebanon more likely. It also opens the door for more TSP from Egypt, Lebanon and Israel.

US imports of DAP/MAP dropped 30% year-on-year (y-o-y) to just under one million tonnes during January-July 2025, according to Global Trade Tracker (GTT) data, while TSP imports into the US were down 41% y-o-y at around 210,000 tonnes. (July trade data are the latest available due to the US government shutdown.)

International suppliers of urea to the US also stand to benefit from the carve-out for fertilizers, having originally been hit with substantial tariff rates on 2nd April. African urea producers in particular, including those in Algeria, Egypt and Nigeria, will be favoured by a return to the pre Trump tariff era – as they will now be free to compete with Russian producers who were never subject to tariffs on their urea and urea ammonium nitrate (UAN) imports.

Ammonia appears to be unaffected by the latest tariff policy change. Imports from Trinidad, for example, are thought to remain subject to a 15% tariff rate.

Tariffs announced, paused and gone

The rescinding of US import tariffs on fertilizers in November is the latest plot twist in an on-off saga. Having originally announced widespread ‘Liberation Day’ tariffs on 2nd April, President Trump then announced a three-month implementation pause on 9th April (Fertilizer International 526, p7) – later extended to the 7th August. With the exception of China, this saw the US cut its so-called ‘reciprocal tariffs’ on imports to 10% for five months.

During this period, fertilizer producers supplying urea, UAN, ammonia and DAP/MAP/TSP to the US generally faced a blanket 10% rate. Tariffs on urea imports from Algeria were cut from 30% to 10%, for example, while Nigeria’s urea tariff was cut from 14% to 10%. The rate on Middle Eastern urea producers was unchanged, being at 10% already.

‘Liberation Day’ levies on granular phosphate imports from Jordan (20%), Israel (17%) and Tunisia (28%) also fell to the more favourable 10% flat rate during the five-month pause. Saudi Arabia and Australia were already at this lower rate and therefore unaffected.

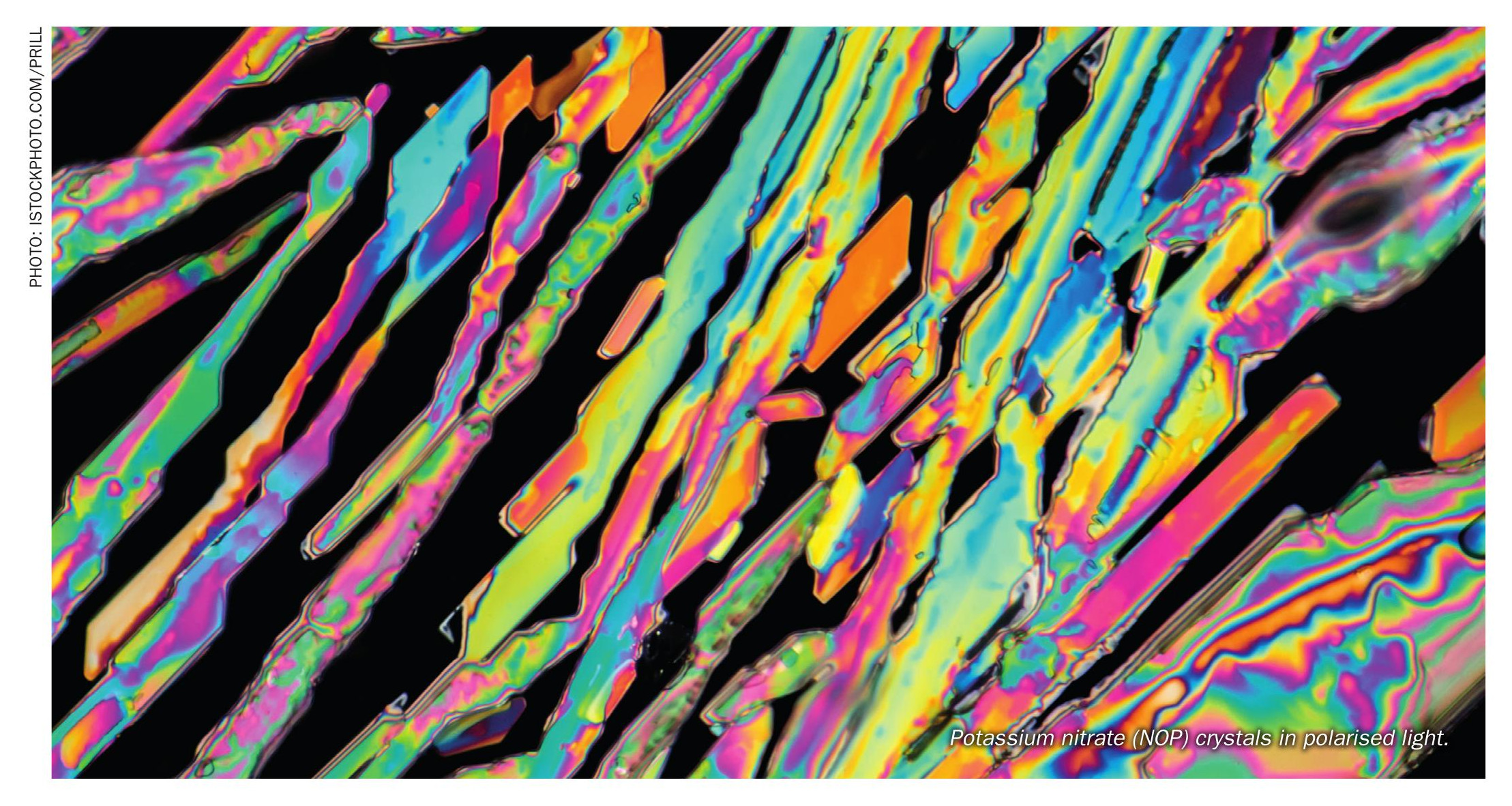

Importantly, a number of fertilizer commodities were already exempted from US import tariffs under the Harmonized Tariff Schedule (Annex II). These include potassium chloride, potassium nitrate, potassium sulphate, phosphate rock and NP/NPK fertilizers.

Similarity, ‘Trump tariffs’ did not apply to America’s northern and southern neighbours, Canada and Mexico, either. Instead, any imports from these two countries that comply with the United States-Mexico-Canada Agreement (USMCA) were exempted from the current 25% tariff imposed by the US.

This USMCA exemption notably covers US potash and sulphur imports. While US sulphur consumption is primarily domestically sourced, imports still account for around 20% of total demand, with Canada being the primary supplier, making up 90% of total non-US purchases.

In response to the ending of fertilizer tariffs, Corey Rosenbusch, president and CEO of US fertilizer trade body The Fertilizer Institute (TFI), said: “The fertilizer market is highly competitive and characterized by a complex web of global supply and demand factors. While the U.S. has robust domestic fertilizer manufacturing and production, it is a net fertilizer importer and relies on both domestic production and imports during busy spring planting and fall application periods.

“Without farmers, there would be no fertilizer industry, and as farmers continue to face economic challenges the focus of the industry remains working with the Trump Administration to promote a strong, resilient fertilizer industry that supports U.S. agriculture and ensures affordable food prices for American families.”